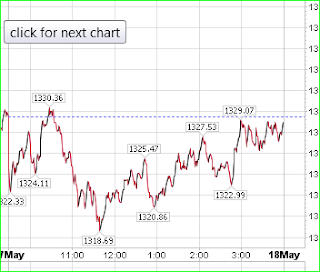

| Yesterdays EKG after the close did show a late recovery as above, | but was not published that way at 8:30am | ||

| May 17th @ 8:30am |

AS noted there is a GAP at 1315 to 1320 which seems likely

however, IF they do get to 1300 today, that will set off NEGATIVE SENTIMENT and thats a sign

to expect a short term bounce

Jaywiz index last Ths was .22= bearish

Fri was. 15 -VERY BEARISH

Monday =.50- BORDERLINE, but leaning toward bullish

Today's main cycle keys off the FEB 9th HIGH

26hrs at 10am

90bars at 11;30

126bars at 2:30 = might be the lod

Tomrrow opens 150bars at 10am, thus we could see a great short term BUY opp at that time

There is a warning to be wary of what looks like great bargains-

Jay

DOW OFF to a greater degree due to HP

9 comments:

ANybody else got any idea about the math in the wave as previously described?

1370 -1329= wve 1 =41 pts

wave 2 back to 1359 = 20pts ~ 50%

wave3 ??

41 pts = 1318 right at the gap

a multiple of wave 41X 1.618 =66

1359 - 66 = 1293

right at the previous LOW

and imo, a great place for bulls to call the correction over.

An intraday low tomrrow at open might seek the 80 pts low and open at 1290, maybe.

Jay

My projected low has been the 17th, but the 18th & 19th appear CHOPPY according to the power data graph, not published yet- ts too messy to get anything really useful from it.

Choppy does not mean lower, but it is possible, if we dont get the fibo lows set today.

the dow is falling more in proportion to the dow on an 8/1 basis

according to the spx, the dow should be off only about 45 pts, and as im writing this, the dow is off 113 at 11am

and even the Nasdaq is not down as much as it should be.

90 bars at 11;30 could produce a bounce

1329 -15 = 1315 if printed on the tape would be the gap fill??

hmm, as I write this, the are still falling

J

Jay

SO FAR, the EARLY data shows the 18th with an UP OPEN

that means to me the 17th has got to set the low, maybe the low of the week, MAYBE

Jay

a choppy B wave the rest of the week might make sense. then a C down, maybe towards 1293/1300, and that will be it for this X wave correction that started in Feb of 2011

sincerely

cementzak

Cementzak

1370 - 66 = 1304 at or near close today.

1330-1337 rebound=40 to 50% rebnd

1250 to 1225 next week on

27th at the latest

Next rally begins June 1st big beginning- get ready for it.

Jay

They keep trying to run the market, and it keeps running out of steam. But the important part is still that the S&P hasn't lost it's 50 MA, meaning that at any moment the techno traders could step in and just blast us higher. Now.. if we were to lose the 50 MA on the S&P, that would be the most serious breech we've had in months and could foretell more downside.

Wednesday reversal - we should close green tommorrow.

pomo will pick up steam later this week .. a low Wed

nice call jay on the ekg!!!!!!!!!!!

Post a Comment