Sam

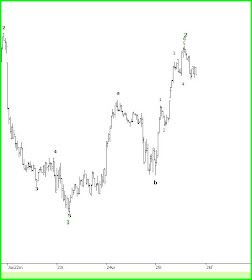

Heres what I was referring to

wave 'a' was 3 waves

wave'b' was 3 waves

wave 'c' JUST COMPLETED TODAY was 5 waves

WOW, at 3:30, it looked like they were coming apart

MY bar cycles did not seem to sync correctly so the 3;30 low

might have been the 258bar cycle occuring again at 270 bars

921.42

Did some one write 922 was possible

oh yeh, it was me

Remember that I posted yesterday to look for the HOD at 4pm

it really did hit at 1;30sh

but tried again at close

Activity index finished on a high at 233

but the after mkt has dropped some to 166

power index GAPS lower from 650 at today's close to 575 at open

and continues lower all day ending at 475

more later

Jay

Jay,

ReplyDeleteIts safe to be short until Monday, as your analyzation.

Thanks jay.

ReplyDeletesam

Jay, do you see Jun 30 high being a higher high than today or a lower high?

ReplyDeleteBreaking news: Michael Jackson just died.

ReplyDeleteArak

ReplyDeleteVery hard to call that one

I dont have all my ducks lines up yet

Only a few of you realize its a PROCESS of putting the pieces of the stock market puzzle together

and the data only gives me so much to work with

FYI

Astro for longer view

Power index for 5 to 7 day view

Propensity index for next day

and there is other internal data

as well as elliott waves & bar cycles & more.

It all comes together by the morning light

dont epxect me to call a market

days or weeks in advance merely because theres not enuf data to work with- it makes for a weak forecast.

Jay

Jay

I've always wondered how you put together your forecasts. Now I know better. Thanks.

ReplyDeleteI went long on the pound @1.637 with tight stop to catch the tail wind of this move - nice bull flag on euro/pound. Ride to 1.645. Then looking for a big turn down to confirm Jays analysis. Will short via futures

ReplyDeleteAnnette

Jay, here is a 5 minute EW chart of todays SPY, and a 1 min chart showing complete subdivisions.

ReplyDeleteand a nice tutorial too -

http://blog.afraidtotrade.com/

perfect-intraday-elliott-wave-lessons-from-spy-june-25/

challo

Challo:

ReplyDeleteHis second chart eneding in a, b, c implies we go up in a new 1, 2, 3, 4,5.

You get bearish interpretation only if you label his a as i down and the rest three wave ii.

That remains to be resolved. Today.

Ravi

Dont expect anything dramtic today but a downtrend has begun

ReplyDeletethey finished 5 waves up from 886

today has

30bars @ 10:30

60b@ 1pm

90b@ 3:30

Monday

120 to 126 b @ 11;30 to noon

150-156 b @ 3:30

That MIGHT be the LOD

We have to watch the behavior of the hourly turns espcially at 3pm

Yesterday for example 3pm TURNED lower to the 3:30 low at 270bars

When the mkt did NOT dive at 2;30, we had to suspect an extension

Power & propens index BOTH show a decline starting today

What does employment have to do with the MKTS-- As per JOE Granville-- NOOTTHHING

I cant understand WHY CNBC commentators who are supposed to be mkt savvy still cant understand that the MKT does NOT respond to EVERY NEWS item that comes out on any particlular day.

And then they have the GALL to make light of people like Arch or Nenner who use totaly different techniques from each other

More later

Jay

The extended hour chart appears to be giving a better reading.

ReplyDeleteLook at the chart posted by Jay. We just did a five down in pre market after making a hi about 1.5 points above yesterdays hi.

Ravi

what does it mean Ravi? bearish or bullish

ReplyDeleteAnon:

ReplyDeleteit opened the possibility on downside, depending where it fits in the higher order wave, which is not yet clear.

Ravi

Nasdaq is still climbing higher, but RSI is showing divergence

ReplyDeletethanks Ravi. I am an e-wave dunce. -g-

ReplyDeleteI thought that the spx might drop enough to fill that 910ish gap (on the 15 min chart) but the daily spy looks as if it is forming a bear flag.

that would seem to confirm Monday's down -

guess we continue to wait . . .

challo

anon's

ReplyDeleteplease identify your comment

with at least a single letter

and if you havent registered as a follower, please do so

its good for my ego to see more people on board

thanks

Jay

PS; I guess the heckler is silent now

Jay, I did not know you were follower of Joe granville. Many young traders have not heard of him. I remember whe he predicted that 100M share will tradeand DJI will swing 100 points. No body believed him. When he gave a sell signal DJI dropped 30 points and it was viwed as a crash.

ReplyDeleteAnyway, it is good hear from old times.

Thanks jay

sam

I am out of half my short position. With stop loss on the rest.

ReplyDeleteReason: The moves from yesterday's hi (cash) and today's hi (cash spx) both look corrective overall with 3 and fives. So chance of a new high is very much there.

Ravi

Ravi,,

ReplyDeleteGood to see an unbiased ellioticion. I think it's safe to say AGAIN that the bottom is in.

tlz

tlz:

ReplyDeleteWhich bottom is in? YR 1931, YR 2008, YR 2009 888.86 or today's in wave b of c , or?

Elliotician gets biased when they publish and get stuck to a call. My only bias is to take only good risk reward reads.

Ravi

888

ReplyDeletetlz

The long corrective since yesterday hi most likely b of (c). Yesterday's hi was then end of a of (c stating from yesterday low.

ReplyDeleteWe are likely to see a new hi, which better keep under 927.09.

We are in very complex corrective up since 666. Very treacherous to read.

Ravi

contd.

ReplyDeleteIf we go over 927.09, to say 931 or so in fashion of Dan Eric's count. But that will likely lead to a low just under 888 as illustrated by Dan.

Ravi

Thanks ravi. Jay how is your separtment doing? any guidance? or no cahnge?

ReplyDeleteI got stoped out out of spx puts. I need to learn to take profit.

sam

The waves are different for SPX and DJI. DJI made a low post 888 SPX.

ReplyDeleteMost likely resolution: a higher hi to let DJI complete a 3 wave move from its bottom which can still be counted a, b, c on SPX. In place of a 5 wave 5,3,x

Knock kncok! are you there jay? where is everyone?

ReplyDeletegoing short over the weekend or wait for Monday?

sam

Ok, we got new hi in SPX unconfirmed by DJI.

ReplyDeleteA sharper down move now POSSIBLE on Monday.

How likely? Jay, what do you say?

Ravi

at 3;30 the activity is rising, but it might be too late to effect the mkt

ReplyDeleteHOURLY in charge today

11am was a low

1pm was a high & turn lower

3:05 pm = a HIGH & TURN lower

3;30 did a low at 90bars

3;48 another potential high dow-10

3:05 + 32 minutes ~ APPROX

I would have sold out earlier, BUT Monday's open GAP LOWER might not allow anyone to get short.

only 8 min left- they cant do much with that.

I shouldnt say that- Ive seen 500 pts come out in less time

Sam,

I went to a presentation of Joe's back in 1980, and he was my first into to tech analysis

He actually plays the Piano

Music is really the KEY to stocks, but how does one apply it?

OK its SLIPPING away at the close- here comes Monday's open in plain sight [g]

OBv tells the story as it topped

at 3pm on the 1 day ~ 1 min chart

Ditto for MACD & ult

Ravi

today counts at a & b ?

or 1 & 2 ?

In either case 3 or c are bearish delights

Jay

Ravi,

ReplyDeleteJust because I posted 922 as potential 88% retracment doesnt mean they had to get it[gg]

Irregular "B" means very deep "C"

NON confirmation and plunge on Monday

913.03 intraday low lower than 914.05 of yesterday

OBv on 5 day/5 min chart topped YESTERDAY at 1pm - ditto for MACD

& Ultimate

Jay

..also came down in clean five waves in the last minutes. Getting more likely.

ReplyDeleteRavi

http://www.corbettreport.com/articles/20090624_bilderberg_predictions.htm

ReplyDelete