Its now or never

Jay

OK, But papa wants MORE

OK, But papa wants MORE Futures indicate a LOWER open

Futures indicate a LOWER open

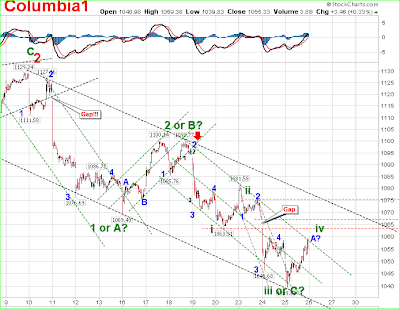

C wave LOW at 1040, was a loss of 180 pts, = or 2x fibo 89 from 1220

C wave LOW at 1040, was a loss of 180 pts, = or 2x fibo 89 from 1220

Its a REALLY simple case of a sell off from August 9th is an A _ B _ C decline

Its a REALLY simple case of a sell off from August 9th is an A _ B _ C decline this one did not work out s well as it shows

this one did not work out s well as it shows Im really not sure what to make of the above

Im really not sure what to make of the above Couldnt get any better

Couldnt get any better Original was published Yesterday at 7:27PM, and did not include the END OF DAY depiction

Original was published Yesterday at 7:27PM, and did not include the END OF DAY depiction I DONT think that mid day retracement wave will come to much if anything at all

I DONT think that mid day retracement wave will come to much if anything at all

The ABOVE graph from COLUMBIA- CLEARLY shows an ENDING DIAGONAL TRIANGLE topping on August 9th at 1131.

The ABOVE graph from COLUMBIA- CLEARLY shows an ENDING DIAGONAL TRIANGLE topping on August 9th at 1131.

I'll take that as a resounding success

I'll take that as a resounding success So far so good

So far so good Once again we have SUCCESS with the EKG still at 68%

Once again we have SUCCESS with the EKG still at 68% Today's energy as previously described is BENEVOLENT

Today's energy as previously described is BENEVOLENT Look carefully at the above graph

Look carefully at the above graph

It would appear that most of the action could occur near the end of the day today.

It would appear that most of the action could occur near the end of the day today.

Excellent depiction - score another success day for the EKG

Excellent depiction - score another success day for the EKG Just as I projected for today

Just as I projected for today I was sort of expecting a much lower close, but this will suffice, and possibly we will see

I was sort of expecting a much lower close, but this will suffice, and possibly we will see today's EKG shows the same outllook as the daily reading,

today's EKG shows the same outllook as the daily reading, ABOVE graph is from SPIRAL calendar web site

ABOVE graph is from SPIRAL calendar web site Above graph is from Alphee Lavoie web site

Above graph is from Alphee Lavoie web site

The End of the day rebound was in progress on the EKG,

The End of the day rebound was in progress on the EKG, It would APPEAR that the EKG for yesterday

It would APPEAR that the EKG for yesterday The last 3 days have been good but obviously not perfect

The last 3 days have been good but obviously not perfect