THE CYCLE IS

52 hours = 8days

And

26 hours = 4days

there was 50 hours, if i counted it right from June 11 @1pm

to 23rd @11am at 888 - High to LOW

11am from the 23rd to 11am on the 29th = 26 hrs LOW to HIGH

_________________________

next 52 hr cycle = July10th at 11am

AND the 13day cycle hits at 10:30 to 11:30

_____________________________________

BUT THAT doesnt have to be the LOWESt point.

If truncated by 2 hours = 3;30 - 4pm on the 10th as you posted possible.

_______________________________________

Remember the Nov 21stlow was a 13 day cycle pivot, but it came in after an UP open

Nov 20th was the closing LOW

THE EVE of July 9th calls for A change to UPBEAT

leaving me suspect July 9th at close for the LOW

PLUS

ItS ALSO 44 cycles x 4 from OCT 27th where we had a 13 day 55% meet a 4day at CLOSE

next day was UP HUGE

_____________________________________________________

WOWOW

WE NOW HAVE a 4day [26hrs] AND 8 day [50hrs]

come to a meeting at 100% on the 9th at 4pm if truncated by 60 minutes

SOOO

we NOW have the LOW at THE SAME 50 hours from the

HIGh on June 29th at 11am to july10@ 10:30,

but NOW truncating to the CLOSE of July9th at the 4day cycle completion.

Another WOW

and the astro reading for the 9th is quite negative also

Now all we have to see is the power index next week,

and the propens index on the 8th.

So the LOW of 820 is possible on July9th at 4pm

Which means we should see at least spx860 on Monday

more later

Jay

THE NEW JAYWIZ 2023

THE NEW JAYWIZ 2023

Tuesday, June 30, 2009

Morning UPDATE

Yesterday's actvity index never collpapsed below 200

today, so far it is still hovering at the 100-133 level

which is obviously less than yesterday, but not low enuf to sell off

and there was some mild flux activity early today

Power index 400 to 500

propens index floats today at the 2990 level but drops tomrrow to 2982

IM STILL HOLDING OUT FOR A HUGE DROP TOMRROW

E Zone reports tomorrow as an important CLUSTER day

81 days from March 6th

191 days from Oct 10th

Jaywiz index last week has been bearish

19-23-44-35-22

and yesterday =18

Technical internals have given a minor sell

5 day arms = 83.4

5 day trin = 417

both bearish

NOW its JUST a matter of sitting out the day

more later

Jay

today, so far it is still hovering at the 100-133 level

which is obviously less than yesterday, but not low enuf to sell off

and there was some mild flux activity early today

Power index 400 to 500

propens index floats today at the 2990 level but drops tomrrow to 2982

IM STILL HOLDING OUT FOR A HUGE DROP TOMRROW

E Zone reports tomorrow as an important CLUSTER day

81 days from March 6th

191 days from Oct 10th

Jaywiz index last week has been bearish

19-23-44-35-22

and yesterday =18

Technical internals have given a minor sell

5 day arms = 83.4

5 day trin = 417

both bearish

NOW its JUST a matter of sitting out the day

more later

Jay

Monday, June 29, 2009

this is ONE busy day for me

20 SPX -day chart

FROM June11th at 956

FROM June11th at 956STILL looks like 5 waves DOWN to 888 = 23.6% for an "A" wave

Looks LIKE 3 waves up from 888

NOW is "B" wave rally to 927 so far

888- 956= 68 pts

68 x 62% % = 42 + 888 = 930 ********right there now

68x 78.6% = 53 = spx 941 - this would be a MAXIMUM

Activity index has come off its highs and now at 233, down from 300

WAVE EQUALITY

That makes the "C" wave low possible at 859

or a multiple of 68 x fibo 1.618 = 110

930 - 110 = 820spx

859 seems more likely on July9th

Jay

Fred's Chart

July Summary

A High June30th

probably lower high than last Friday - cliff wants 8405

then a Solid decline into July6th

then

deeper LOW on 8th & open for 9th

then

Rebound to July22nd High

but setbacks on 15th & 17th on the way up

Does That seem clear enuf?/

After july22nd BEARS take over again to EOM

Jay

Hope this adds some clarity that may have been missing b4.

More later

Jay

probably lower high than last Friday - cliff wants 8405

then a Solid decline into July6th

then

deeper LOW on 8th & open for 9th

then

Rebound to July22nd High

but setbacks on 15th & 17th on the way up

Does That seem clear enuf?/

After july22nd BEARS take over again to EOM

Jay

Hope this adds some clarity that may have been missing b4.

More later

Jay

Sunday, June 28, 2009

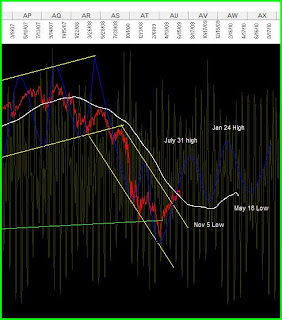

ONE MORE CHART

Chart of Interest

Saturday, June 27, 2009

Another good chart

Since I generally borrow these charts from other sources, Mr heckler,

Since I generally borrow these charts from other sources, Mr heckler,it shows I am NOT alone about seeing a decline coming in the next 30days

Remember I posted a drop to 770 area would NOT be out of the question

and the above chart clearly presents those parameters.

ITS really simple FIBO math

_______________________________________________

Heres something else to soak up

July 14, 2006 was a LOW at DOW 10,739

July 19, 2007 was a HIGh at DOW 14,000

July15, 2008 was a LOW at dow 10,900

NOW what should we expect on July17th, 2009

This years Astro is leading toward a LOW on r about july15

the timing above represents approx 250 tr days between each annual date

248 trade days / 8 = 31

we've seen this b4, and are tracking it now

JULY 15 th is 89 fibo trade days from March 9th

Astro has a double negative on the 15th as well as a qtr moon -90*

______________________________________________________

The end of the month could end up LOWER, but for now lets concentrate on

shorter term such as next week

_____________________________________________

I dont think from what ive got so far, that the 29th will be very deep,

so it does leave the DOOR OPEN for another run up on 30th with EOM

window dressing to help lift prices back to or even above spx922.

the reading calls for an OPEN high on JULY 1st and thats the

END of the HIGHS

for July which might THEN end on LOWS as above

more later

Jay

Thursday, June 25, 2009

ELLIOTT Wave 3 -3- 5

Sam

Heres what I was referring to

wave 'a' was 3 waves

wave'b' was 3 waves

wave 'c' JUST COMPLETED TODAY was 5 waves

WOW, at 3:30, it looked like they were coming apart

MY bar cycles did not seem to sync correctly so the 3;30 low

might have been the 258bar cycle occuring again at 270 bars

921.42

Did some one write 922 was possible

oh yeh, it was me

Remember that I posted yesterday to look for the HOD at 4pm

it really did hit at 1;30sh

but tried again at close

Activity index finished on a high at 233

but the after mkt has dropped some to 166

power index GAPS lower from 650 at today's close to 575 at open

and continues lower all day ending at 475

more later

Jay

Wednesday, June 24, 2009

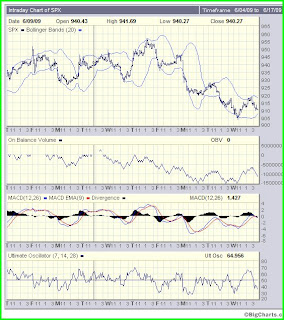

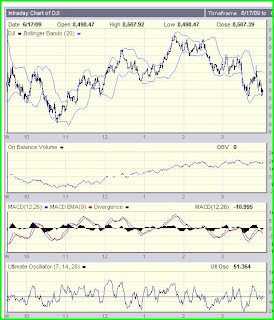

Todays Action

FOR The DOW, the action followed the power index closely

this is 1 day/ 1 min chart

OBV is headed DOWN

Macd Crossed over early

GOT 156bars @ 12:30

& 180bars @ 2:30

3 pm hourly took over for an lower low @ 3:15

which would count out to 188 bars, which is not what I generally expect but it does happen

or 3;30 turn at 192 bars.

HOWEVER, 3pm TURNED DOWN ~~ add 32minutes = 3;32pm for another TURN

10day/ 15 min chart has the SAME for OBV

solid DOWN MODE

POWER INDEX and PROPENS index BOTH show HUGE RALLY TOMRROW

SPX WAY ABOVE DOW indicating a GAP UP OPEN of at least 70pts

Both indexes are pointing toward a LATE HIGH, maybe 3pm or later

the 258bar cycle is at 2:30 leaving PLENTY OF TIME FOR A GRAND FINALLE

I got back too late to review my data and get long at the close

The ONLY trade for me now is going to be SHORTING THE CLOSE @ 100%

26th is Bradley TURN date

And 25th is an 8 DAY HIGH & TURN

SPX should make it to 919 = 78.6%

and could even make it to 88% @ 922

the reason I write that is because the PROPENS index is STRAIGT UP from

2974 at the start of today, and finishes late in the day tomrrrow at 2997

Wave iv can be a doosy and FOOL EVERYONE

more later

Jay

Ravi & Waves

The right MATH is:

from Ravi

HIGH 927.09 to LOW @ 888.86 -38.23

21.4% = 897.04 + 8.18

38.2% = 903.46 + 14.60

50.0% = 907.98 + 19.12 from close at 895 = 12pts = dow about + 100

61.8% = 912.49 + 23.63 from close @ 895 = 17 pts = dow about +136

78.6% = 918.91 + 30.05 from close @ 895 = 24pts = dow about + 192

FROM Ravi

Does your cycle/astro work allow for a sharp move towards 903 ish in th AM followed by a drop below 900 and then a move towards 909 at 2:15 or so tomorrow after Fed speak? If so, 907-909 can be another back up the trucjk and short entry after 2:10 announcement.

Awaiting your bar cycle /fibo answer unadultarated by my wave count and fibo targets.

Thanks,

Ravi

Fantastic -Your analysis need only be superceded by mkt action

Other comments are good also, but dont be afraid to EDIT and cut them short

remember that SOMETIMES ---LESS IS MORE !!

The ACTIVITY INDEX IS ROMPING up now at 266 as I write this at 9am

AND we see the SPOOS Up 8.10

THe POWER index lays out the next 2days like this

UP today , then Fizzle - FOMC, at 2;15 maybe --

we will need to watch FIBO levels YOU laid out very carefully at that time juncture and or 1pm

TOMORROW, the POWER index has the SAME reading

Up till Mid day, then fizzle

this lead to a LOWER open on friday

and continues LOWER on Monday

KISS Elliott means a 3 wave rally that GOES no where today and TOMRROW

but lets watch the FIBO levels

most likley

50% = spx 907 ** easy target for today + 100 dow

61.8% = spx 912 ** most likely to succeed tomrrow

78.6% = spx 918 ** this might be a stretch

THEn the NEXT 5 wave decline STARTING from Tomrows MIDDAY high

I think that makes it very clear

more later

Its now 9:15am

Jay

from Ravi

HIGH 927.09 to LOW @ 888.86 -38.23

21.4% = 897.04 + 8.18

38.2% = 903.46 + 14.60

50.0% = 907.98 + 19.12 from close at 895 = 12pts = dow about + 100

61.8% = 912.49 + 23.63 from close @ 895 = 17 pts = dow about +136

78.6% = 918.91 + 30.05 from close @ 895 = 24pts = dow about + 192

FROM Ravi

Does your cycle/astro work allow for a sharp move towards 903 ish in th AM followed by a drop below 900 and then a move towards 909 at 2:15 or so tomorrow after Fed speak? If so, 907-909 can be another back up the trucjk and short entry after 2:10 announcement.

Awaiting your bar cycle /fibo answer unadultarated by my wave count and fibo targets.

Thanks,

Ravi

Fantastic -Your analysis need only be superceded by mkt action

Other comments are good also, but dont be afraid to EDIT and cut them short

remember that SOMETIMES ---LESS IS MORE !!

The ACTIVITY INDEX IS ROMPING up now at 266 as I write this at 9am

AND we see the SPOOS Up 8.10

THe POWER index lays out the next 2days like this

UP today , then Fizzle - FOMC, at 2;15 maybe --

we will need to watch FIBO levels YOU laid out very carefully at that time juncture and or 1pm

TOMORROW, the POWER index has the SAME reading

Up till Mid day, then fizzle

this lead to a LOWER open on friday

and continues LOWER on Monday

KISS Elliott means a 3 wave rally that GOES no where today and TOMRROW

but lets watch the FIBO levels

most likley

50% = spx 907 ** easy target for today + 100 dow

61.8% = spx 912 ** most likely to succeed tomrrow

78.6% = spx 918 ** this might be a stretch

THEn the NEXT 5 wave decline STARTING from Tomrows MIDDAY high

I think that makes it very clear

more later

Its now 9:15am

Jay

Tuesday, June 23, 2009

CHART

heres a nice Elliott chart from Kenny

heres a nice Elliott chart from KennyHis questions show he has NO IDEA where the mkt is at the moment,

and thats because he has NO way to envision direction from here

and the expected LOW on July6th

Its sort of like taking a trip without a MAP,

and can only see where you've been, but not where your going

Ive found that true of many Elliotters,

but we are VERY FORTUNATE to have Ravi as a contributor

who is not afraid to use the tools we present here

the above chart looks like we got

5 waves down ~~ 956 to 904

3 waves UP ~~904 to 927

5waves down from 927 to 889

those 5 waves might be misconstrued as a complete cycle, but we know better

we already KNOW the rest of the story,

IT JUST NEEDS TO UNFOLD

and follow the script to July6th.

more later

Jay

Comments

Kathy

Congrats for 2 things

1 . READING ME CORRECTLY

AND

2. Playing it RIGHT

I had posted

Lower - AFTER higher OPEN

LOW at 11am

LOW at 4pm

BINGO we got ALL

SAM

IM LONG At close TONIGHT at 4pm to catch TOMRROW's MORNING rally

Not sure how high or what time YET.

How high we can get from FIBO and RAVI

but they will probably make it to 11am

_________________________________

THE MATH

we got from 927 down to spx 889 = 38 pts

X 23.6 =9 = spx 904

X 38.2=15 = spx 909 = dow + 120

X 61.8%=24=spx 919 ** = dow + 190 pts

Etc

RAVI- are we on the same page MATH wise??

________________________________-

Sam

FIZZLE IS NOT SIZZLE, and it means just that

Fizzle = Air comes out of the tube , and it deflates

SPX closed HIGHER [+2.06] than the DOW [-16]

which would indicate the DOW is actually 32 pts higher than

what it closed at, and should gap open at least by that much

Again 11am, 1pm & 4pm play an integral part in timing today

_____________________________________

NExt 2 days the TIMES CHANGE

Tmrrow

150B @ noon

180b@ 2:30

Thsday

204b@ 10am

228b@ noon

258b @ 2:30

friday

30b @ 10:30

60b @ 1pm

90b @ 3;30

AND we ALWAYS have 11-1 & 3pm DAILY

_________________________________________

BTW, the 258bar cycle is 21.5 HOURS

You can track it yourself , just start at 12:30 on Monday , 22nd

even tho the LOD was at 1;30

A cyclical BREATH USUALLY occurs every 2+1/2 hours

but is sometimes influenced by astro or the daily hourly

as seen on Monday as a a good example

the 258 bar cycle can extend to 270

or

contract to 252

So it becomes 21 to 22 hours with the MEAN Ave at 21.5

___________________________________________

more later

Jay

PS.

I cannot SPECULATE about EXACTLY HOW low July6th will take the SPX

I have posted parameters and thats the BEST ANYONE CAN offer

Isnt it BETTER to get important TIME parameters ??

Congrats for 2 things

1 . READING ME CORRECTLY

AND

2. Playing it RIGHT

I had posted

Lower - AFTER higher OPEN

LOW at 11am

LOW at 4pm

BINGO we got ALL

SAM

IM LONG At close TONIGHT at 4pm to catch TOMRROW's MORNING rally

Not sure how high or what time YET.

How high we can get from FIBO and RAVI

but they will probably make it to 11am

_________________________________

THE MATH

we got from 927 down to spx 889 = 38 pts

X 23.6 =9 = spx 904

X 38.2=15 = spx 909 = dow + 120

X 61.8%=24=spx 919 ** = dow + 190 pts

Etc

RAVI- are we on the same page MATH wise??

________________________________-

Sam

FIZZLE IS NOT SIZZLE, and it means just that

Fizzle = Air comes out of the tube , and it deflates

SPX closed HIGHER [+2.06] than the DOW [-16]

which would indicate the DOW is actually 32 pts higher than

what it closed at, and should gap open at least by that much

Again 11am, 1pm & 4pm play an integral part in timing today

_____________________________________

NExt 2 days the TIMES CHANGE

Tmrrow

150B @ noon

180b@ 2:30

Thsday

204b@ 10am

228b@ noon

258b @ 2:30

friday

30b @ 10:30

60b @ 1pm

90b @ 3;30

AND we ALWAYS have 11-1 & 3pm DAILY

_________________________________________

BTW, the 258bar cycle is 21.5 HOURS

You can track it yourself , just start at 12:30 on Monday , 22nd

even tho the LOD was at 1;30

A cyclical BREATH USUALLY occurs every 2+1/2 hours

but is sometimes influenced by astro or the daily hourly

as seen on Monday as a a good example

the 258 bar cycle can extend to 270

or

contract to 252

So it becomes 21 to 22 hours with the MEAN Ave at 21.5

___________________________________________

more later

Jay

PS.

I cannot SPECULATE about EXACTLY HOW low July6th will take the SPX

I have posted parameters and thats the BEST ANYONE CAN offer

Isnt it BETTER to get important TIME parameters ??

UPDATE - 9:20am

Thanks Guys and Gals for all the great comments- very useful stuff

EH latest says JULY6th -10th is NEXT Critical LOW & TURN to higher highs

HE uses CYCLES ONLY - NO ASTRO

and it matches EXACTLY my astro outlook for an important low & turn that week

ECLIPSES take center stage

Back to present

PROPENSITY index today starts at 2982 - moves higher in the AM to 2985, then DROPS by end of day to 2976

IT Does NOT give me intraday TIME parameters so I have to look at bar & hourly cycles for that

Bars today

60b@ 11am

90b @ 1:30

120B @ 4pm

Using what we know, we should see the rally stop at 10am - 10;15

11am turns lower with the bars and hourly turn

A 1;30 low should offer a rebound to 3pm, the next hourly turn

and a lower close on the 120bar cycle

_____________________________-

wow -There we go with 11am and 1:30

fascinating

Jun 11 high @ 1:30 @ 956

17th low @ 11am @ 904

19th high at 11am @ 927

22nd low @ 1;30 @ 894

or 893 at 4pm

_______________________________

rebound this am possible

33pts lost x 23.6 = 8 = dow 64

x 38.2= 13 = dow 100 - very typical

34 = perfect fibo

___________________________________________

FUTURES ARE NOT VERY STRONG, and we may not get

as high as the above

33x 14.6 = 5pts

_______________________________-

ITS very possible we get to a LOW at close today

Because Tomrrow's open calls for a FALSE START

huge oversold bounce and creates bullish excitement

AND

the PRO index JUMPS to near top of range to 600 at OPEN

then DROPS back to bottom of the range at 200

_____________________________________

25th reading says money under siege and

Friday calls for a Challenging start-

just the reverse of Wed.

_____________________________________

Summary

Low today after higher start

HUGE start UP on WEd, with fizzle

sluggish on Thsday

Friday open down, better later

Monday 29th = a serious type day

30th = harmonious & good for $$ ~~ Jupiter 30 Uranus influence all day

From there its DOWNHILL TO July6th

and dont forget the 3rd is a holiday

that makes the 6th on MONDAY

Mars 90 Neptune @ 10:43am

Mars 90 Jupiter @ 4;48pm

Eclipse at 4am on 7th

which clears the 7th for take off, but not b4 the 8th has its say

next Eclipse on july22, and there is NO hard energy to stop it

more later

Jay

EH latest says JULY6th -10th is NEXT Critical LOW & TURN to higher highs

HE uses CYCLES ONLY - NO ASTRO

and it matches EXACTLY my astro outlook for an important low & turn that week

ECLIPSES take center stage

Back to present

PROPENSITY index today starts at 2982 - moves higher in the AM to 2985, then DROPS by end of day to 2976

IT Does NOT give me intraday TIME parameters so I have to look at bar & hourly cycles for that

Bars today

60b@ 11am

90b @ 1:30

120B @ 4pm

Using what we know, we should see the rally stop at 10am - 10;15

11am turns lower with the bars and hourly turn

A 1;30 low should offer a rebound to 3pm, the next hourly turn

and a lower close on the 120bar cycle

_____________________________-

wow -There we go with 11am and 1:30

fascinating

Jun 11 high @ 1:30 @ 956

17th low @ 11am @ 904

19th high at 11am @ 927

22nd low @ 1;30 @ 894

or 893 at 4pm

_______________________________

rebound this am possible

33pts lost x 23.6 = 8 = dow 64

x 38.2= 13 = dow 100 - very typical

34 = perfect fibo

___________________________________________

FUTURES ARE NOT VERY STRONG, and we may not get

as high as the above

33x 14.6 = 5pts

_______________________________-

ITS very possible we get to a LOW at close today

Because Tomrrow's open calls for a FALSE START

huge oversold bounce and creates bullish excitement

AND

the PRO index JUMPS to near top of range to 600 at OPEN

then DROPS back to bottom of the range at 200

_____________________________________

25th reading says money under siege and

Friday calls for a Challenging start-

just the reverse of Wed.

_____________________________________

Summary

Low today after higher start

HUGE start UP on WEd, with fizzle

sluggish on Thsday

Friday open down, better later

Monday 29th = a serious type day

30th = harmonious & good for $$ ~~ Jupiter 30 Uranus influence all day

From there its DOWNHILL TO July6th

and dont forget the 3rd is a holiday

that makes the 6th on MONDAY

Mars 90 Neptune @ 10:43am

Mars 90 Jupiter @ 4;48pm

Eclipse at 4am on 7th

which clears the 7th for take off, but not b4 the 8th has its say

next Eclipse on july22, and there is NO hard energy to stop it

more later

Jay

Monday, June 22, 2009

Last 10 days

If we get a 5-3 -5 correction from JUNE11th

If we get a 5-3 -5 correction from JUNE11ththen where are we now?

Ravi has posted the numbers but heres the visual

From June11th I can count 5 waves down from 956 to 905 on the 17th at 11am

this can be either wave 1 or an "A"

wave 2 or "B" was 3 waves from June 17th at 904 to JuneJune19 @ 927

____________________________________

that was then, this is NOW

NOW we should be in the SECOND set of 5 waves LOWER

AND IMO, the GOAL is JULY 6th just before the ECLIPSE at 4am on the 7th.

IT NOW looks like the first of 5 waves is NOT COMPLETE YET

today as a 3rd wave from 927 to 894 at 1;30today

THEN wave 4 to 3;36pm,

and NOW looking for 5th of THIS LEG at 11am to 11;30 tomrrow

BUT thats only the first wave of 5 yet to be played out between now and July6th

Ravi

Does that paint a clear picture ?

38.2% of 300 pts = 100 pts

would give us spx 956 high to 856 at the low

61.8% = 186 pts = 770

ive seen some analysts offering that level

It would also mean June25th might offer the 856 level, then we would expect

770 level on July6th.

THIS IS ALL JUST CONJECTURE on my part

more later

Jay

waves 1 which was 5 waves

Annette's CHART

Heres that CHART you sent me to look at

Heres that CHART you sent me to look atAnd YES it ALSO hows a LOW today and high Late July

______________________________________

What about today ?

the INDEXES show a DOWN- UP Down day

we have 228bars at 10am = a possible low as now indicated by the opening futures

the Mars 120 at 11am = a high

and new moon cluster at close = a LOW

Activty index which has been DEAD FLAT ALL night has shown a little life at 9am

jumped from 66 to 133 and now sitting at 100 at open

the 24th power index shows potential for recovery high in the AM;

more later

Sunday, June 21, 2009

GOLD or Equities ??

This is Charts Edge pic of GOLD as you can see

This is Charts Edge pic of GOLD as you can seeHOWEVER, it is ALSO MY VIEW OF STOCKS during the same time period

The prior week shows a high on June 29-30 to which I am also in agreement

There are 2 eclipses in July

Full moon on July 7 th

new moon on July 21st

and another one full Moon On August 5th

Natural energy on 6th is very negative

but the FM eclipse occurs at 4am, and when

we get such events like that - it acts like a catapult for stocks on the 7th

THEN the 8th is wracked up again with hard aspects.

Summary

ive written this b4, and I know it will get lost as we move forward.

Im making a LOW on JULY 8th which will LEAD to a STRONG HIGH on July 20/22nd

____________________________________________________---

Murry Math NOW shows that the SPX once above 909, the NEXT LEVEL Up is 940

and HIS chart shows spx 937.50 is the 4/8 level.

If Jly 6th-8th SURVIVES 909 as a low, then we might look to spx 971 and or 1002

for July 21.

__________________________________________-

more later

Jay

Saturday, June 20, 2009

WAVES

Theres the Standing JOKE- How many ______ does it take to ______________

in this case= how many waves does it take to make a high??

WE can ALL SEE 5 waves DOWN from the mid day high on June11th, to June17th

but we area All having trouble with locating the next high

Lets see if we can find some clarity BEFORE the fact,

and keep in mind no matter what

IT NEVER works out exactly the way we think it should.

There is NOW 6 waves off the LOW on June17th at 11am

WHY 11am ? answer = SUN 90 Uranus

WHAT ? You dont believe in astro -thats OK because

No one is asking for believes - just observers

And at the SAME time we had a 78.6% segment of the 13 day cycle - double whammy.

_______________________________________________________

what does ALL this say about the FUTURE ??

OK- LETS EXPLORE

_________________________________________

Lets Return to this question- HOW many waves make the next high?

Were at 6 waves NOW

Ravi - can we see 7 waves or 9waves ??

IMO, I think it will be 9 waves and heres why

Natural energy SEEMS to have 3 more waves thru JUNE 30th.

and those waves should probably get TIGHTER as we reach the pinacle

_____________________________________

OK , heres how it breaks down

I hope this is NOT TOO MUCH to absorb.

*********************

Natural energy has Mars 120 Saturn high on Monday at 11am

BUT its QUICKLY followed by

1. A 13day cycle low

2. NEw Moon

3. Venus 135 Pluto

4 Sun 180 pluto

Those are the reasons for my projections for Monday

And the reading again calls for shake ups & insecurity.

THIS MIGHT BE PART OF THE 6th WAVE down ,and not a 7th wave

all depends on making a lower low than SPX904 on Monday's close - 899/900 would do it???

or Tuesday's open

Maybe we should not have closed out those shorts at a loss,

but I WILL BE USING the proceeds to buy the same shorts

back at CHEAPER PRICES at 11am

________________________

Moving ON - skip over to JUNE30th

JUNE30th has

JUPITER 30 Uranus - this is a very powerful event

reads = RESOLVE conflicts , Harmony & expect a GOOD MONEY DAY

That is the POINT where its MOST LIKELY to get the PINNACLE of THE 7 of 9 waves

AND This move might still ONLY be a WAVE "a"

____________________

WHY?? , you ask, Ok you forced my hand [g]

JULY 6th - ECLIPSE

July 8th - hard aspects

SPX to 850 as the 38% retracement

_________________________

SUMMARY

Natural energy SHOWS

A HIGH on June30th

A LOW on July8th

& THERE IS A VERY STRONG POTENTIAL for a HIGHER high on July 20 and or July 22nd

This mght be the high of 3 legs completing the MAIN counter trend wave from March 9th

more later

Jay

Friday, June 19, 2009

CONFUSION or NOT

If you think YOUR confused - TRY FOLLOWING THIS GUY

If you think YOUR confused - TRY FOLLOWING THIS GUYand HE is GOOD

This chart shows a RED TIDE and a GREEN TIDE

He says that the mkt can follow the red tide or green tide ALL DAY

OR SWITCH between tides at any point where they cross

HMMM -I think I like my indexes better

So far today and its not 8:30yet, we have futures mildy positive

_____________________________

Im glad I waited for the propensity index to get a clearer picture of today's mkt.

It NOW looks like the 10am Moon 0 Mars will most likely provide the HOD

and possibly get to the spx 923 & or 927 as mentioned by Rafi & JR

THE PROPENS index NOW shows that more clearly ALSO.

FROM THERE, BOTH the power & PROPENS index show a steady drop to the end of day low

HOW LOW IS LOW ??? dont know & it doesn't matter at this point, but it should be substantial

enuf to trade on.

IF we get the LOW and I hope its at least 900 SPX to 885, then I WILL BE BUYING limited

long position.

WHY ? you ask.

Monday at 10:45 is a Powerful Mars120 Saturn

but is followed by a new moon at 3:36pm calling for emotioanl security & defenses

accompanied by a venus 135 pluto & Sun 180 pluto

the reading calls for a SHAKE UP

Summary & GAME PLAN

I expect to sell MY short postion at 4pm today

I expect to buy some longs positions at close today

MONDAY --TO BE confirmed Sunday night.

I expect to sell those long positions at 11am, and buy shorts

I would then expect to sell those shorts at close , and buy long for a rally on Tuesday

Wed calls for CAUTION

Thsday calls for $ problems -BUT I DONT expect any new lows

Thats more than we need to know for now, because It will adjust as we go.

_______________________________________________________

More Later

Jay

Thursday, June 18, 2009

FROM a VERY ASTUTUE ELLIOTT waver

Most of you have called asking me let you know when I'm switching directions from semi-bullish to all-out bearish. That time is one teeny small degree wave "v" away. That will complete the a-b-c corrective rally from yesterday's low. My max. price target is the "wave iv" of one lesser degree. On the OEX, that = ~432.50. On the SPX, that comes out to ~927.ish. At the moment (11:30a.m. PDT), we have completed a-b and a-b-i-ii-iii-iv of c.

This was written at 2;30 EST

the SPX got to 921.93 as Ravi and I mentioned, he was also thinking 927.93

BULLETIN

RIMM is CRASHING

now off after market down $4.60 at 4;10pm

I dont have ENUF detail from the PROPENSITY index

to call an OUTRIGHT BEARISH day for tomrrow, but teh open should be similar to the 17th

the POWER INDEX does show lower levels, but not yet confirmed by above

AT 1:10 the spx hit 921.93

At 3;15, the SPX hit 921.48

then hit a low at 3:50pm at 916.02, which was also the 11;46 low

SO whats it all mean?

It looks like the high of 3:15 might have been a "v" wave failure

and it looks like 4 waves to the close

which means Friday should open in a 5th impulse wave DOWN

VIX now @ 30.06 & hit 29.60 at yep, you guesses it at 3;15, right at the days failure high

Heres some astro

Venus # Neptune @ 2am tonight = disenchantment -rimm -hmmm

should effect techs tomrrow which have not done well this week

Moon 45 Uranus @ 6am

moon 45 Sun @ 9am

Moon 0 Mars at 10am

these appear negative

150bars at 10am

matches the Astro effects for a low

Astro moon 120 Saturn at 1:33 = potential high

Midnite low tide could see the closing low

more later

Jay

A Range

It would appear we have a range setup between 920 and 885 for now

& will remain until the lower end is resolved

which may not happen till tomrrow at the earliest

the POWER index remains on a decline thru Friday

And the Propens index shows a similarity to the 16th which opened higher

and turned down at 11am

SO whats the game plan

Futures now point to a moderately higher open

I will still sell some puts at 10am if a low is offered

if not at 10am then at least at the 90bar low at 11;30

Either or situation

And

will consider re entering additional shorts at 3pm

Ian's low on 18th or 19th is looking now IMO, at the 19th

I'll worry abut the 25th-26th NEXT week

A little heads up for Monday - PRELIM astro report

there is a Very positive Mars 120 Saturn at 10:45am

but the new moon seems to be a drag as it also is clustered

with a venus 135 pluto & Sun 180 Pluto

SO, and UP start on Monday should give way to selling in the afternoon

As far as the wave count -- expecting a 5-3-5 correction form the 956 high to 885

It looks like we got 5 waves down from the high as per Ravi, and I agree

it also looks like we may have gotten,

or in the process of completing an ABC rebound off spx904

From yesterdays high at 1;45pm we might have gotten 5 waves down = wave 1

which gives them room for wave 2 UP today finishing at 3pm

heading down into tomrrow for a possible low Friday, and or Monday on the new moon

Ive given up on the idea of a huge rebound for now until the eclipse low of July6th

thru the eclipse high of July22nd

more later

Jay

Wednesday, June 17, 2009

CHART

CHART

This is a one day 5 minute chart

5 waves down from spx 956 to spx 904 at 10;55 today

from this morning at 10:55 , it looks like a B wave rebound against the CONTINUING downtrend

TODAY could also have been a 4th wave

NOW looking for the actual 5th wave for tomrrow which could end at

90bars at 11;30 with a lunar 135 at 11;46

Remember the reading was to take care of biz in the AM

propens index & power index both agree with such for tomrrow AM.

TODAY - the BAR cycle did make a low at 1pm at 30bars and

3:30 at 60 bars so there's NO reason to look for the 329 bar cycle at 10am,

It makes the 90 bar cycle at 11;30 a better bet.

and the SPX should break 900 , leading to 885= dow off about 200 pts

Its NO where near the math level at 38.2% but it does fit with 23.6%

300 x 23.6% = 71 pts

956- 71 = 885

Jay

Tuesday, June 16, 2009

Chart of Interest

A day of REST

I Sold some puts yesterday as reported

Before heading much lower tomorrow, TODAY is just a day OFF

Looks like an UP open as posted yesterday

Today should looks like something this

UP till 9;45 to 10am

DN @10:30

UP to 1pm to 3pm

204b@ 12:30

228b @ 2;30

Rally to 3pm- 3;15 or even 3;30

DN last hour & close

HOURLY HIGHS & turns are usually found at

11am

1pm

3pm

NOW, those of you who EXPECT everything I write to become ABSOLUTELY accurate,

I can assure you will be disappointed, but the info I offer is based on scientific data & daily cycles, etc.

BUT-- IF youve got something better, then lets see it.

MY game plan is to SHORT any rally above spx 930

I will be adding as the day progresses

Also SOLD my JUNE gold puts yesterday, but will buy July today

Jay

9:29am

Before heading much lower tomorrow, TODAY is just a day OFF

Looks like an UP open as posted yesterday

Today should looks like something this

UP till 9;45 to 10am

DN @10:30

UP to 1pm to 3pm

204b@ 12:30

228b @ 2;30

Rally to 3pm- 3;15 or even 3;30

DN last hour & close

HOURLY HIGHS & turns are usually found at

11am

1pm

3pm

NOW, those of you who EXPECT everything I write to become ABSOLUTELY accurate,

I can assure you will be disappointed, but the info I offer is based on scientific data & daily cycles, etc.

BUT-- IF youve got something better, then lets see it.

MY game plan is to SHORT any rally above spx 930

I will be adding as the day progresses

Also SOLD my JUNE gold puts yesterday, but will buy July today

Jay

9:29am

Monday, June 15, 2009

Todays GAME PLAN REVISED

Im GOING TO CLOSE out some of my short positions at 3;30 and or close today

3;30 pm is 90 bars using 329 on Friday at 2;30

OR

168 bars adding 60b from 1;30 minor dip

PLUS 108 bars which gets us to ** 4pm today

THIS IS NOT a usual suspect when it comes to bar cycle lows

BUT the PROPENS index does show lows at 4pm

AND

BOTH the POWER & PROPENS index show potential for OPENING rally

& Theres more

IN ADDITION

there is a Moon 60 Mercury at 8:37, and guess what

there are several reports coming out at 8:30

housing starts - PPI- Bdlg permits just to name a few

the 8:37am ASPECT infers ENTHUSIASM

Should get us an OPENING rally TILL at least 9:45 to 10am,

but it should be JUST that short lived **AS BOTH indexes show losses to follow

More Later

Jay

3;30 pm is 90 bars using 329 on Friday at 2;30

OR

168 bars adding 60b from 1;30 minor dip

PLUS 108 bars which gets us to ** 4pm today

THIS IS NOT a usual suspect when it comes to bar cycle lows

BUT the PROPENS index does show lows at 4pm

AND

BOTH the POWER & PROPENS index show potential for OPENING rally

& Theres more

IN ADDITION

there is a Moon 60 Mercury at 8:37, and guess what

there are several reports coming out at 8:30

housing starts - PPI- Bdlg permits just to name a few

the 8:37am ASPECT infers ENTHUSIASM

Should get us an OPENING rally TILL at least 9:45 to 10am,

but it should be JUST that short lived **AS BOTH indexes show losses to follow

More Later

Jay

ELLIOTT Wave

From Daneric Elliott wave site

Beginning of a significant decline? Futures point bearish. Here are the support layers that exist from 878. There exists support (which may quickly become resistance) at 935. The next support layer spans from the top of the gap at 923 - 927 or so.

After that breakout support at 914 and a little below that the 200DMA.

900-904 offers a zone as well. Ultimately 875 - 878 is the bedrock support for P2 at this stage.

At this point EWI's primary count that this was a 4th wave triangle (a distributive kind of triangle I suppose) and the 956 push was a 5th wave top is looking pretty good at this stage. Indeed if their count is correct, than the gap at 920-923 may be filled today or tomorrow. For if their count is correct then any decline today would be a 3rd wave down and Friday's goofy action was just a pause in the decline. I guess all of Friday's ABC structures were just that - correctives.

Ultimately though, I still am looking at 910 - 914 support as a key to the whole wave structure. Thats a key EW marker for now. If 910-914 maintains, then any decline might be considered an ABC pullback from 956. If 910-914 breaks lower, then you're looking at a potential significant decline and a signifcant impact to the overall wave structure with larger impulsing patterns down.

Jay

Beginning of a significant decline? Futures point bearish. Here are the support layers that exist from 878. There exists support (which may quickly become resistance) at 935. The next support layer spans from the top of the gap at 923 - 927 or so.

After that breakout support at 914 and a little below that the 200DMA.

900-904 offers a zone as well. Ultimately 875 - 878 is the bedrock support for P2 at this stage.

At this point EWI's primary count that this was a 4th wave triangle (a distributive kind of triangle I suppose) and the 956 push was a 5th wave top is looking pretty good at this stage. Indeed if their count is correct, than the gap at 920-923 may be filled today or tomorrow. For if their count is correct then any decline today would be a 3rd wave down and Friday's goofy action was just a pause in the decline. I guess all of Friday's ABC structures were just that - correctives.

Ultimately though, I still am looking at 910 - 914 support as a key to the whole wave structure. Thats a key EW marker for now. If 910-914 maintains, then any decline might be considered an ABC pullback from 956. If 910-914 breaks lower, then you're looking at a potential significant decline and a signifcant impact to the overall wave structure with larger impulsing patterns down.

Jay

Bar cycle count

OK,

It would seem that 90 bars hit at open as suggested Friday

low so far at 9:45 off 155 dow & spx 928 RIGHT near SUPPORT,

the previous high of May 8th at 929 is being chipped away as I write this.

Today we have

120 b @ noon

OR

126b @ 12;30

we'll see which one becomes more important

THEN

150b@ 2:30

or 156B @ 3pm

Then

that gives us 180b tomrrow @ 10:30

Im ignoring the possible 329b hit on Friday @ 2;30 for the moment

but do keep it on the back burner

Activity index is FLAT at its lows all day so far at 66

Power index seems to indicate a mid day low so the 126b cycle might become the LOD

AND

the Propens index confirmed the DOWN open

THEN bounces in the afternoon, BUT seems to give it up again end of day

with another strong down open tomrrow leading to the 180 bar cycle at 10;30

Game plan is to ride it down to the 17th where I AM EXPECTING

an even more severe plunge -all day, but not yet confirmed by indexes

more later

Jay

GOLD also giving up its winning ways

It would seem that 90 bars hit at open as suggested Friday

low so far at 9:45 off 155 dow & spx 928 RIGHT near SUPPORT,

the previous high of May 8th at 929 is being chipped away as I write this.

Today we have

120 b @ noon

OR

126b @ 12;30

we'll see which one becomes more important

THEN

150b@ 2:30

or 156B @ 3pm

Then

that gives us 180b tomrrow @ 10:30

Im ignoring the possible 329b hit on Friday @ 2;30 for the moment

but do keep it on the back burner

Activity index is FLAT at its lows all day so far at 66

Power index seems to indicate a mid day low so the 126b cycle might become the LOD

AND

the Propens index confirmed the DOWN open

THEN bounces in the afternoon, BUT seems to give it up again end of day

with another strong down open tomrrow leading to the 180 bar cycle at 10;30

Game plan is to ride it down to the 17th where I AM EXPECTING

an even more severe plunge -all day, but not yet confirmed by indexes

more later

Jay

GOLD also giving up its winning ways

Saturday, June 13, 2009

At the Precipice

I want to lay out next weeks potential, and thanks to all for great comments

& Ravi for the potential daily price levels

Natural energy first

Harmonic cluster of hard aspects culminating on the 17th

17th

Sun 90 Uranus

Venus 45 Uranus

Readings are

Jupiter starts RX- does NOT usually have such an immediate impact, but

15th = setbacks - obstacles- run out of steam

16th = watch your safety - no new starts- commun disruptions

17th - repeat 16th + $ is unsettling- run for cover- watch what you download

18th - take care of biz early- look for bargains

Bradley is the 18th & MULTI Fibo convergence as posted b4

_____________________________________________---

Power index - long term view

Monday - 400 @ open to 550 @ close

Tuesday - 550 start to 450 close

Wed - 500 to 400

Thurs - 500 to 400

Propens index has yet to confirm the above

____________________________________

Bar cycles

Im going to run 2 different cycles

BECAUSE there MAY HAVE BEEN a 329bar cycle low at 2;30pm Friday, yet to be confirmed

BOTH cycles started on Monday @ 258bars at 1pm, actual low as a little early at 12;45

258 bars was due Thursday at 3pm,

but may have ALSO occurred a little early @2;45pm

THEN 3:10 pm started a serious dive ending at 10 am the next day'

thus that low would have hit at 276 bars & would appear out of sync. with expected low points.

altho we had a 150 bar low at 2pm on WEd + 126b = 276- i'll have to watch that one.

_______________________________

Monday

we are expecting a 90 bars hit to get back into sync at the OPEN.

This does seem to correlate with the power index above starting at 400 at open

THE STRONG turn UP Friday at 2:30 did come right on A 329bar cycle low point ??

yet to be confirmed - BUT Monday's open should settle the matter if it opens sharply lower

IF NOT, then adding 329bars to Friday at 2;30 take us to EXACTLY 4pm on Thursday

If it has shifted which it does on RARE occasions, we will watch the bar low points on Monday

to try and confirm.

other wise the original cycle ends Thursday at 3;30 at 126 bars which could also become a low

typically ending the day at a low between 3;30 and 3;45pm.

Anyone of you who is following this is welcome to work the cycles and report on their correlations

thanks

more later

& Ravi for the potential daily price levels

Natural energy first

Harmonic cluster of hard aspects culminating on the 17th

17th

Sun 90 Uranus

Venus 45 Uranus

Readings are

Jupiter starts RX- does NOT usually have such an immediate impact, but

15th = setbacks - obstacles- run out of steam

16th = watch your safety - no new starts- commun disruptions

17th - repeat 16th + $ is unsettling- run for cover- watch what you download

18th - take care of biz early- look for bargains

Bradley is the 18th & MULTI Fibo convergence as posted b4

_____________________________________________---

Power index - long term view

Monday - 400 @ open to 550 @ close

Tuesday - 550 start to 450 close

Wed - 500 to 400

Thurs - 500 to 400

Propens index has yet to confirm the above

____________________________________

Bar cycles

Im going to run 2 different cycles

BECAUSE there MAY HAVE BEEN a 329bar cycle low at 2;30pm Friday, yet to be confirmed

BOTH cycles started on Monday @ 258bars at 1pm, actual low as a little early at 12;45

258 bars was due Thursday at 3pm,

but may have ALSO occurred a little early @2;45pm

THEN 3:10 pm started a serious dive ending at 10 am the next day'

thus that low would have hit at 276 bars & would appear out of sync. with expected low points.

altho we had a 150 bar low at 2pm on WEd + 126b = 276- i'll have to watch that one.

_______________________________

Monday

we are expecting a 90 bars hit to get back into sync at the OPEN.

This does seem to correlate with the power index above starting at 400 at open

THE STRONG turn UP Friday at 2:30 did come right on A 329bar cycle low point ??

yet to be confirmed - BUT Monday's open should settle the matter if it opens sharply lower

IF NOT, then adding 329bars to Friday at 2;30 take us to EXACTLY 4pm on Thursday

If it has shifted which it does on RARE occasions, we will watch the bar low points on Monday

to try and confirm.

other wise the original cycle ends Thursday at 3;30 at 126 bars which could also become a low

typically ending the day at a low between 3;30 and 3;45pm.

Anyone of you who is following this is welcome to work the cycles and report on their correlations

thanks

more later

Friday, June 12, 2009

Timely OIL chart

Heres another chart I think you'll find timely

I think OIL has had its MAIN MOVE up against the tide,

but it wont give up its gains so easily

It could be another few months b4 lower OIL prices can be seen

in a more steady decline.

Just like stock,s I think it will still be at least until October 1st to 10th

before the tide starts to EBB lower Into Next year

Jay

Thursday, June 11, 2009

JUNE 11th

I was looking for a chart to post but not out there to my liking

anyway today is again showing MIXED results

futures are moderately lower toward open and so is the

activity index which is bouncing between low #s of 66 earlier at 8am

to NOW at 100 at 9am

Pwr index also lower for open but after a small recovery slips lower later

no real change from yesterday's outlook for today, except NO open high

Propens index shows potential for rally high to challenge 950 ONCE again

summary

after a lower open we should expect a rally to maybe noon to 1pm

then steady slide into close

I like the PROSPECTS for tomrrow according to the power index

which shows a HIGHER open, and steady sell off afterward like yesterday,

with possible later recovery.

As far a NEXT week

PANICS cannot be seen in advance UNLESS you are reading natural energy patterns

Jay

anyway today is again showing MIXED results

futures are moderately lower toward open and so is the

activity index which is bouncing between low #s of 66 earlier at 8am

to NOW at 100 at 9am

Pwr index also lower for open but after a small recovery slips lower later

no real change from yesterday's outlook for today, except NO open high

Propens index shows potential for rally high to challenge 950 ONCE again

summary

after a lower open we should expect a rally to maybe noon to 1pm

then steady slide into close

I like the PROSPECTS for tomrrow according to the power index

which shows a HIGHER open, and steady sell off afterward like yesterday,

with possible later recovery.

As far a NEXT week

PANICS cannot be seen in advance UNLESS you are reading natural energy patterns

Jay

Wednesday, June 10, 2009

Chart of Interest

GOLD

10day GOLD chart of GLD

from the HIGH of June 2nd and 3rd

count 5 waves DOWN to a low on Monday AM

THEN COUNT 3 waves A-B-C to this morning at 963

NOW entering WAVE 3 DOWN

See the OBV - slipping lower

MACD , cant really tell yet, but the blue line seems to be

in the midst of crossing under the red line

Ult osc heading lower

________________________________________________

stocks

Activity index has now risen from 133 level at 11am to 200 now at noon

Deos that insure a rally?

NO, but it sure has some potential - We'll see how it performs later

__________________________________

Looks like a TRIPLE TOP is forming on the DOW at 8835 & SPX 950

950-650= 300 pts

a 1/3 correction = 100pts

can it happen?? yes

will it happen ?? Maybe

When will it happen ?? VERY SOON

_______________________________

JUNE 10th IS HERE- finally, and the next big move potential as above

June 17th fibo cycles convergence

144 days - Nov 20

233 day - July 15, 2008

377 days - Dec 17, 2007

All are low to low

ALSO 34 weeks Oct 10th, 2008= 171 tr days

& 71 tr days March 9th, 2009

and of course the 60 year cycle from 1949

228bars @ 2;30 on 17th

258 Bar cycle on 18th = 10;30am

Astro events harmonic 3 day CLUSTER June15 to 17

more on that later

Jay

June10th update

Monday, June 08, 2009

June Swoon

Heres another great chart from Ibo

NOTICE the SMOOTH nearly unbroken wave on the rally from March 9th to June 9/10

90 calendar days = nice symmetry

Anyone else see it as one wave such as a large "A" with NO break yet for the "B" wave

If< as most of us suspect, March 9th wave was the bottom of a very large wave 1 = 17 months in a very long bear market still unfolding thru 2012, then what we are now in might be a wave 2

And since it took 17 months to complete, we should expect wave 2 to last at least 6 months to complete its work which would take us to October where we normally expect the market to take its dive OK, lets come back to present looking at the chart again we have NOT had what might be called a sell off against the main up trend since March 9th However, June10th to 17th IMO

the next question other than time is HOW low is LOW ?

anyone got good idea?

spx gains 300 pts nearly unbroken sets up possible 1/3 swoon??

100 pts in a few days- not out of the question, but not your everyday occurrance either.

more later

Jay

This Week

We are now past the June3rd to 6th Bradley turn zone looking at the next dates of June14 to 18 & 26.

June14 is a Sunday so we would expect a turn IMO lower on the 12th

Ending on the 17th, 18th open with a huge recovery by months end on the 26th

NOTE the 26th is shown on most Bradley charts as a low- dont believe that-

__________________________________________

Today we have

activity index at 9:15 FLAT at the 100 level = bearish

VHF @ 6 = ditto

flux @ 0 = bitto

dynamic at the lower end of its scale, but at 9:25 is slight off the lowest level

power index for today starts at 325, then 300, and ends at 350

propens index at 3000 drops to 2990

Bar cycles

228b @ 10:30

258B @ 1pm

either one could be off by 15 min in either direction

hourly

9:45 first open target for a low

11am

1pm 3pm

summary

Today, the SELLING PRESSURE seems to be ON till 12;30 to 1pm

____________________________________________

TOMRROW

power index jumps to the 500 level all day indicating a recovery from today's low

________________________________________________

Wed astro has some hard aspects up until 11:34 am

and the power index starts the day at 300, but closes at the 500 level

________________________________________

Ths

has a 13day cycle event at 2pm

258bars at 3pm

venus 90 moon at 3:45 pm

power index hangs at the 400 level

_______________________________________

Friday is called as uneventful and dull

pwer index also at the 400 level

Its now 9:55am and the dow is off 96pts

As mentioned on Friday, when the mkt turns lower on a Friday

it usually continues into Monday

more later

Jay

June14 is a Sunday so we would expect a turn IMO lower on the 12th

Ending on the 17th, 18th open with a huge recovery by months end on the 26th

NOTE the 26th is shown on most Bradley charts as a low- dont believe that-

__________________________________________

Today we have

activity index at 9:15 FLAT at the 100 level = bearish

VHF @ 6 = ditto

flux @ 0 = bitto

dynamic at the lower end of its scale, but at 9:25 is slight off the lowest level

power index for today starts at 325, then 300, and ends at 350

propens index at 3000 drops to 2990

Bar cycles

228b @ 10:30

258B @ 1pm

either one could be off by 15 min in either direction

hourly

9:45 first open target for a low

11am

1pm 3pm

summary

Today, the SELLING PRESSURE seems to be ON till 12;30 to 1pm

____________________________________________

TOMRROW

power index jumps to the 500 level all day indicating a recovery from today's low

________________________________________________

Wed astro has some hard aspects up until 11:34 am

and the power index starts the day at 300, but closes at the 500 level

________________________________________

Ths

has a 13day cycle event at 2pm

258bars at 3pm

venus 90 moon at 3:45 pm

power index hangs at the 400 level

_______________________________________

Friday is called as uneventful and dull

pwer index also at the 400 level

Its now 9:55am and the dow is off 96pts

As mentioned on Friday, when the mkt turns lower on a Friday

it usually continues into Monday

more later

Jay

Saturday, June 06, 2009

COMPARE energy

COMPARE the TOP chart to the BOTTOM chart

COMPARE the TOP chart to the BOTTOM chartTOP CHART is RIGHT NOW and the next 2 weeks

**Shows a HIGh on or about JUNE 10th of which I have mentioned SEVERAL times

COMPARE TO NOV 13th

** then a SEVERE LOW on June17th/18th

SIMILAR to Nov 20

And subsequent rebound to EOM June

similar to Nov 28th

BOTTOM chart was the NATURAL ENERGY Graph for Nov 2008

Notice the Nov 13 high @ 8835 DOW

Nov 20 low @7552

Nov 30 high @8829

_______________________________________________

THE DOW GOT TO 8835 yesterday

COINCIDENCE or not ??

More Later

Jay

SPX Range

Friday, June 05, 2009

Market exhaustion

Lack of VOLUME

Lack of VOLUMENO support at highs

I bot an additional short position at today's open Dow +89

bottom chart = NO MOMENTUM on this last rally

Please soften & ameliorate your comments

Lots of rough edges yesterday - I realize we are all under great stress, and each day

that goes by withOUT a resolution makes it worse. I am ALSO WAY UNDER WATER -60%

We are very fortunate that OE is June19th

because as posted the BIG FIBO and CYCLE resolution LOW is JUNE 17th,

which means the price levels MUST now from here to there begin to sell off.

_______________________________________________________

Todays Plummet in Gold at the open -21, more to follow, including stocks

Stocks drop at 9:50, a minor 14.6%/13day cycle low

NOW at 10:15 dow - 33

150Bars @ 10:15am

180Bars @ 12;45 to 1pm

204bars @ 3pm

Sun 90 Saturn, that nasty son of a __

Saturn can lead to ruination, IF your a bull today

who do you think the PROFESSIONALS were SELLING TO this morning? Hmm.

_________________________________________--

Propensity index starts out at 2998 but finishes the day much lower at 2990

A STRONG Friday SELL OFF usually spills over into Monday

Power index starts Monday at a low level of 300, and builds to 500 later on

VHF more bearish today over the 5 level to as much as 9 so far today

___________________

258 bars is scheduled for 1pm on Monday

Monday, of course is NOT the LOW of LOWS, but it should be a good

start toward recovery for my portfolio, and Im sure yours as well

If you remember the READING for today :

$ is a touchy subject, and WOW we can vouch for that by the comments

Obstacles & aggravation - another wow

Harsh reality NOW sets in & watch your valuables

Any rally OFF Monday's LOw should be another shorting OPP, or a BUYING opp

at those lows if you want to go long, but I think its TOO later for that NOW.

Anytime I try to catch those quick moves, it doesnt work out well

Remember this also

I will be CLOSING OUT ALL my short positions on JUNE17th , andwill be BUYING Long postions

on JUNE18th looking for ONE hell of a huge rally into the 23rd and or the EOm

More Later

Jay

Thursday, June 04, 2009

ELLIOTT Wave graph

Sam, Heres his graph of Elliott wave

LIKE many ELLIOTTERS and Ive mentioned this to Ibo many times

THEY ARE TOO SHORT SIGHTED and END waves tooo soon

IMO,

the "B" wave low as shown does not have to be the END on June5/8

as we are STILL expecting a LOWER low on June17th

Thus we have

an "a" wave low on June5th to 8th

a "b' wave HIGh on June10th to 11th

and a SEVERE "c' wave LOW on June17th

THIS WHOLE 3 legged wave would NOW be labelled as a "B"

Then the HUGE "C" rally to End of month as previously projected

NO CHANGES

June 4th performing as indicated so far

open low @ 60 bars was influenced by moon 150 sun at 10;30, a LOW today -35 dow

ITS now 11am & we got the recovery high at the 11am hourly TURN

Activity index has dropped from 233 early today to 100 and has been flat at that

level for about an hour.

VHF , is only mildly active @5 which is only mildly bearish.

Jaywiz index =14 = very bearish, but could take another day as we expect for the 5th

PC are ratios somewhat neutral

A high today at either 11am or 1pm should lead to a sell off as projected into the 5th at 3;11pm

more later

Jay

DOLLAR

A reversal on the DOLLAR seems inverse to STOCKS and Metals

in other words

the DOLLAR looks ready to RALLY

stocks and metals look ready to drop

Thanks for the Support, great comments

& links to other sites of relevance

Sam :: You can see how wordy those guys get just to make one point.

It seems that if they dont give LONG winded explanations,

they are worth buying their mkt letters

A trading LOw might run over to Monday,

but it will be very hard FOR ME to hold over the wkend

258bars cycle on Monday @ 1pm

And 1pm is a typical turn on the hourly

10am low on 60 bars came in a little late but the 6/3

bars have been about 15 minutes late also.

more later

Jay

Wednesday, June 03, 2009

Those darn bulls

thanks Billy,

AS I LAST wrote

It may take 2 to 3 days to get to a short term low on the morning of June3rd.

heres the stats

June3rd at 10:30am =13 day cycle low

June3rd at 11am = 258 bar low

power index opens at 300

prop index declining phase from 3004 to as low at 2992

THUS

A low should occur on June3rd by 11am

but here is the conflict

June3rd is a BRADELY date and thus could close higher

power index jumps from open @ 300 to 450 @ closing

_______________________________________

THE ABOVE WAS written on June1st.

UP close came in spite of ALL MY ATTEMPTS to push it lower --GRRR.

________________________

Now the REST of the STORY

Tomrrow has 60bars at OPEn and both Propens & power indexes agree with an opening DIVE.

However, this time there WILL be an INTRADAY recovery to MID DAY

and THIS TIME a FAILURE at closing which WILL LEAD To a severe sell off on Friday

Jaywiz index = 14

but the PC ratios are not as bearish

thus the support for a mid day recovery

GOLD, nice hit down 18.50

more to follow

more later

Jay

AS I LAST wrote

It may take 2 to 3 days to get to a short term low on the morning of June3rd.

heres the stats

June3rd at 10:30am =13 day cycle low

June3rd at 11am = 258 bar low

power index opens at 300

prop index declining phase from 3004 to as low at 2992

THUS

A low should occur on June3rd by 11am

but here is the conflict

June3rd is a BRADELY date and thus could close higher

power index jumps from open @ 300 to 450 @ closing

_______________________________________

THE ABOVE WAS written on June1st.

UP close came in spite of ALL MY ATTEMPTS to push it lower --GRRR.

________________________

Now the REST of the STORY

Tomrrow has 60bars at OPEn and both Propens & power indexes agree with an opening DIVE.

However, this time there WILL be an INTRADAY recovery to MID DAY

and THIS TIME a FAILURE at closing which WILL LEAD To a severe sell off on Friday

Jaywiz index = 14

but the PC ratios are not as bearish

thus the support for a mid day recovery

GOLD, nice hit down 18.50

more to follow

more later

Jay

Tuesday, June 02, 2009

JUNE 5th AND 17th

attention traders !!!

Please verify that 34 wks from Oct 10th = June5th

IT doesnt,

but June5th is an important low regardless Sun 90 Saturn

In addition heres the outlook for JUNE5th

$ woes & depressive

Harsh realities & expect aggravation galore + obstacles

watch your valuables & dont sign documents

SOUNDS LIKE MY KIND OF DAY - the BEAR GROWLS & attacks

__________________________________________

BUT still not as

important as JUNE17th- June 17th- June17th

do you think I'm repeating myself?

WHICH IS -- YES IT IS = 34 weeks = 171 tr days

October 10th to June17th

June17th- June17th - June17th

**********

And now the rest of the story for june17th

34 wks = 171 tr days = Oct10th low to June17th

Yet to be LOW

March 9th to June17th = 71 tr days

ive heard this cycle mentioned occasionally

_________________________

JUNE17th , June17th IS ALSO

FIBO wealthy

233 july 15th,2008 - low to low

377 Dec 17th,2007 - low to low

144 Nov 20, 2008 - low to low

______________________

AND even more important

60 year cycle low to low from June17th, 1949

_____________________________

Dear Mr. Trader

please contact your nearest online broker to take advantage of this deal

OH Yeh, BTW,

This communication will self destruct as soon as you view it so no comments are necessary,

unless they are constructive.

Best Wishes

Jay

Please verify that 34 wks from Oct 10th = June5th

IT doesnt,

but June5th is an important low regardless Sun 90 Saturn

In addition heres the outlook for JUNE5th

$ woes & depressive

Harsh realities & expect aggravation galore + obstacles

watch your valuables & dont sign documents

SOUNDS LIKE MY KIND OF DAY - the BEAR GROWLS & attacks

__________________________________________

BUT still not as

important as JUNE17th- June 17th- June17th

do you think I'm repeating myself?

WHICH IS -- YES IT IS = 34 weeks = 171 tr days

October 10th to June17th

June17th- June17th - June17th

**********

And now the rest of the story for june17th

34 wks = 171 tr days = Oct10th low to June17th

Yet to be LOW

March 9th to June17th = 71 tr days

ive heard this cycle mentioned occasionally

_________________________

JUNE17th , June17th IS ALSO

FIBO wealthy

233 july 15th,2008 - low to low

377 Dec 17th,2007 - low to low

144 Nov 20, 2008 - low to low

______________________

AND even more important

60 year cycle low to low from June17th, 1949

_____________________________

Dear Mr. Trader

please contact your nearest online broker to take advantage of this deal

OH Yeh, BTW,

This communication will self destruct as soon as you view it so no comments are necessary,

unless they are constructive.

Best Wishes

Jay

The Mortgage Mess

recent chart from Ethan

Cycle Conflicts

thanks Billy,

AS I LAST wrote

It may take 2 to 3 days to get to a short term low on the morning of June3rd.

heres the stats

June3rd at 10:30am =13 day cycle low

June3rd at 11am = 258 bar low

power index opens at 300

prop index declining phase from 3004 to as low at 2992

THUS

A low should occur on June3rd by 11am

but here is the conflict

June3rd is a BRADELY date and thus could close higher

power index jumps from open @ 300 to 450 @ closing

______________________________

4th seems to want to stand pat as the power index

opens at 450, slips to 400 & closes at 450

BUT

A more important low should then occur on friday @ 3:11 pm

Sun 90 saturn

204bars @ 3pm

Jay

AS I LAST wrote

It may take 2 to 3 days to get to a short term low on the morning of June3rd.

heres the stats

June3rd at 10:30am =13 day cycle low

June3rd at 11am = 258 bar low

power index opens at 300

prop index declining phase from 3004 to as low at 2992

THUS

A low should occur on June3rd by 11am

but here is the conflict

June3rd is a BRADELY date and thus could close higher

power index jumps from open @ 300 to 450 @ closing

______________________________

4th seems to want to stand pat as the power index

opens at 450, slips to 400 & closes at 450

BUT

A more important low should then occur on friday @ 3:11 pm

Sun 90 saturn

204bars @ 3pm

Jay

Monday, June 01, 2009

Kevin Murhpy research

As promised from Kevin Murhpy

The theoretical Dow compared to the print is clearly telling us the market is getting weaker. At the on May 8 the Dow Theoretical high 8657, 70 points above the print high of 8587. On May 20 The Dow made a new print high at 8592, 5 point above the print high on May 8th but the theoretical high was 8645, 12 points below the theoeretical high on May 8th. So although the Dow went higher on May 20th, the theortical high was lower. So the second time the gap was 53 points, not 70. The result was a sharp sell off. On May 29th the Dow print high was 8523, which was 69 points below the print high on 20th. But the theoretical high on May 29th was 8541, which was 104 points below the theoretical high on May 20th. So clearly each rall is getting weaker and the market is saying it's done. I Still expect a final push up into June 4/5 but then the theoretical high should be rather pathetic and far below the Mid May highs. KWM

Jay

The theoretical Dow compared to the print is clearly telling us the market is getting weaker. At the on May 8 the Dow Theoretical high 8657, 70 points above the print high of 8587. On May 20 The Dow made a new print high at 8592, 5 point above the print high on May 8th but the theoretical high was 8645, 12 points below the theoeretical high on May 8th. So although the Dow went higher on May 20th, the theortical high was lower. So the second time the gap was 53 points, not 70. The result was a sharp sell off. On May 29th the Dow print high was 8523, which was 69 points below the print high on 20th. But the theoretical high on May 29th was 8541, which was 104 points below the theoretical high on May 20th. So clearly each rall is getting weaker and the market is saying it's done. I Still expect a final push up into June 4/5 but then the theoretical high should be rather pathetic and far below the Mid May highs. KWM

Jay

Subscribe to:

Posts (Atom)