ONLY ONE WORD TO DESCRIBE this PHENOMENA

AMAZING!!

JOIN the Jaywiz VPN and YOU too will KNOW WHAT TOMORROW will bring.

THE NEW JAYWIZ 2023

THE NEW JAYWIZ 2023

Tuesday, November 27, 2012

Market Timing -Whats Next ! ! TIME IS RUNNING OUT

Take a look at these 2 charts

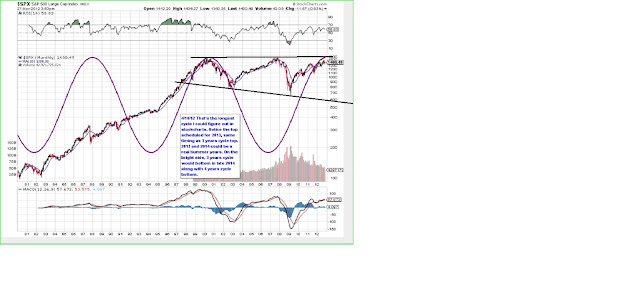

The SPX is nearing a 10 year cycle SOMETHING from a March 2003 MAJOR PIVOT LOW.

IS THIS GOING TO REPEAT that in 2013?? NOT LIKELY- However, IT COULD BE Offering a 10 YEAR TOP leading to a 12 year CYCLE LOW in 2015 -- JAY - IF THAT'S THE CASE< THEN HOW LOW IS LOW??

JUST LOOK AT THESE 2 charts and SEE IT FOR YOURSELF

SPX is in a BROADENING FORMATION

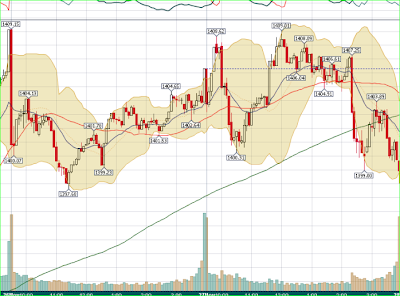

SILVER is headed to the price range as noted

IGNORE ALL THOSE PUNDITS trying to GET you to BUY STOCKS, proposing an SPX at 1600 -- BAH HUMBUG, and ALL THOSE Hollywood people telling you GET on the BAND WAGON FOR GOLD & Silver --

THEY ARE LATE TO THE PARTY - THE HIGH for GOLD in 1980 at $850 took till 1999 to bottom out at $250, THAT'S NINETEEN YEARS later, when it got to a point that NO ONE

EVER WANTED TO HEAR the word GOLD, ever again.

TAKE A LESSON from Father Time. a MARKET that runs from $250 to $1900 in 12 years WILL NOT just keep on TICKING-- NOT UNTIL it gets setback to a considerably lower price.

IF YOUR NOT SURE what is being proposed, then you need to join the JAYWIZ VPN and get a clear picture of day to day activity . THEN the LONG term will fall into place as we go. BUT it is paramount to have a LONG TERM PERSPECTIVE such as this.

WHEN will this BEGIN to happen ??

Thats a GREAT QUESTION, since its obvious that such an event is not an overnight sensation.

AS noted it should take at least 3 years to get to a critical bottom in 2015, but then HOW LONG will it take to get out of it> WELL thats a question for another time.

AS FOR NOW, we need to become AWARE of the PITFALLS coming in 2013. IVE already alerted you to what IM CONSIDERING the FIRST SHOCK WAVE to hit WORLD Markets with at least a 25% decline in stock prices.

To find out more, You know what you need to do

Stay Tuned for Further udpates

Jay

The SPX is nearing a 10 year cycle SOMETHING from a March 2003 MAJOR PIVOT LOW.

IS THIS GOING TO REPEAT that in 2013?? NOT LIKELY- However, IT COULD BE Offering a 10 YEAR TOP leading to a 12 year CYCLE LOW in 2015 -- JAY - IF THAT'S THE CASE< THEN HOW LOW IS LOW??

JUST LOOK AT THESE 2 charts and SEE IT FOR YOURSELF

SPX is in a BROADENING FORMATION

SILVER is headed to the price range as noted

IGNORE ALL THOSE PUNDITS trying to GET you to BUY STOCKS, proposing an SPX at 1600 -- BAH HUMBUG, and ALL THOSE Hollywood people telling you GET on the BAND WAGON FOR GOLD & Silver --

THEY ARE LATE TO THE PARTY - THE HIGH for GOLD in 1980 at $850 took till 1999 to bottom out at $250, THAT'S NINETEEN YEARS later, when it got to a point that NO ONE

EVER WANTED TO HEAR the word GOLD, ever again.

TAKE A LESSON from Father Time. a MARKET that runs from $250 to $1900 in 12 years WILL NOT just keep on TICKING-- NOT UNTIL it gets setback to a considerably lower price.

|

WHEN will this BEGIN to happen ??

Thats a GREAT QUESTION, since its obvious that such an event is not an overnight sensation.

AS noted it should take at least 3 years to get to a critical bottom in 2015, but then HOW LONG will it take to get out of it> WELL thats a question for another time.

AS FOR NOW, we need to become AWARE of the PITFALLS coming in 2013. IVE already alerted you to what IM CONSIDERING the FIRST SHOCK WAVE to hit WORLD Markets with at least a 25% decline in stock prices.

To find out more, You know what you need to do

Stay Tuned for Further udpates

Jay

Monday, November 26, 2012

Market Timing- Whats Next !! SELL SIGNALS generated

SELL SIGNALS WERE generated on Friday's CLOSE on my 10 year old SPREAD SHEET of INTERNAL TECHNICAL Arms data.

2 graphs are available for viewing at Rant Finance under the Jaywiz blog- There are also many previous articles on that data and how it is tracked. Scroll thru those articles to review & print them out.

BUT FOR NOW, we are looking at a drop back to probably the 1340 area or lower by Friday Nov 30th.

EKG & PD for last week showed the upward movement quite well and it DOES ALL THAT IN ADVANCE.

You've already seen the EKG for last week so no need to show it again

The Jaywiz VPN members get all the above WELL IN ADVANCE, and become aware of potential

for the WEEK AHEAD which is confirmed daily via the EKG

Stay tuned for further updates

but better yet

GET AHEAD of the market & join the Jaywiz VPN

$100 gets you 90 days of multiple daily updates via email as well as TIMELY commentary, charts & graphs & lots more.

Most of the members are market technicians who merge my data with their own to confirm their own work.

BUT I do have several clients who do not trade the market, but like to keep up with it.

Learning first can lead to successful trading.

Later

Jay

2 graphs are available for viewing at Rant Finance under the Jaywiz blog- There are also many previous articles on that data and how it is tracked. Scroll thru those articles to review & print them out.

BUT FOR NOW, we are looking at a drop back to probably the 1340 area or lower by Friday Nov 30th.

EKG & PD for last week showed the upward movement quite well and it DOES ALL THAT IN ADVANCE.

You've already seen the EKG for last week so no need to show it again

The Jaywiz VPN members get all the above WELL IN ADVANCE, and become aware of potential

for the WEEK AHEAD which is confirmed daily via the EKG

Stay tuned for further updates

but better yet

GET AHEAD of the market & join the Jaywiz VPN

$100 gets you 90 days of multiple daily updates via email as well as TIMELY commentary, charts & graphs & lots more.

Most of the members are market technicians who merge my data with their own to confirm their own work.

BUT I do have several clients who do not trade the market, but like to keep up with it.

Learning first can lead to successful trading.

Later

Jay

Saturday, November 24, 2012

Market Timing-Whats Next !! Review the Jaywiz Daily EKG

Last week's EKG certainly told the story as each day unfolded,

VPN members already knew what to expect.

GET IN TUNE

Jay

VPN members already knew what to expect.

GET IN TUNE

Jay

Wednesday, November 21, 2012

Saturday, November 17, 2012

Market Timing- Whats Next - The Jaywiz IMPACT STREAM Resource

THIS INDEX IS ALSO AVAILABLE ONE DAY AHEAD and this graph shows EXACTLY

what transpired the NEXT DAY- THIS VIEW IS OCT & NOV 2012 with the SPX below for comparison. ALSO NOTED is the SPX HIGH & LOW price levels on the graph

AMAZING !!

and when the Dynamic matches with the Impact, its a perfect combination

Join NOW and get ahead of 2013

$100/ 90 days gets you to FEB 18th

IS THAT REALLY TOO MUCH to pay to see ahead

I THINK NOT

Stay Tuned for Further updates

Jay

Keep in mind the IMPACT STREAM does NOT EXCLUDE Weekends a marked out.

what transpired the NEXT DAY- THIS VIEW IS OCT & NOV 2012 with the SPX below for comparison. ALSO NOTED is the SPX HIGH & LOW price levels on the graph

AMAZING !!

and when the Dynamic matches with the Impact, its a perfect combination

Join NOW and get ahead of 2013

$100/ 90 days gets you to FEB 18th

IS THAT REALLY TOO MUCH to pay to see ahead

I THINK NOT

Stay Tuned for Further updates

Jay

Market Timing-Whats Next !! OFF TOPIC

PLAY THIS VIDEO on YOU TUBE

go to you tube

or

just Google it .

Prager University - The Middle East Problem

its only 5.59 minutes

EXTREMELY ENLIGHTENING

Jay

go to you tube

or

just Google it .

Prager University - The Middle East Problem

its only 5.59 minutes

EXTREMELY ENLIGHTENING

Jay

Market Timing Whats Next !! REVIEW the Power Data

Join the Jaywiz VPN &

GET A WEEK AHEAD VIEW of what to expect for next week

Review the last 2 weeks below- Nov5th to 16th

ANOTHER VIEW OF THE ABOVE looks LIKE THIS below.

Each day is separated by a different color for easier identification.

NOTE HOW WELL THE POWER DATA CAPTURED THE ESSENCE OF EACH DAY LAST WEEK and IT WAS PUBLISHED to the VPN group ON WEEK AHEAD on NOV 11th.

Stay Tuned for Further Updates

Jay

GET A WEEK AHEAD VIEW of what to expect for next week

Review the last 2 weeks below- Nov5th to 16th

ANOTHER VIEW OF THE ABOVE looks LIKE THIS below.

Each day is separated by a different color for easier identification.

NOTE HOW WELL THE POWER DATA CAPTURED THE ESSENCE OF EACH DAY LAST WEEK and IT WAS PUBLISHED to the VPN group ON WEEK AHEAD on NOV 11th.

Stay Tuned for Further Updates

Jay

Friday, November 16, 2012

Market Timing-Whats Next !! VPN -GET A HEADS UP

STAY AHEAD OF THE MARKET

DAILY EKG performance has been incredible - better than 80% for weeks now.

IF you missed the last drop of 800 dow pts from Nov 5th, then Your not a VPN member

Join NOW and Stay informed

Jay

DAILY EKG performance has been incredible - better than 80% for weeks now.

IF you missed the last drop of 800 dow pts from Nov 5th, then Your not a VPN member

Join NOW and Stay informed

Jay

Market Timing - Whats Next -!! MORE SELLING NEXT WEEK

76% correlation

NO NEED for any further explanations

one picture = 1000 words

the BLUE LINE below is from the Thanksgiving week of Nov26th, 2007

the BLACK line is CURRENT

Also note the strong recovery the week after

BULLS with CASH, get ready to BUY

BIG FIBO CLUSTER on NOV23rd which is a HALF DAY mkt closing at 1pm

Jay

Market Timing -Whats Next !! OVERVIEW graph- A DANGEROUS moment

IT doesnt take a ROCKET SCIENTIST to SEE just how VULNERABLE the market is to another 1000 pts LOSS on the Dow Jones index NEXT WEEK.

INTERNAL TECH DATA is oversold, but it is JUST AT A TIME like this when we can get the most serious declines.

Elliott wave view shows the market in a potential serious "C" wave which could challenge

the previous June lows at 1266.

Internal tech oversold data was actually alleviated Thsday with a one day ARMS of .60

and my XL Spread sheet re iterated another SELL SIGNAL

Heres the graph that shows exactly whats next.

SPX at 1350 is the break down to the next major support level at 1266.

Stay Tuned for further updates

Jay

INTERNAL TECH DATA is oversold, but it is JUST AT A TIME like this when we can get the most serious declines.

Elliott wave view shows the market in a potential serious "C" wave which could challenge

the previous June lows at 1266.

Internal tech oversold data was actually alleviated Thsday with a one day ARMS of .60

and my XL Spread sheet re iterated another SELL SIGNAL

Heres the graph that shows exactly whats next.

SPX at 1350 is the break down to the next major support level at 1266.

Stay Tuned for further updates

Jay

Thursday, November 15, 2012

Market timing -Whats Next !! Jaywiz Daily EKG & SPX

It does take a little time & experience to best comprehend how the EKG works, but part of the "WELCOME to the Jaywiz VPN" is an INTRODUCTION to the EKG and HOW to USE IT.

ALSO included in that welcome is an explanation of ALL THE OTHER RESOURCES.

Join now and take advantage of the Jaywiz VPN get ahead program

Stay tuned for further updates

Jay

Wednesday, November 14, 2012

Market Timing-Whats Next - by Jaywiz - Review the Power Data Resource

The BLUE DOTS represent what the POWER DATA graph shows us ONE WEEK in ADVANCE

The GREY LINE is my interpretation of the expected daily activity.

The Orange line is the ACTUAL SPX price level extremes and close.

Are you sure this would not help you become a more informed trader?? 200 VPN members certainly would NOT be called foolish, and their 70% renew rate proves it- thus I would gather that this resource has become very important.

note that-

Most of the VPN membership are REAL TRADERS of all experience levels, many of whom are also good technicians. They combine their knowledge with Jaywiz giving them data that cannot be found anywhere else on the web. **Ive even got 2 people who don't trade at all.

The whole point is to provide info that assists traders to make better trading decisions.

$100/ 90 days gives you multiple daily updates of the scientific resources plus charts, graphs, internal tech data, energy flow, my daily comments, and much more.

There are others who charge $100/ month, and dont provide anywhere near as much.

Try it out for 90 days and if you don't improve your trading results, then just don't renew.

Sorry, there are NO trial periods less than 90 days- There is a LOT of back ground data that NEW members get which gives comprehensive info connecting the graphs with the market.

Just giving you a couple days of current reports won't make as much sense without all that background. And it would not be fair to give you that background for free.

Stay Tuned for Further Updates

Jay

Each day is independent, but some what tied to the next day.

Also the PD is NOT intended to depict OVERALL DIRECTION for the week, but does seem to have some validity for the purpose-- IF this sounds like double talk, Im sorry, but its really hard to explain it unless you see how it works for a longer period to time than just 5 days.

Of course there is NO such thing as down for the week or up for the week. Wha used in conjunction with other technical graphs, charts and data, the PD becomes another powerful

resource. Jay

The GREY LINE is my interpretation of the expected daily activity.

The Orange line is the ACTUAL SPX price level extremes and close.

Are you sure this would not help you become a more informed trader?? 200 VPN members certainly would NOT be called foolish, and their 70% renew rate proves it- thus I would gather that this resource has become very important.

note that-

Most of the VPN membership are REAL TRADERS of all experience levels, many of whom are also good technicians. They combine their knowledge with Jaywiz giving them data that cannot be found anywhere else on the web. **Ive even got 2 people who don't trade at all.

The whole point is to provide info that assists traders to make better trading decisions.

$100/ 90 days gives you multiple daily updates of the scientific resources plus charts, graphs, internal tech data, energy flow, my daily comments, and much more.

There are others who charge $100/ month, and dont provide anywhere near as much.

Try it out for 90 days and if you don't improve your trading results, then just don't renew.

Sorry, there are NO trial periods less than 90 days- There is a LOT of back ground data that NEW members get which gives comprehensive info connecting the graphs with the market.

Just giving you a couple days of current reports won't make as much sense without all that background. And it would not be fair to give you that background for free.

Stay Tuned for Further Updates

Jay

Each day is independent, but some what tied to the next day.

Also the PD is NOT intended to depict OVERALL DIRECTION for the week, but does seem to have some validity for the purpose-- IF this sounds like double talk, Im sorry, but its really hard to explain it unless you see how it works for a longer period to time than just 5 days.

Of course there is NO such thing as down for the week or up for the week. Wha used in conjunction with other technical graphs, charts and data, the PD becomes another powerful

resource. Jay

Monday, November 12, 2012

Market Timing - Whats Next !! This weeks Jaywiz outlook

Tech charts show the market is NOW is a declining phase as I've shown since SPT20th, at about the same time Apple announced the Iphone 5, and has dropped from $700 to about $525.

NO It was NOT just a Coincidence,

& the market decline on Nov 7th was NOT due to the Re Election of President Obama

THIS WEEK, we should get a little strength early which may amount to nothing but wait & see

However, there should be a stronger PIVOT LOW on Wed the 15th, but its NOT expected to be THE LOW. That low should occur later in the month leading to a strong December.

HERE is an ADVANCE PEEK at the DAILY EKG for today, and partial for Tuesday-

KEEP IN MIND that the EKG is best used to see intraday direction rather than magnitude,

as it does a better job of depicting changes in direction than the depth of those changes.

Combining the EKG with the WEEKLY Power Data gives VPN members a HEADS UP on what to expect for the week. IN addition, we also publish in advance all the JAYWIZ short term CYCLE pivots with daily psych readings as well as INSIGHTS for the month.

Insights alert us to the more frustrating days of the month which can also be helpful in your own daily activities.

AND THATS JUST FOR STARTERS

All the charts, graphs, and other research is brot to the VPN to keep up with the latest internal and external market statistics.

Stay Tuned for Further Updates

Jay

better yet- JOIN THE JAYWIZ VPN & GET a HEADS UP on the

NEXT DAY, WEEK, MONTH, & QTR

NOTE HOW WELL THE EKG PREDICTED the FLOW of PRICE CHANGES

YOU MEAN TO TELL ME YOU CAN STILL IGNORE such an incredible resource

Jay

NO It was NOT just a Coincidence,

& the market decline on Nov 7th was NOT due to the Re Election of President Obama

THIS WEEK, we should get a little strength early which may amount to nothing but wait & see

However, there should be a stronger PIVOT LOW on Wed the 15th, but its NOT expected to be THE LOW. That low should occur later in the month leading to a strong December.

HERE is an ADVANCE PEEK at the DAILY EKG for today, and partial for Tuesday-

KEEP IN MIND that the EKG is best used to see intraday direction rather than magnitude,

as it does a better job of depicting changes in direction than the depth of those changes.

Combining the EKG with the WEEKLY Power Data gives VPN members a HEADS UP on what to expect for the week. IN addition, we also publish in advance all the JAYWIZ short term CYCLE pivots with daily psych readings as well as INSIGHTS for the month.

Insights alert us to the more frustrating days of the month which can also be helpful in your own daily activities.

AND THATS JUST FOR STARTERS

All the charts, graphs, and other research is brot to the VPN to keep up with the latest internal and external market statistics.

Stay Tuned for Further Updates

Jay

better yet- JOIN THE JAYWIZ VPN & GET a HEADS UP on the

NEXT DAY, WEEK, MONTH, & QTR

NOTE HOW WELL THE EKG PREDICTED the FLOW of PRICE CHANGES

YOU MEAN TO TELL ME YOU CAN STILL IGNORE such an incredible resource

Jay

Friday, November 09, 2012

Market Timing-Whats Next !! Anatomy of a CORRECTION

Nov 1st at 1434 as the B wave TOP is similar to the EDGE of the CLIFF

The TREND LINE FROM OCTOBER 3rd is CRITICAL support

and is in JEOPARDY of breaking at 1370.

HOW LOW IS LOW ??

and WHEN is the LOW??

see the graph above

Stay tuned for further updates

Jay

The TREND LINE FROM OCTOBER 3rd is CRITICAL support

and is in JEOPARDY of breaking at 1370.

HOW LOW IS LOW ??

and WHEN is the LOW??

see the graph above

Stay tuned for further updates

Jay

Thursday, November 08, 2012

Market Timing-Whats Next !! Pathway to SPX 1371

From my EMAIL to the VPN group - note the Time & Date Nov7th @ 1:30pm

Stay Tuned for further updates

Jay

Stay Tuned for further updates

Jay

Monday, November 05, 2012

Market timing-Whats Next !! LAST WEEK IN REVIEW

LAST WEEK"S POWER DATA WAS COMPLICATED BY HURRICANE SANDY

BUT

IT LOOKS LIKE THE MARKET DID NOT SKIP A BEAT !!

Was there supposed to be an interruption ?? OR NOT ?? Certainly cant rule it out.

see the comparison below.

STAY TUNED FOR FURTHER UPDATES

Jay

BUT

IT LOOKS LIKE THE MARKET DID NOT SKIP A BEAT !!

Was there supposed to be an interruption ?? OR NOT ?? Certainly cant rule it out.

see the comparison below.

| ||

| THERE IS NO WAY THAT YOU CAN TELL ME THIS SCIENTIFIC RESOURCE would not be of IMMENSE VALUE TO YOUR TRADING EFFORTS, and of course your BANK ACCOUNT - |

STAY TUNED FOR FURTHER UPDATES

Jay

Saturday, November 03, 2012

Market Timing-Whats Next !! Jawyiz DAILY EKG NAILS FRIDAY Nov 2nd

ONE picture is worth 1000 words

NO Need to write any more

Stay Tuned for further updates

NO NEED TO WAIT !!.

OK- HERES ONE NOW !!

POWER DATA FOR Monday , along with Energy & wave progression POINT to a LOWER open for Nov5th with a potential for a pivot turn at 11am to noon, and or 2:30pm at the latest.

The only question that cant be answered in advance is

IF THE SPX WILL BREAK UNDER 1403.

***

1410 is at the 78% retrace, but since it closed at 1414, It doesn't look like that will hold, THUS it becomes more likely that 1403 will not hold either.

The 258 BAR CYCLE pivot low at 11am got obliterated on Friday ,as the SPX

made lower lows into the close.

THE NEXT 258bar cycle low is NOW DUE on Nov 7th at 1pm, and we would expect some strength after that event. Even the reading for the day indicates a stressful AM, but better later. THIS ALSO agrees with the Power Data index.

SO, we CONNECT the DOTS in advance AND look forward to Monday & how well the market follows this scenario, but also with a KEEN EAR to the ground, as we are always vigilant of a fibo level matchup to the above outlook.

Jay

NO Need to write any more

Stay Tuned for further updates

NO NEED TO WAIT !!.

OK- HERES ONE NOW !!

POWER DATA FOR Monday , along with Energy & wave progression POINT to a LOWER open for Nov5th with a potential for a pivot turn at 11am to noon, and or 2:30pm at the latest.

The only question that cant be answered in advance is

IF THE SPX WILL BREAK UNDER 1403.

***

1410 is at the 78% retrace, but since it closed at 1414, It doesn't look like that will hold, THUS it becomes more likely that 1403 will not hold either.

The 258 BAR CYCLE pivot low at 11am got obliterated on Friday ,as the SPX

made lower lows into the close.

THE NEXT 258bar cycle low is NOW DUE on Nov 7th at 1pm, and we would expect some strength after that event. Even the reading for the day indicates a stressful AM, but better later. THIS ALSO agrees with the Power Data index.

SO, we CONNECT the DOTS in advance AND look forward to Monday & how well the market follows this scenario, but also with a KEEN EAR to the ground, as we are always vigilant of a fibo level matchup to the above outlook.

Jay

Subscribe to:

Comments (Atom)