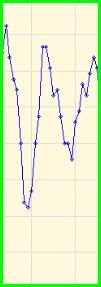

The lower tag after the second rally was not available on this morning's graph

The lower tag after the second rally was not available on this morning's graphit shows 2 rallies and last hour dip- astro late today would have indicated a stronger close

but the activity index at 3pm is not responding thus the above might be more correct

Looks like bigger swings than today

Mars 150 Pluto at 7am should keep Europe in the red giving us a lower open

secondary low at 2;20pm

higher close

Jay

54 comments:

Jay,

Having a good week.

Trying to plan out some longer term position trades. Your looking for a high next week and then a multi-week drop that concludes around the 1st week of April. correct?

If yes, any insight to the stronger selling periods during this time frame?

Thanks

Jay,

Based on futures close it looks like we may get a gap up instead of gap down. There was some furious big block buying into the close.

the night is young. we will gap down, no worries.

Jay I am new to the site. Is there any numbers asigned to the X and Y axis or is it merely likely patterns you are charting. Thanks, Wendy

Gap up or gap down....it makes no difference.

We're going down tomorrow morning.

I'd prefer a gap up so I can fade it and add shorts to my short position

Woooooooohooooooooo!

p.s. Nice rally huh? We'll see soon enough if 90 day and 9 month cycle still going down or if it bottomed already. For sure the 40 day cycle is bottomed easy.

wooooohooooooooo!

Mars 150 Pluto kept Europe green.

The opposite to what jay predicted again!!!!!!!!!!!!!!!!!

fran

out of long es at 1067.75 and long /dx 80.79 it finally broke! Will wait for open to go long ...

not so fast Anonymous, europe is showing red. a gap down as predicted!!!!

out of short /es I meant to say

I think we break 1080 today I think flash called today a high I think Jay is right about tuesday being a high but I'm nervous about it since the holiday may mess it up but I'm thinking Monday might be the high in the futures so I am thinking go long in my IRA at open and close it out today but go long /es at open but hold it until Monday ....

heres the gap lower as stated overnight,ive just bought futures coming up to the 7am timeline,hopefully the china thing wont kill it off any further into the open.im looking for at least 10pts up from this level.opening the cash market below 1066 and ill probably cut.

break 1080 today? no way, most of the day we'll be trending down. i expect Down (A or 1) Up (B or 2) down (C or 3) - and then maybe the start of another ABC up OR a crash and that would mean the correction is over. astro seems to point to the bullish option.

Kaviaar

thanks

I dont know what FRAN is trying to prove, but she is confused, and might be confusing some, but NOT the most astute traders as have been posting excellent commentary.

great tech analysis from Registered members.

thanks

1080 will probably wait for the 16th & 17th, which should top out this abc rebound at that time

and as mentioned b4, we would then expect the mkt to head to lower levels

Remember that spx 1020 is OCT- NOV support, and will probably get

tested b4 months end= this would set up a sneak attack from the bulls from about Feb 24th to March 1st rebound- thus allowing the BULLISH side to ACCLAIM a successful test of previous support - ITS just at that point when the bears begin to Re-Assert

and March will show us the real bear market.

Jay

Hi WEndy

If you expect me to respond, you first need to register as a follower, and join the other members

If there were any more detail on those Daily guidance graphs, it would have been shown.

ITs only a GUIDE, NOT AN ABSOLUTE

Jay

the near term plan for me is the top out somewhere above the 20wkma,maybe just overshooting the 50% retrace level at 1098 on the 16th completing b of a-b-c.then down.

.618 of A takes us down to the low 1030's in the last week of feb,where i think we set off in the final 5 waves up to the top.

Woooooohoooooooooo!

Easy Money this morning.

I will take profits off the bat and hold some. Looking for entry at some point later, maybe sooner.....my work will tell me.

Woooooooooooooohoooooooooooooo!!

I'm going to go long but waiting on the eur/usd to bottom on the 15" stoches looks liek 80.82 on the dollar may be where I go short the dollar long es I still think we break 1080 today 1090 may be on tap

tough support at 1061.6,if it breaks that, im folding for a bit of a nasty one....should see something of a pop at least in the next 10 mins.

14 points from yesterday afternoon

almost all out of short. don't get greedy

woooooohooooooooo!

added long here 3 pt stop.

Got out of the puts near SPY 106.60. Now looking for a higher low and turn up to get long for a day trade. Want to be flat over the weekend.

long /es 1064.50

Think this is a bear trap , and will head to 1080 by 17th before heading to 980 in March.

Simples

added more long /es at 1062.50

closed add on for 3.4pts,letting original run for the time being.

i am believe that today s&p500 to go near 1045.REMEMBER 19-22 FEBRUARY NEAR 920 IS VERY PROBABLY.

Correction may not be over. Looks like a "B" wave off the top with a "C" yet to come.

5 min chart certainly looks like a bear flag, Y.

OK, Folks,

We got the 10;30 LOW @ 120bars;

Out of short and now long till maybe 1pm, or mkt flat at prev close

Activity index

was at 100 this am

JUMPED to 233 at 10am with 30 min delay

11am expected daily hourly turn

and 126 bars could provide the turn

Jay

i would be very surprised now if we dont close the gap.

My long entry point for the SPY after the initial low was 106.68 and now 106.69. Came close but no banana.

May yet see 106.69 near 1:30 for a run up into the close.

I hate waiting but that is what I have to do.

I think we close up very green maybe 50 to 100 pts Europe closing green is a sign

Great call, your work with stock market times

Thank You!

Fill the gap is in play. I'm going long now for a day trade til we fill the gap and then maybe shorting there.

x

once the short covering on the short the euro trade starts to reach epic proportions this day will be a sight to see...

Are we going short or long over the weekend

Reza i'm going to close my fas out at close because of the holiday but hold my /es longs until monday I have a funny feeling about tuesday I dunno just nervous about this holiday...I'm thinking we top out monday on the futes

ok out of my /es long flat waiting for Jay's 1pm turn to pass before getting back in long..

Complimentary of OBG

Stock Trader's Almanac 2010: Has Wed & Thurs marked bullish , but bearish Friday.

Friday, the day before President's day weekend, S&P down 15 of last 18.

Monday: CLOSED for President's Day

Next week: bullish Tuesday,

However the Monday before Feb. Expiration the Dow has been down 4 of the last 5.

Wed, Thurs Friday: down into Expiration.

Dow has been down 7 of last 10 Fridays of Feb. Expiration.

1pm is here and the activity index DROPPED from 233 to 133

I sold my longs and im out a here

for the day

Jay

Jay your hint on the 11 1 and 3pm turn times are very wise advise I put them in my I PHone as alarms with a 15" warning and it makes me look closely and if the 15"stoches on the indexes are at the top or the bottom depending on the day its time to go flat and take a break for an hour or so and see what happens ..

back in long /es 1073.25

Hi Jay. I am a follower now. Is that the same as member? Wendy (AKA Hannah)

Frustrating day for me. I had 11:00 and my favorite, 1:50 as pivots/trend continuation times. In both cases my entry price was not hit and that is quite unusual.

Looks like I will stay flat into the close.

FWIW if the current rally continues the up side target is SPY 108.38. If price fails at the prior high of 107.98 then should be down into the close.

Wendy

Welcome to Jaywiz

FWIW there is 54-56 hour cycle low due Tuesday that implies there should be a significant low on that day setting up yet some more upside during OPEX week.

If a gap down I believe it can be bought and if a gap up that could be shorted. Both fast day trades.

HI Wendy- Hannah

Welcome to our little corner of the world

Thanks Reza

Welcoming another female

Welcome Iqplat also

IM out for the day and will stay out over the wkend

Expecting Tuesday to OPEN LOWER< but head for highs by days end, and overflow on Tuesday AM,should end the run

Monday nite, I will have a better idea of more precise timing as the power index & propensity

come to light in view of the astro

for the day.

more later

ps

this is a much better group

thanks for the great comments

Sometimes, I wonder where those wild cards come from or why they are bothering to post anything over here. Do I really piss them off when I lose touch with the mkt? Guess so??

I tried signing with Disqus, but there was a problem along the way

importing my Biz card which appears at the top of the main page.

more later

Jay

activity index is still sitting at 100 , and UNLESS it pops in the next 30 minutes, we could go out lower as shown by the Guidance graph

Jay

out all longs flat for the weekend

What a week! Thanks Jay you are a blessing one of the best weeks in a year for me....looks like next week should have a lot of fun too except its going down...

Have a good weekend Jay

ok couldn't resist went short /es 1079 a few seconds before lockup

Couldn't help myself! Have a 54-56 hour cycle low due Tuesday so took a small swing SPY Mar 110 Put position after hours. Darn if the SPY didn't finally hit the 108.38 area after hours.

I am new to the board this week and it has taken some time to understand Jay's commentary and I wanted to see how well it worked. Simply, if I had followed him step by step I would have easily doubled my profits this week! That is significant. I know his methods will fail from time to time like all methods but he definately has something of serious capability going on. I have been trading full time for 12 years and to date is by far the best board I have seen, ..., and I have seen way tooooo many.

Thanks Jay for sharing your work.

Moving forward. Aside from the small cycle low due Tuesday, there are some significant fib upside targets for the SPX and DOW. The 50% are about 1100 and 10270 repectively and if things really get wild the 76.4% lies at 1125 and 10500 respectively. Those levels are a fair amount above today's close so some day trading longs should be available next week. I'll let Jay indicate when...

Of more significance is the downside once a top is put in. The 90/180/360 calendar day cycle lows bottom about March 1st. Both the 127.2% downside extensions and 200 day simple MA's target for the SPX and DOW about 1015-1030 and 9500-9600 respectively.

That lines up with what Jay is indicating and with some other crazy stuff I do. The next 2-3 weeks should provide the opportunity to make some serious money.

Again, thanks Jay for a great board and hello to some of the contributors I have seen and followed on other boards.

Thanks RRMAN

Glad I was able to help

I had a good week also

KC, thanks and its great to have another technician on board.

Yes I think I have a good feel for the market, and YES , sometimes I lose my way, but hopefully we gain a lot more than we lose

I think rrman will agree that the Guidance graph has been a blessing

Im still trying to figure out why

FEb 1st & 2nd did not pan out as it was graphed, and I think I have a handle on that too

What I need is some one like KC to point out what doesnt look right B4 it happens, and I think we can confer on that and eliminate some losing trades.

Thats what conferencing is all about

not snippy remarks from the bleachers

As for next week, many of my Associates on my Yhaoo group are looking for a high on the 16-17th also

KC,

1100 and dow 11,270 are very good targets which I mentioned also to Flash.

After which, the OCT- NOV spx1020

should get hit maybe even b4 months end- FEB 25th- which would say to the bulls that a test of support has been successful, and of course we then get a small rally to March 1st.

Boy, are they in for a shock in March.

Jay

I am believe that after choppy week the next week is very down,22 february s&p500 in 900 points is my target.

Bye bye.

Post a Comment