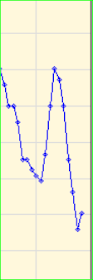

26hrs & 126bars converge at 10am

26hrs & 126bars converge at 10am156bars at 12:30

180bars at 2:30

Tomrrows read says its not a nice day

Today's pc ratios are 50% bullish

Jaywiz ratio = .66 and is near the border line, but slightly more bullish

One of these days has got to be at least a 300 pts decline,

but it might wait for the 29th on that one

Until then they are eating away at price levels and building a bullish case

Technicals can deceive going down as well as on the way up

Nov 29th still the target date

Jay

great work Jay

ReplyDeleteHello Jay

ReplyDeleteI have been following your blog for about 10 days very interesting.

I'm curious how you got the 29th tho.

As I have the 29th and 30th as serious down days.

The government wont allow the market to fall today just before thanks giving.

While I have no respect for chartists and charting I am open and very intrigued by what your using to obtain future dates. As I do also..

great work and congrats

Hi Futures trader

ReplyDeletethanks for your input

great to have you aboard

Nov 29th/30

is simply a fibo converge date for the most part

144May 6 & 7

89Jul 26

Its also a Bradley date +

Low energy projection

It would appear as you say, to be serious down days

BUT the 30th is scheduled for a

turn

29th is an 8day LOW

which makes the 30th as 8 day TURN

30th reading is irritations, but a late recovery

DEC 1st calls for

REACHING agreements

DEc 2nd = Fortunate

Dec3 = disruptions, but better later

How I get this info is

"MY SECRET",

but Im willing to discuss the outcomes at length

thanks Again

Jay

Honolulu Beach

ReplyDeleteWELCOME

I was at Waikiki beach in 1980

enjoyed it immensely

Join in anytime you have something to add.

Jay