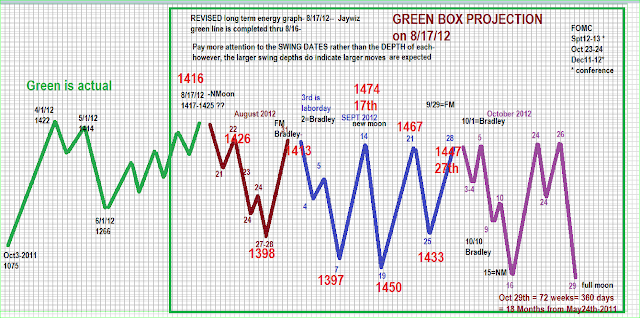

for trading from there to thru OCT29th. HOW WE DOING SO FAR !!

THE VPN GROUP GOT THIS GRAPH ON AUGUST 17th, 2012

As noted on the graph- the MAGNITUDE or DEPTH of each swing may or may not be PRECISE

to scale when compared to actual trading- BUT that is NOT AS IMPORTANT as the SWINGS from LOW TO HIGH and LOW again Etc. that were ALL caught within a day of actual.

STAY TUNED FOR FURTHER UPDATES

better yet

IF you want to take advantage of this kind of PRECISE FORECASTING

JOIN THE JAYWIZ VPN

Jay