Dont expect EVERY NUANCE to get hit precisely , but this should offer some guidance

Dont expect EVERY NUANCE to get hit precisely , but this should offer some guidanceinto December's price action

Jay

Once again the traders EKG did a fairly good job

Once again the traders EKG did a fairly good job  Day trader EKG is still 70% accurate daily since inception on March 24th

Day trader EKG is still 70% accurate daily since inception on March 24th DID YOU PAY ATTENTION to the EKG this morning

DID YOU PAY ATTENTION to the EKG this morning I was tempted NOT to publish the EKG today

I was tempted NOT to publish the EKG today Jaywiz.blogspot.com is at the TOP of the Google page - Jaywiz

Jaywiz.blogspot.com is at the TOP of the Google page - Jaywiz The EKG below was for the WHOLE day, so the depiction was PERFECT for the half day

The EKG below was for the WHOLE day, so the depiction was PERFECT for the half day Activity index was dead flat at 33 all nite - its lowest possible value

Activity index was dead flat at 33 all nite - its lowest possible value

Could have been a better ending for the bears, but NOT TODAY

Could have been a better ending for the bears, but NOT TODAY LOOKS LIKE Futures pointing to HIGHER OPEN

LOOKS LIKE Futures pointing to HIGHER OPEN 26hrs & 126bars converge at 10am

26hrs & 126bars converge at 10am Once again, the End of day sell off appears it will occur tomrrow and

Once again, the End of day sell off appears it will occur tomrrow and

ONCE again we see the END OF DAY rising with no late drop off, but like Friday's

ONCE again we see the END OF DAY rising with no late drop off, but like Friday's

MOST times, I would agree with Columbia to look for a B then C wave higher

MOST times, I would agree with Columbia to look for a B then C wave higher that EKG could have worked out better or actually PERFECT without the eod sell off

that EKG could have worked out better or actually PERFECT without the eod sell off Energy levels take a DIVE after Yesterday's strong runup

Energy levels take a DIVE after Yesterday's strong runup Just as predicted, a late drop off

Just as predicted, a late drop off It does LOOK like the 144 FIBO trade day cycle from April26th hit yesterday

It does LOOK like the 144 FIBO trade day cycle from April26th hit yesterday Today calls for a cycle convergence

Today calls for a cycle convergence that DOWN close expected MIGHT show up on open tomrrow

that DOWN close expected MIGHT show up on open tomrrow Today is a Bradley turn date, BUT that turn may have come yesterday midday

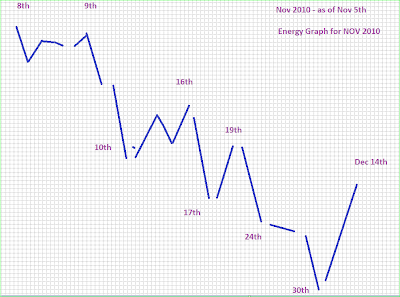

Today is a Bradley turn date, BUT that turn may have come yesterday midday As we can PLAINLY see the TREND for NOVEMBER has been DOWN and according to the

As we can PLAINLY see the TREND for NOVEMBER has been DOWN and according to the That MID day DECLINE now looks like a closing decline,

That MID day DECLINE now looks like a closing decline,  Does look like much ado about nothing today

Does look like much ado about nothing today DOLLAR now at 78.15, looks possible to 83

DOLLAR now at 78.15, looks possible to 83 Heres a graph from Columbia which typifies what many Elliotters are thinking

Heres a graph from Columbia which typifies what many Elliotters are thinking Darn close to the real days action

Darn close to the real days action Its only 7am, and Im early- got an appt to go to

Its only 7am, and Im early- got an appt to go to NOW WE SEE the RESULTS of the LATE GAP down which

NOW WE SEE the RESULTS of the LATE GAP down which  JUST AS I mentioned this morning- The end of GAP lower did NOT materialize

JUST AS I mentioned this morning- The end of GAP lower did NOT materialize According to the above EKG graph, the end of the day looks like a gap lower

According to the above EKG graph, the end of the day looks like a gap lower OK,

OK, Today's reading

Today's reading This TYPE OF GRAPH may be a much better representation of the

This TYPE OF GRAPH may be a much better representation of the  Heres Nov Energy graph For better or worse

Heres Nov Energy graph For better or worse AS expected ,today traveled in a very narrow range hitting ths hod at close which I mentioned in my comments

AS expected ,today traveled in a very narrow range hitting ths hod at close which I mentioned in my comments Was that SURGE a 5th wave Final THRUST 0r overthrow for real?

Was that SURGE a 5th wave Final THRUST 0r overthrow for real?