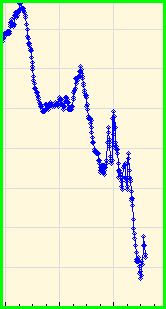

------------------------------open-------11;30L-----3pmH-----4pmL

------------------------------open-------11;30L-----3pmH-----4pmLFYI- Pay little or NO attention to the AMPLITUDE, only the direction

Daily Reading= Poor morning , mid day better, poor close

disruptions & accidents

Wait a day or 2 before venturing out to shop

Tuesday

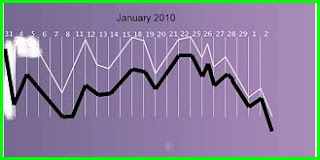

FIBO convergence has NOT gone away

Feb 2nd Chinese new year of the Tiger- well we alrady know what happened to one Tiger

Feb 2nd ground hog day

Feb2nd reading

challenges & pressures

serious issues & road blocks

MONDAY

180 bars at open

204bars @ 11:30

13 day cycle @ 11;00

228bars@ 1:30

258bars POSSIBLY @ close

Tuesday

258bars possible at open unless it hit at 4pm yesterday

39hours high at 10am

its also possible that 329bars occurs at 3;30

or a 3;30 low is effected by Moon 0 Saturn at 3:49pm

AND moon 90 Pluto @ 4:01pm

Typcially, on a wash out day we get the LOD at 3:45-3;55pm which fits well with the above

Jay

Jay