Count now is 43/62 = 69% success ratio

Count now is 43/62 = 69% success ratioYES it was a good day for the EKG, but MY expectations were for much

more than we got given the nature of the energy this wkend.

TO complete the ELLIOTT wave IMO, we MUST see 1040 ON CLOSE at a minimum

NEXT best DATE for such a low is JUNE30 at either 11am or 4pm - will give more details later

Today's LOD hit at 11am which MUST NOW be considered the 26 HR cycle rather than the 10am high

SIMPLY because the LOD was not surpassed but the 10am WAS - after the 11am low

bar cycles did not do well today.

204bars at 4pm appears to have truncated the pivot at 3:30

Its 9am and the Futures are NOT definitive as to any major move this AM

Its 9am and the Futures are NOT definitive as to any major move this AMwe do have 126bars at open which MIGHT have a small negative effect, but as I write this

they have turned back higher once again, so I have to assume that

120bars yesterday at 3;30 was the pivot

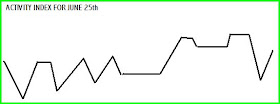

Astro8 mentioned 3pm today as a potential low, and the EKG shows a possible

low before the close with a small rise after

energy at 2;52 and 180 bars at 2pm suggests the same, then 204 bars could then setback

right at the close, but possibly a little higher

There is Little energy this morning to have any effect on trading

activity index is on a moderate rise this morning now at the 200 level

Oil is now up 75cts

Jay

THis is ONLY a PRELIM and will not count in the official TALLY

THis is ONLY a PRELIM and will not count in the official TALLYThe END OF DAY does appear to be heading lower toward the close,

but we dont have that piece of the graph yet

It does SHOW potential for 10am to hit the HOD @26hours cycle

Cycles today meaning Friday June25th

78.6% @ 12:25

150Bars at 11:30

180bars at 2pm

and most important is

204bars at CLOSE right at 4pm

______________________

Keep some things in mind

we hit a 3:30 LOW today June24th@ 120bars exactly @ 1071.60

THERE WAS NO BOUNCE and secondary failure to make a lower low

on lesser volume.

Tuesday's low hit on 228bars exactly at close

Tues had 92% DOWN VOLUME- was a low tide day & an 8 day low

Wed was an 8day turn, and that cycle was satisfied

Today had 90% down vol -

ARMS INDEX today was a hardy 3.06

June4th ARMS was 13.48, and ALL that did was SIGNAL a SELL

anything near that tomrrow, and it will signal a SHORT TERM BUY

Bradley date is Saturday- JUNE26th and the MAIN NEG Energy CLUSTER

occurs on the wkend,

But NOT TO BE LEFT OUT - tomrrow has a grouping of 3 negative energy effects

12;36pm = Disruptions

2:52pm = Tyranny

5:50pm = Worrisome

TOmrrow is the ONLY day that the ENERGY from the HUGE wkend cluster which includes

a full moon partial solar eclipse CAN influence human behavior in regards to selling or buying stocks

the FULL MOON calls for Caring for CRITICAL NEEDS

Side NOTE -Princess Dianna Died on an ECLIPSE day

_______________________________________

HERES ONE MORE TID BIT TO DIGEST

May 6th the day of the FLASH CRASH- has a READING which said

WILD DAY - Out of KILTER

was off 1000 pts at 2;45pm

__________

TOMRROW's read says

Upheavals & upsets

WILDLY Disturbing

Neg energy hit at 2;52pm

HHHMMMMMM. !!!!

-------------------

THEY DO SOUND VERY SIMILAR- dont they!!

more later

Jay

Jay

ReplyDeletethis was just a suggestion. It will remain visible all the time

Are you saying at EOD, you would only go LONG if TRIN/ARMS index continues to rise to something as crazy as 13?

ReplyDeleteThanks! I like the preview...:)

Jay - why do you say that tomorrow is the only day that negative energy of weekend can affect ?

ReplyDeleteWhy can it not affect on Mon / Tues - pls can you explain ...

We got our big down day -145 point no change in my outlook tomorrow should be an up day maybe 100 pts or so Monday should be up then the big decline into the 30th

ReplyDeleteIf you still have not bought faz or tza Friday around 2 or 230 central should be a good time....faz closed at 15.97 up 6.11 percent today and tza 7.38 up 4.84 percent today both up over 20 percent for the last week or so ....great job Jay on the daily you were right on the money

This comment has been removed by the author.

ReplyDeleteHi Rose

ReplyDeleteI agree

will add it on June30th

Jay

AS

ReplyDeleteEnergy is not saved

Once past the date of effectiveness

the NEXT energy event takes effect

Next weeks power index will show a huge uptick for Mon & Tuesday

and concurs with an energy boost.

Jay

this means we get our "big down day" today or forget it?

ReplyDeletebecause we are going up big on monday?

Jay question...EKG Does this show the energy for the Open? or can it begin at Premarket? Seems more open but wanted to ask how you view it. Sorry if this is a review. Looks like it is going to be spot on today

ReplyDeleteJay you said.

ReplyDelete"Next weeks power index will show a huge uptick for Mon & Tuesday

and concurs with an energy boost."

What does huge uptick mean. is this a big rally or big drop or either one just a big move but don't know the direction.

BEn

ReplyDelete????????

Up means UP

Jay

FALLING WEDGE OF S&P 500

ReplyDeletehttp://niftychartsandpatterns.blogspot.com/2010/06/falling-wedge-of-sp-500-reversal.html

astro8

ReplyDeleteThe REASOn I publish the EKG at 8:30 is to PIN point the OPEN based on futures which is something I cannot do at close, so Im learning

how to evaluate the close based on other parameters, and I guess Im getting better at it.

The graph comes to me in a CONTINUOUS FLOW as I get it from the data, and thus I have to PICK a spot from which to publish to catch the OPEN-

thus its NOT pre market.

Jay

Thanks Jay. Felt more open to me than pre and read it that way

ReplyDelete26 HOURS HOD at 10am

ReplyDeleteFantastic

Jay

High Five Jay!

ReplyDeleteHi Jay, folks,

ReplyDeleteGreet comments here.

I'll toss my view out here. I think the EKG has inverted and low of week is right now and we risk moving up into the close adding more data for a big move up Monday.

I'll probably hold short for another hour or two to see what happens after 1pm. Green delta has 3:40 HOD for a S4L to high day and we're following that pattern.

Just reading the market as I see it.

The premium signal at the open gave a bullish slant to the day.

Just offering what I think,

curt

/6e euro hit the bottom of the channel at 1.2274 this morning now is making a run for the top 1.2422 last time we hit the top was yesterday morning .....will it drag the /es with it..? probably Helge shows the /6e hitting the top of the channel sunday around midnight

ReplyDeleterrman

ReplyDeletemaybe Im looking at Helge and just seeing what I want to make of it

DOES he SHOW a LATE SLUMP TODAY

or what am i looking at??

thanks

Jay

THE ENERGY at 12:36pm provided

ReplyDeletea short term high,

maybe the rebound high shown on the EKG

I just cant see it ending at 1070

IMO, should be 1040 to 1020, or maybe just wishful thinking

Jay

Curt

ReplyDeletethanks for your comment

I THINK Your not following the cycles, especially the 39 hour cycle that I have discovered and SHOWN as PRECISE within an hour ORB

from 10am to 11am on the days It occurs

TODAY at 10;15 HIT THe HOD at 26 hours of the 39 hr cycle

Next occurrence is on the 29th at

10am

Last one hit on Monday at 10 am and was the HOD.

Previous to that was the 17th at 10am = HOD

And so forth as we look back

Jay

Other inputs for my view are a decent rally in copper futures and oil today. If these weren't rallying I'd stop fretting about a rally from here.

ReplyDeleteHelge does look like a LL early next week, but we know that's just a guide, not carved in stone.

jay, you lost me

ReplyDeleteHOD = high of day..correct?

it's 1pm and currently at HOD and climbing...what am I missing here

The EKG looks correct still...

ReplyDeleteWe'll see in the next couple hours!

Again, Jay doesn't have the exact forecast of the market, but it's so damn close it's scary!

Go JAY!

Looks like HOD now as per EKG showing this as the HOD. Shortly should start drop onto close.

ReplyDeleteNice work Jay!

OK, so HOD is going to be higher than when I last posted. EKG looks good so far.

ReplyDeletealmost to the top of the channel helge says high of day should be 2pm central then reverse back down some into the close i will buy tza around 2pm looks like

ReplyDeletealesund,just be careful not to keep comin back every 1/2 hour into the close and saying "whoops,higher still" only to realize the possibilty the ekg inverted...

ReplyDeletenot saying it's the case,but let it play out

This is a straight up day with a gap up on Monday.

ReplyDeleteSome prominent cycles bottomed today at the same time.

rrman -

ReplyDelete>>If you still have not bought faz or tza Friday around 2 or 230 central should be a good time....

Now you say Monday is up, Jay said Monday (and Tuesday?) up huge. You are buying FAZ today?? What am I missing?

Best Regards,

-Mark

agreed mark...

ReplyDeletetza for a 1 1/2 hour trade maybe is all I can deduce by the cross currents

high on Tues,and Jay says huge mon tues...why not wait for tza to come to you?

I don't think it's 6.98 if huge up mon tues into close

ok bought tza and out of long euro /6e

ReplyDeletenice move rrman... looks like your timing might be perfect!

ReplyDeleteor maybe not...haha..ok, i wont comment till EOD...this is crunching it close to EOD.

ReplyDeleteDow Jones reversal from 61.8% fib level

ReplyDeletehttp://niftychartsandpatterns.blogspot.com/2010/06/dow-jones-fib-levels-and-break-out.html

S&P 500 Break out from consolidation

http://niftychartsandpatterns.blogspot.com/2010/06/sp-500-consolidation.html

Looks like rrman is scalping.

ReplyDeleteIf a bottom is in, then the rally today is a wave 1 of something with a wave 2 retrace to follow. The top for the SPY, if it holds, is 108.42 and the 76.4% retracement is 107.16. So, ..., even if the markets are bullish then a scalp short from 108.42 to 107.16 should happen.

Then again, if the markets are still bearish then the 107.16 level will fail to hold and the scalp short will turn into a big winner.

The bottom line is rrman should win either way as long as SPY 108.42 holds any more upside. That would be the SPY stop if I was shorting this move.

ok we're done going up going short /6e euro should be a nice dump into the bell

ReplyDeleteI appreciate your thoughtful and detailed take on it, KC.

ReplyDeleteThanks,

-Mark

i will look at going back long /6e euro after the bell and lockup at 4pm central helge says a big runup that starts at unlock sun nite until midnight i figure we will test the upper channel line again before the big down starts after midnight sun into wed.

ReplyDelete*bows down* in jay's presence... :)

ReplyDeleteyep Jay's da man!

ReplyDeleteJay, rrmn. End of the day what r u planning to buy: TNA or TYH

ReplyDeletembeider sorry i missed your question ...I believe we rally sun nite then reverse around midnight thats what helge shows and big decline into wed and that ends this decline then we reverse and go up for a couple of weeks and the reversal will be severe..so the issue is that imo today is the last day to buy faz or tza during trading hours before the decline begins in the futures sun nite and causes us to gap down monday morning and never look back

ReplyDeletei already bought tza in my ira and will get out of my short /6e euro and go long /6e for the runup when the unlock begins sun nite

ReplyDeleteSince TODAY did NOT drop to 1040

ReplyDeleteor lower, then the NEXT best date for such a possibility is June30th

BUT Monday STILL has potential to POP back to 1100 by 3pm or close

Then sell off on Tues & wed, but IM not CONVINCED of this projection as yet

rally today from FINS & BANKS only

Jay

DAMN

ReplyDeleteAs suggested EKG

low at 3;30

short runup and close lower

or at least OFF the HIGH, but not the LOD.

ONE THOUGHT about 10am @ 26hs

looks like it MADE the LOD

at 11am

thats why the high at 10am was overtaken

Jay

Jay

Jay did you close shorts? and go long?

ReplyDeleteActivity index dropped from 266 at 2pm to 100 at 3pm & now at 3;45 = 100 also

ReplyDeleteMkt did fall

Jay

JUFU, Im waiting for 3:55pm

ReplyDeleteJay

thought i would post up here. TSLA Tesla motors will IPO. could be Tuesday too. They like to run the market up on IPO's

ReplyDeleteFWIW the pattern for pre 7/4 week is up into Wed (sell short) cover 7/5. Note this also fits the end of month run up pattern as well.

ReplyDeleteMy view though is that my worry of an up into the close did come to pass since we are up here at 1072 and not down at <1065, so my view of up into Monday+ I think is still in play.

I'm with Rman re reversing/closing shorts at/after the close.

tnx folks, curt

Thanks Jay~

ReplyDeleteOverall, wish it went lower, but still, the trade was profitable. In hindsight, I should probably scale in and out of positions. For example, in the EKG, could have covered half of my position first LOD and then second half at the close of day.

We'll have to wait until Mon/Tues for the minor wave ii as elwave describes up to 1090-1100 range.

Have a good weekend folks!

I've enjoyed the conversations this week.

FANTASTIC COMMENTARY

ReplyDeletethis is the WAY traders SHOULD communicate

THANKS TO ALL

have a great wkend

JUST GUESSTIMATING

a CLOSING low at 1040 to 1025

would allow the rebound to run back in JULY

from 62% to 78% of the approx loss of 100 pts

1025 + 62= 1087

1025 + 78 = 1103

or 1040 + 62 = 1102

Jay

ok reversed out of short to long /6e euro to catch the up move sunday nite

ReplyDeleteJay,

ReplyDeleteDoes this mean you closed your shorts or are you holding on until June 30?

Thanks!

JUFU

ReplyDeleteSOLD SOME AND held some

WE Should DISCUSS TRADING strategies once we know we in a position, and what we expect the mkt to do with some alternatives or minor adjustments

If we had been looking for a possible 26 HR low between 10 & 11, we might have jumped on the earlier low- bigger profits lost

to that one, once it started back up.

If I can get LONG MOnday on a lower open, I will be planning to sell EOD

Monday

Once I prepare the Weekly power index and can compare it to the flow of energy, I can then get a fair evaluation of what to expect next week

I really cant get a good picture of the power index until Sunday for a 5 day view

Will publish it all up Sunday eve

Jay

In a few weeks, we’ll see four leveraged bear ETFs from Direxion undergo a 1 for 5 reverse split. They are the Direxion Daily Energy Bear 3x Shares (ERY), Direxion Daily Real Estate Bear 3x Shares (DRV), Direxion Daily Small Cap Bear 3x Shares (TZA), and Direxion Daily Technology Bear 3x Shares (TYP).

ReplyDeletedear jay - your JUNE ENERGY UPDATE stopped on june 25th, i always wondered about the rest of the month. it think we have a pretty bullish set up for early next week. dollar also looking very weak.

ReplyDelete