| |

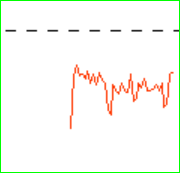

| AS WE CAN EASILY SEE, the AFTERNOON LOW AT 2Pm was not in keeping with the DEPICTION of the EKG |

|

| Add caption |

IMPACT stream showing us the SAME weakness this morning

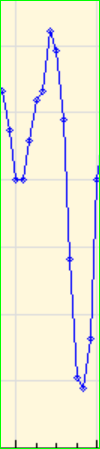

180bars at 10am could be the lod

204b@ noon

228bars at 2pm

258 bars at 10:00am on Tues which is also RIGHT ON the 39 hour cycle

which makes 60 bars hit 5 hours later @ 3pm.

THIS Weeks readings

Monday

Enthusiasm & favorable, but he futures this am dont look that way, but WHOLE day is not predicated

on 8:30 am futures.

Monday Night = unsettling news- DARN, you mean there's more that what we already got??

EXPECT DISRUPTIONS & SUDDEN CHANGES MONDAY NIGHT effecting Tuesday

Tuesday-

Keep low profile

NO New projects

WEd

Early mis -communications

stressful & exaggerated distortions

THS

WELCOME changes

optimism

Friday

Navigate tricky waters

obstacles & annoyances

Harmony by days end

**

TUESDAY'S POWER data SHOWS a big sell off could OCCUR agreeing with the above

energy forecast & so far the early EKG also AGREES

Jay

Getting used to this new format

the ACTUAL low at 2pm was at 228BARS but NO where near as low as the EKG showed it, and Ive warned about this many times that can happen-{ I have NO control over it }- IT DID however, show the PIVOT low at 2pm which then allowed a little upward motion AFTER that pivot.

Jay

12 comments:

REMEMBER that DIRECTION COUNTS MORE THAN AMPLITUDE

PEOPLE expect the EKg to show the mkt exactly in amplitude

IT DONT WORK THAT WAY

and I cant change the way it comes to me, IM NOT IN CONTROL of, it, I just publish it for you to USE

IF YOU CANT USE IT{ THEN IGNORE IT} ANd go on your merry way

Jay

THE DECLINE in enthusiasm for discussion within blogs and Yahoo groups can be attributed to COMPLACENCY

Does this mean the mkt must fall??

NOT QUITE YET, but this week should give rise to a little more enthusiasm amongst the bears

I will be away for 3 day from Wed to Fri, and will have only limited access to the web.

So expect a lack of data for 2 days- THs & fri

Jay

Hi Jay

I think its more a case of many refusing to publish there views on the markets as having been wrong.

We are not rocket scientist and we will always make mistakes, its what you learn from your mistakes that counts.

For what its worth I have found on my blog that many are emailing there comments and questions rather than going public, which is sad because the idea is to learn from others knowledge.

Money cant buy knowledge..Cheers

Thanks FT

BUT I still think its a matter of COMPLACENCY

WE will see what happens to the number of comments once this week is over

Jay

Jay, I am not sure it is complacency. I am sure many of your readers are fairly sophisticated traders, not likely to be "lulled to sleep" by media reports, market events, etc. Rather, the fact that many of us have had a rough few months trading markets which, rationally, can only be considered as "contrived" speaks volumes. Fact is, just as shell shocked people generally withdraw from social interaction, shell shocked traders can withdraw from market commentaries

Good morning Jay I agree with Jeff think a lot of traders arent trading waiting for a direction to establish and also after misjudging Dec you kinda want to withdrawel but we are watching your stuff closely

Another day where market forces seem to want to "let go" and someone is buying the dips. Well we sort of know who the someone is, and I still have the same question as always.. can the Fed's billions in POMO offset what is clearly weakening demand? Time is going to tell us for sure.

I'm 'thinking" that they'll try and use earnings season here as the "reason" to keep things up, but I also feel that sometime soon, we're going to see our first decent pull back, one that goes maybe 15-18% across the board.

Just my 5 cents worth I have a negative move coming tomorrow afternoon and into wednesday morning for what its worth ..

According to Jay's EKG negative on close 13 Jan.

looks like the criminals will save the day for the 1000's time.

JEFF_ RMMAN

I agree with both of you 100%

Just like the RETAIL trade has gone into hibernation for 7 years now.

traders have NOT gotten ANY volatility and its KILLING out trading

thus we ALL PULL BACK and HIBERNATE

BUT, I cant DO THAT

IM Committed to publishing the data no matter how good or bad it is for traders

YES, FT- agree with BIGGEST down day TOMMORROW afternoon than we have seen since SPT.

ABdullah, dont count on the 13th lower than the 12th, but I cant rule it out either-

Whichever the actual level, matters very little as the DOWN wave has begun, but dont expect much till MID MARCH

Im going to keep on preaching that UNTIL the mkt proves me right or wrong.

Jay

Post a Comment