|

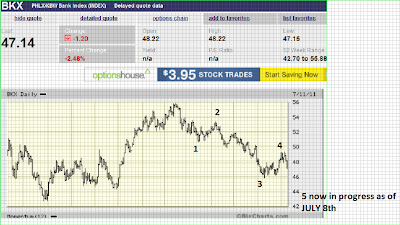

| BANKING STOCKS HEADED FOR A 5th wave CULMINATION of the current DOWN wave |

SPX

WAVE count seems incomplete- deficient at 1319??

If wave c = wv a then it should have stopped at 1322

1356-1334 = 22

1344-22 =1322

If an impulse wave lower

then the price level should get to 1308

22X 1.618% =36

1344 - 36 = 1308

more bearish countWv [1] was 1356 to 1334

Wv [2] was 1334 to 1344

this latest move to 1319 could be Wave (i) of [3]

if so, [3] would take us to 1281

WE cannot MATCh Elliott & energy MINUTE BY MINUTE.

but, IMV, ENERGY DRIVES ELLIOTT

and

THE MAIN DRIVING FORCE this WEEK is on THsday & Friday

Full moon

Bradley

**UNruly & militaristic

**Death - Evil- Ruination

**Disgrace & scandals

plus

13 day- 84.5hr cycle= same pivot that set the LOW on NOV 21st, 2008@ 11am

WHICH in terms of 13 day cycles = 663 tr days due to the Nov & Dec half days.

FRom NOv 21 to the MAr 9th LOW was 67 tr days

67 tr days cycle can indicate lo-lo, lo - hi, hi-lo etc.

And one such cycle occurs on WEd @67 to FRi 69 tr days from Apr6th high

The most important convergence is that 666 tr day from 666 on Mar 9th

brot to our attention by Jerry R.

6+6+6 = 18=9,. a FINAL or ENDING #

HOW IT GETS THERE can sometimes be synced along the way

IF the energy force is strong enuf to be an influence-

BUT JUST LIKE anything else we use to forecast the mkt- there are VARIANCES

THE MAIN POINT here is that the ENERGY as shown above

IS EXTREMELY STRONG as IT IS A MULTIPLE CLUSTER.

Just like the week of JULY 4th had a MULTIPLE positive cluster

this week is the antithesis of that.

Jay

No comments:

Post a Comment