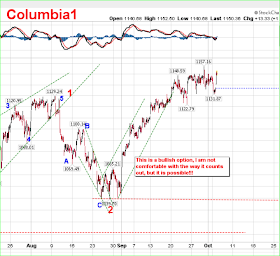

Chart from Columbia

Chart from ColumbiaCOMPARE TODAY to August 9th

EKG not available so far today

Today's open seems VERY SIMILAR to AUGUST 9th

Appears as a Possible 5th wave right back to the 1150/52 area

and is occurring right at the 13hr cycle at 10am

NOW, I think I know WHY the WARNING - dont follow the crowd

We had the SAME reading on AUGUST 10th- dont follow the crowd

It was not indicating a bottom, but a PEAK as on August 9th

If we follow a similar pattern, we should see a

LOW on the 8th

10am =39hrs from the 1158 high

10:42 am = 38.2%/13 day cycle

150bars at 11am

All clustered in the same time zone

And after a brief rebound next week thru the 15th-18th

the end of the month {28th} should reach a tradable pivot for a stronger rebound in Nov.

Jay

Energy at 11:24am= EXAGGERATIONS

ReplyDeleteJay

Jay--After this type of blow off--and new marginal high What kind of numbers on on the RADAR by Friday??? Iknow you don't like to put numbers out there--But for most of us who appreciate your effort--we like your input!! Thanks again

ReplyDeleteOuch...my VXX/FAZ/BGZ in the toilet.

ReplyDeleteSnoopy

ReplyDeleteThe AUG 9th peak led to a 60 pt spx drop.into Spt 1st.

should we not expect more at the next degree of wave?

FLUX indicator reviewed showed me something I had not looked at for a while

1160-1161 should max this out

1161 = 9, and should not get above that number

FLUX indicator today is VERY STRONG- whats that mean?

it happens at or near tops

or close to bottoms, in other words at significant times

example

June26-27-30 were strong days

JULY 1 & 2nd were lows

Aug4th was strong near highs

Spt 2nd was strong at lows

Oct5th showed up strong today

at a top?

we'll see that outcome quickly

DONT FOLLOW THE CROWD

last 30 minutes coming up soon???

Jay

DOW +200 / 10961

ReplyDeleteSPY +25 / 1162

It looks like BULLS will be pushing DOW to 11200 and SPY to 1200.

the crash could be delayed 2-3 days from Monday Oct 4th.

ReplyDeleteOctober as a month of crashes - Although October has a dark reputation for the stock market, the month has a positive record in the year of midterm elections. Seven of the past nine Octobers in midterm years have been winners for stocks. The average gain in the Nasdaq was 8%, and the median 5%. It didn't matter which political party was about to gain seats. It didn’t matter which political party winning.

ReplyDeleteAbdullah

ReplyDeleteHadik cycle today

dont follow the crowd

spx having trouble holding 1162

backing off after 3:30

228bars at 4pm or open.

Tomorrows outlook is grim-power struggles

LIKE Aug 10th =Caution with $$

Aug11- be practical

Thsday= stressful

Aug12 -Stressful

Fri = serious start, should be a low in the AM

Jay

Aug 13- dont act in haste

Check the above

NOv is showing a rebound, thus it will be said the mkt liked the election results, no matter who comes out on top.

ReplyDeleteJay

The criminals at the Fed know exactly what they are doing, free money for the Wall Street banks that they can use to juice stock and commodity prices. Meanwhile the dollar drops into the toilet.

ReplyDeleteThanks, Ben, for higher gas prices, higher food prices, higher heating oil prices just in time for winter.

The sad thing is that most working Americans (including most of the 1 in 6 who is currently out of a job) know nothing of this shell game. Otherwise, it would have been torches and pitchforks for those thieves long ago.

The game will continue at least until the election, so it seems unlikely that October will finish red.