NEAR PERFECT for Monday FEB 25th

Below is a SNEAK PEAK of Tuesday FEb 26th

VPN members ALREADY know what to expect for the 27th till noon

WHAT ABOUT YOU ??

DO You know what today & Tomorrow's trading day will look like?

I doubt it, BUT WE DO !!

JOIN THE Jaywiz VPN & get ahead of the market.

ARE YOU STILL LETTING THE MARKET SURPRISE you??

UNSURE ABOUT 2mrw?

UNSURE about next week ?

UNSURE about next month ?

YOU DONT NEED TO BE UNSURE any more!!

JOIN THE Jaywiz VPN

Jay

THE NEW JAYWIZ 2023

THE NEW JAYWIZ 2023

Tuesday, February 26, 2013

Monday, February 25, 2013

Market Timing-Whats Next!! UP & AWAY -TO the Moon -??

NOT SO FAST, folks,

BE PATIENT, we will get there in MARCH as previously noted

DOES the Sequester and continuing resolution have anything to do with the market action?

YES, and No.

EVENTS FALL INTO PLACE as the market progresses

Human EVENTS do NOT CAUSE stock market movement although it certainly looks that way quite often.

Today's OPEN rally seems to have started Friday at close and may have touched a trend line as shown on the graph below, setting up the NEXT DOWN LEG as indicated on the graphs.

BEST BET FOR GETTING INTO A LONG position looks like it will come on MARCH 5th near the open. CONSIDER that the low of wave (4) thus setting up the next leg wave (5) to 1566 by March 28th.

IVE WRITTEN ALL THIS BEFORE and REPEAT IT AGAIN

exactly What BAD NEWS will accompany this drop off is anybody's guess, but we do know

there are major Congressional interactions due on the 27th. - I'm just guessing as a maybe.

ANYWAY, enuf speculation about events, here are the graphs for this week.

BE PATIENT, we will get there in MARCH as previously noted

DOES the Sequester and continuing resolution have anything to do with the market action?

YES, and No.

EVENTS FALL INTO PLACE as the market progresses

Human EVENTS do NOT CAUSE stock market movement although it certainly looks that way quite often.

Today's OPEN rally seems to have started Friday at close and may have touched a trend line as shown on the graph below, setting up the NEXT DOWN LEG as indicated on the graphs.

BEST BET FOR GETTING INTO A LONG position looks like it will come on MARCH 5th near the open. CONSIDER that the low of wave (4) thus setting up the next leg wave (5) to 1566 by March 28th.

IVE WRITTEN ALL THIS BEFORE and REPEAT IT AGAIN

exactly What BAD NEWS will accompany this drop off is anybody's guess, but we do know

there are major Congressional interactions due on the 27th. - I'm just guessing as a maybe.

ANYWAY, enuf speculation about events, here are the graphs for this week.

Saturday, February 23, 2013

Market timing-Whats Next- REASONS TO JOIN The Jaywiz VPN

REVIEW LAST WEEK"S preformance of the POWER DATA< EKG & E-WAVE projections

JAYWIZ Resources give VPN members the EDGE

POWER DATA on TOP gives us a VIEW of WHATS NEXT for the WHOLE WEEK AHEAD

EKG next chart confirms DAILY activity, ONE DAY AHEAD

Chart #3 shows CYCLE PIVOTS and WAVE COUNT

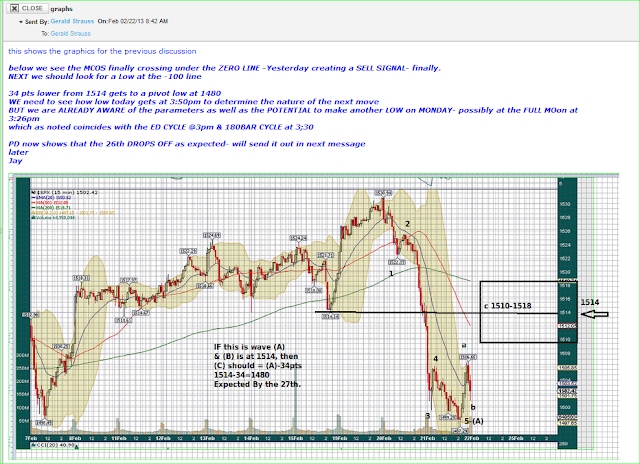

Chart #4 - VPN EMAIL FRIDAY @ 8:42 AM --

PINPOINTING the POTENTIAL to get to 1510 to 1518 , with 1514 as a middle level

MKT CLOSED at 1515.60

GETTING AHEAD of the MARKET is OUR GOAL, and keeping up with the daily pivots

keeps us in touch with our trading activity. It THEN becomes a matter of matching up the data with reality as it occurs.

STAY TUNED FOR FURTHER UPDATES

Jay

JAYWIZ Resources give VPN members the EDGE

POWER DATA on TOP gives us a VIEW of WHATS NEXT for the WHOLE WEEK AHEAD

EKG next chart confirms DAILY activity, ONE DAY AHEAD

Chart #3 shows CYCLE PIVOTS and WAVE COUNT

Chart #4 - VPN EMAIL FRIDAY @ 8:42 AM --

PINPOINTING the POTENTIAL to get to 1510 to 1518 , with 1514 as a middle level

MKT CLOSED at 1515.60

GETTING AHEAD of the MARKET is OUR GOAL, and keeping up with the daily pivots

keeps us in touch with our trading activity. It THEN becomes a matter of matching up the data with reality as it occurs.

STAY TUNED FOR FURTHER UPDATES

Jay

Wednesday, February 20, 2013

Market Timing-Whas Next!! WHAT HAPPENED TODAY??

BUSTED RISING WEDGE WITH STRONG DOWNSIDE VOLUME

ARMS on the FIRST DECLINE of 3.23

9 / 1 DOWNSIDE VOLUME -

90% DOWN VOLUME on the FIRST DAY -off the TOP

THAT stat does NOT BODE WELL for the near term.

_____________________________________________________________

AND what about TOMORROW ??

Thats EASY when YOU have the EKG in front of you-- see the lower graph

As of right now, we can see a LOW occurring at about noon to 1:30pm

cant tell about the close yet, but 30 bars at close could override the 258 bar pivot at 1:30.

_____________________________________________________________

SURE- JUST when YOU thought it was safe to get back in the water, some one pulls the plug

FED spoke up at just the wrong time, OR WOULD IT HAVE DROPPED ANYWAY.

_________________________________________________________________

I JUST SENT OUT A NUMERICAL STUDY of the SPX over the past 5 years

WHICH CLEARLY points OUT PRICE LEVELS that indicate TURNS.

the OUTCOME showed the SPX - DOW- DJT- DJI - RUT - NDX & NASDAQ

ALL MET the CRITERIA for indicating a TOP -yesterday, FEB 19th, 2013.

VPN members got that chart yesterday

STAY TUNED FOR FURTHER UPDATES

better yet get all this and more AHEAD of the action - JOIN THE VPN

Jay

ARMS on the FIRST DECLINE of 3.23

9 / 1 DOWNSIDE VOLUME -

90% DOWN VOLUME on the FIRST DAY -off the TOP

THAT stat does NOT BODE WELL for the near term.

_____________________________________________________________

AND what about TOMORROW ??

Thats EASY when YOU have the EKG in front of you-- see the lower graph

As of right now, we can see a LOW occurring at about noon to 1:30pm

cant tell about the close yet, but 30 bars at close could override the 258 bar pivot at 1:30.

_____________________________________________________________

SURE- JUST when YOU thought it was safe to get back in the water, some one pulls the plug

FED spoke up at just the wrong time, OR WOULD IT HAVE DROPPED ANYWAY.

_________________________________________________________________

I JUST SENT OUT A NUMERICAL STUDY of the SPX over the past 5 years

WHICH CLEARLY points OUT PRICE LEVELS that indicate TURNS.

the OUTCOME showed the SPX - DOW- DJT- DJI - RUT - NDX & NASDAQ

ALL MET the CRITERIA for indicating a TOP -yesterday, FEB 19th, 2013.

VPN members got that chart yesterday

STAY TUNED FOR FURTHER UPDATES

better yet get all this and more AHEAD of the action - JOIN THE VPN

Jay

Market Timing-Whats Next for GOLD ??

VPN members have the most recent updates and they offer solid projections for GOLD

DO you know where GOLD is headed and WHEN to expect strong TURNS??

WE do !!

Join the Jaywiz VPN and get the answers your looking for ***

Stay tuned for further updates

NOTE the CORRELATIONS on the graph below

Jay

FUTURE projections are already moving correctly as projected by the updated graphs

DO you know where GOLD is headed and WHEN to expect strong TURNS??

WE do !!

Join the Jaywiz VPN and get the answers your looking for ***

Stay tuned for further updates

NOTE the CORRELATIONS on the graph below

Jay

FUTURE projections are already moving correctly as projected by the updated graphs

Saturday, February 16, 2013

Market Timing Whats Next- THIS IS HOW Jaywiz WORKS

rr

LOOK CLOSELY and YOU WILL SEE JUST HOW WELL THESE RESOURCES PERFORM

POWER DATA ABOVE is PUBLISHED ONE WEEK AHEAD

EKG below is published daily starting at 7pm on SUNDAY to SEE most of MONDAY

then 8am Monday to see up thru most of Tuesday, etc etc

WE get testimonial after testimonial praising just how well this works,

especially in conjunction with your own work.

NO ONE ANALYST will be RIGHT 100 % of the time- THUS you CANNOT just follow that person and expect fabulous results without doing your own research then ADDING Jaywiz to complement your work.

POWER DATA ABOVE is PUBLISHED ONE WEEK AHEAD

EKG below is published daily starting at 7pm on SUNDAY to SEE most of MONDAY

then 8am Monday to see up thru most of Tuesday, etc etc

WE get testimonial after testimonial praising just how well this works,

especially in conjunction with your own work.

NO ONE ANALYST will be RIGHT 100 % of the time- THUS you CANNOT just follow that person and expect fabulous results without doing your own research then ADDING Jaywiz to complement your work.

More later

Jay

Friday, February 15, 2013

Market Timing- Whats Next !! HUGE PROFITS

Just ONE unsolicited EMAIL from a VERY LONG TERM & SATISFIED VPN CLIENT

GET in TOUCH with the Market and MAKE BETTER TRADING DECISIONS

Jay

GET in TOUCH with the Market and MAKE BETTER TRADING DECISIONS

Jay

Thursday, February 14, 2013

Market Timing-Whats Next !! Jaywiz EKG in TUNE again this week

IM SURE YOU CAN SEE just how valuable this resource can be for trading

and

ITS ONLY ONE OF MANY TOOLS that we use to determine the best course of action

to assist traders when making decisions.

Stay Tuned for Further Updates

Jay

and

ITS ONLY ONE OF MANY TOOLS that we use to determine the best course of action

to assist traders when making decisions.

Stay Tuned for Further Updates

Jay

Wednesday, February 13, 2013

Market Timing-Whats Next!! Compare Jaywiz EKG & Comments

WE have 2 EKG models that assist our endeavors to determine the best course of action for trading the next day and part of the day after-- as shown, Feb 13th & 14th.

BOTH of these EKG'S were sent out at 8am today giving us a heads up for the days action.

In addition we also provided the following daily data

*2/13 - EXPECT A POSITIVE EARLY START, with difficult trends later and less effective in the afternoon.

AS SUCH, we are NOT EXPECTING anything severe on the downside THIS WEEK.

Ive noted that several times.

BUT after the 15th, the MARKET will be under a DIFFERENT ENERGY PATTERN

making the 19th SUSCEPTIBLE to a one day HORRIFIC looking sell off.

THE LOWER EKG shows MORE DETAIL as per intraday SWINGS while the one on top shows

overall direction more clearly.

Both show potential for an afternoon recovery. IF it does NOT occur today, what often happens

then is we get it the next morning.

THE MOST IMPORTANT thing we will get from the EKG will come out on MONDAY at 7pm when we will get to see JUST What to expect for Tuesday, FEB 19th. WE do expect the EKG to CONFIRM a serious decline, and will be sending that out to VPN members as noted on Monday at 7pm.

IF IM RIGHT and the SPX runs at or above 1525 on FRIDAY, I WILL BE SHORTING THE CLOSE at the latest, or just might add shorts from 1pm thru to 4pm.

Using the 40 pt rule of thumb , it is possible we might get to the 1543-1546 level this week

its very simple math and Ive shownt he VPN group just how viable the 40 pt rule of thumb is.

1266 + 280 = 1546 ((((((( 7 X 40 = 280

1343 + 200 = 1543 ((((((( 5 X 40 = 200

80 pts between those runs is also a 40 X 2

You can take that rule of thumb all the way back to Mar9 @666, and LONG BEFORE that.

23 X 40 = 920pts, and the SPX LOST 910 pts from HIGH to Low.

NO, this is NOT 100% ALL the TIME, but we have been getting an 80% correlation for more than 2 years now.

Stay Tuned For Further Updates

better yet, JOIN THE JAYWIZ VPN & GET A HEADS UP ON TOMORROW'S market.

AMAZING, talking heads on CNBC have been SMILING for 3 months now singing the BULL

TUNE ALL THE WAY UP THRU yesterday, BUT NOW THE MKT has hit 1525 and appears to be backing off some giving rise to <>CORRECTION talk- What will the SAY on FRIDAY when the SPX reaches up to 1545 area and the DOW runs up near its previous 2007 top?

OF COURSE, Maria will give a GIDDY closing report with SMILES and praises to the bull.

What will be the MOOD ON Tuesday?? Hmmm

OH NO JAY< NOT ANOTHER CRASH report !!!

NO~~~, SORRY, ~~~A ONE DAY drop of UP TO 5% does NOT constitute a crash

but does conform to the 40 pt rule X 2.

Later

Jay

BOTH of these EKG'S were sent out at 8am today giving us a heads up for the days action.

In addition we also provided the following daily data

*2/13 - EXPECT A POSITIVE EARLY START, with difficult trends later and less effective in the afternoon.

AS SUCH, we are NOT EXPECTING anything severe on the downside THIS WEEK.

Ive noted that several times.

BUT after the 15th, the MARKET will be under a DIFFERENT ENERGY PATTERN

making the 19th SUSCEPTIBLE to a one day HORRIFIC looking sell off.

THE LOWER EKG shows MORE DETAIL as per intraday SWINGS while the one on top shows

overall direction more clearly.

Both show potential for an afternoon recovery. IF it does NOT occur today, what often happens

then is we get it the next morning.

THE MOST IMPORTANT thing we will get from the EKG will come out on MONDAY at 7pm when we will get to see JUST What to expect for Tuesday, FEB 19th. WE do expect the EKG to CONFIRM a serious decline, and will be sending that out to VPN members as noted on Monday at 7pm.

IF IM RIGHT and the SPX runs at or above 1525 on FRIDAY, I WILL BE SHORTING THE CLOSE at the latest, or just might add shorts from 1pm thru to 4pm.

Using the 40 pt rule of thumb , it is possible we might get to the 1543-1546 level this week

its very simple math and Ive shownt he VPN group just how viable the 40 pt rule of thumb is.

1266 + 280 = 1546 ((((((( 7 X 40 = 280

1343 + 200 = 1543 ((((((( 5 X 40 = 200

80 pts between those runs is also a 40 X 2

You can take that rule of thumb all the way back to Mar9 @666, and LONG BEFORE that.

23 X 40 = 920pts, and the SPX LOST 910 pts from HIGH to Low.

NO, this is NOT 100% ALL the TIME, but we have been getting an 80% correlation for more than 2 years now.

Stay Tuned For Further Updates

better yet, JOIN THE JAYWIZ VPN & GET A HEADS UP ON TOMORROW'S market.

AMAZING, talking heads on CNBC have been SMILING for 3 months now singing the BULL

TUNE ALL THE WAY UP THRU yesterday, BUT NOW THE MKT has hit 1525 and appears to be backing off some giving rise to <

OF COURSE, Maria will give a GIDDY closing report with SMILES and praises to the bull.

What will be the MOOD ON Tuesday?? Hmmm

OH NO JAY< NOT ANOTHER CRASH report !!!

NO~~~, SORRY, ~~~A ONE DAY drop of UP TO 5% does NOT constitute a crash

but does conform to the 40 pt rule X 2.

Later

Jay

Monday, February 11, 2013

Market Timing-Whats Next !! -- JAYWIZ DAILY EKG-AMAZING

|

YOU COULD NOT ASK FOR ANYTHING BETTER

THIS WAS SHOWN TO YOU ON SUNDAY and again more complete on Monday-

JOIN the JAYWIZ VPN and GET the DAILY EKG ALL THE TIME

and a HECK OF A LOT MORE

THE whole point of bringing this AMAZING NATURAL RESOURCE to YOU is simply to give the TRADER more information with which to make better trading decisions.

Jay

Despite the 6.5% stock market rally over the last three months, a handful of billionaires

are quietly dumping their American stocks . . . and fast.

Warren Buffett, who has been a cheerleader for U.S. stocks for quite some time, is dumping

shares at an alarming rate. He recently complained of “disappointing performance” in

dyed-in-the-wool American companies like Johnson & Johnson, Procter & Gamble, and Kraft Foods.

In the latest filing for Buffett’s holding company Berkshire Hathaway, Buffett has been drastically

reducing his exposure to stocks that depend on consumer purchasing habits. Berkshire sold roughly

19 million shares of Johnson & Johnson, and reduced his overall stake in “consumer product stocks”

by 21%. Berkshire Hathaway also sold its entire stake in California-based computer parts supplier Intel.

With 70% of the U.S. economy dependent on consumer spending, Buffett’s apparent lack of faith in

these companies’ future prospects is worrisome. Unfortunately Buffett isn’t alone.

Fellow billionaire John Paulson, who made a fortune betting on the subprime mortgage meltdown, is

clearing out of U.S. stocks too. During the second quarter of the year, Paulson’s hedge fund,

Paulson & Co., dumped 14 million shares of JPMorgan Chase. The fund also dumped its entire position

in discount retailer Family Dollar and consumer-goods maker Sara Lee

….

No investors, let alone billionaires, will want to own stocks with falling profit margins and shrinking

dividends. So if that’s why Buffett, Paulson, and Soros are dumping stocks, they have decided to

cash out early and leave Main Street investors holding the bag.…

Sunday, February 10, 2013

Market Timing-Whats Next !! SNEAK PEAK -UPDATE

IT'S SUNDAY FEBRUARY 10th at 7pm--

SEE tomorrow's Market - TODAY

TODAY'S EKG is somewhat ADJUSTED - NOW THAT WE GET TO SEE THE WHOLE DAY

AS PER MY EMAIL MESSAGE THISMorning

with a more complete graph I was able to correct the DAILY BOXES

and compare 3 models to get a better picture of what to expect next 2

days.

DYN seems best for projecting more than one day, and since

it appears may have started a minor downtrend- making Thsday a POSSIBLE

PIVOT LOW

matching the PD and daily psych reads for a strong rally on Friday.

IF were buying the DIPS, NOW_ IT would seem like thsday would be best bet for that strategy

If day trading and buying the dips, TODAY looks like a late comeback after the 258b@ 3pm

OTHERWISE, IT STILL LOOKS LIKE THE BEST SHORTING OPP will come at CLOSE on FRIDAY FEb15th

as TUESDAY, FEB 19th, with Monday closed should, should be the FIRST STRONG BEARISH decline leading to that FEB 27th PIVOT

but March wont get much upward motion till after the 4th.

Later

Jay

SEE tomorrow's Market - TODAY

TODAY'S EKG is somewhat ADJUSTED - NOW THAT WE GET TO SEE THE WHOLE DAY

AS PER MY EMAIL MESSAGE THIS

Friday, February 08, 2013

Market Timing-Whats Next!! LONG CYCLES CONVERGE

Peter Eliades on CNBC this afternoon

says the FEB 6th coincides with MAJOR TURNS & Changes

including Oct19th 1987, and other significant dates in the past

Heres another one that I just ran- from this cycle that I noted previously.

Feb 7th = 987 tr days takes us back to March 9,09

That means HIS LONG term and My FIBO are on or about the same date

ONE more

987 tr days x 10 = 9870

9870/ 260 tr days per yr = 37.96 years

2012- 38 years = 1974

says the FEB 6th coincides with MAJOR TURNS & Changes

including Oct19th 1987, and other significant dates in the past

Heres another one that I just ran- from this cycle that I noted previously.

Feb 7th = 987 tr days takes us back to March 9,09

That means HIS LONG term and My FIBO are on or about the same date

ONE more

987 tr days x 10 = 9870

9870/ 260 tr days per yr = 37.96 years

2012- 38 years = 1974

BUT

we still have to see just what Monday FEb 11th brings

IF only a minor dip within the FIBO from 1400 to 1518

then we STILL have one more high on the 15th at possibly 1525

AND

ONE MORE shot at 1566 late March

we still have to see just what Monday FEb 11th brings

IF only a minor dip within the FIBO from 1400 to 1518

then we STILL have one more high on the 15th at possibly 1525

AND

ONE MORE shot at 1566 late March

IF the mkt falls out of bed next week, then any recovery should be considered only

a minor retrace.

From Mar9th to SPX 1370 in 2010 and the current high from that point

(High to High) are just about EQUAL in TIME to TODAY

Stay Tuned for Further Updates

Jay

Wednesday, February 06, 2013

Monday, February 04, 2013

Market Timing- Whats Next!!- SEE Tomorrows Market, TODAY

JUST AS EXPECTED

the EKG showed us at 7pm ON SUNDAY what to expect today,

& our analysis on Friday indicated such an event was likely for today.

HOW MUCH longer, HOW LOW, and WHEN will we see the BULL AGAIN?

Is this the start of some terrible, or just a blip in the action??

All the answers are available to VPN members

and what about GOLD?? DO YOU REALLY BELIEVE that gold can NOW run over 1900 to as high at $2500/ ounce?? If you do, Ive got a BRIDGE too far to offer.

SEE THE EKG below -ONE PICTURE IS WORTH 1000 words

THIS IS AN AMAZING resource that SO MANY MEMBERS cannot wait another day to see.

THEY ALREADY KNOW ABOUT FEB 5th-- DO YOU ??

NO MORE NEEDS TO BE WRITTEN

Stay Tuned for Further Updates

better yet

JOIN the Jaywiz VPN, and get a HEADS UP on whats next

Jay

the EKG showed us at 7pm ON SUNDAY what to expect today,

& our analysis on Friday indicated such an event was likely for today.

HOW MUCH longer, HOW LOW, and WHEN will we see the BULL AGAIN?

Is this the start of some terrible, or just a blip in the action??

All the answers are available to VPN members

and what about GOLD?? DO YOU REALLY BELIEVE that gold can NOW run over 1900 to as high at $2500/ ounce?? If you do, Ive got a BRIDGE too far to offer.

SEE THE EKG below -ONE PICTURE IS WORTH 1000 words

THIS IS AN AMAZING resource that SO MANY MEMBERS cannot wait another day to see.

THEY ALREADY KNOW ABOUT FEB 5th-- DO YOU ??

NO MORE NEEDS TO BE WRITTEN

Stay Tuned for Further Updates

better yet

JOIN the Jaywiz VPN, and get a HEADS UP on whats next

Jay

Saturday, February 02, 2013

Market Timing-Whats Next !! -- TOO THE MOON ??

NOT SO FAST, folks

See the graph below-- speaks loudly

NO- We are NOT going to CRASH, but an overdue sell off is upon us.

STAY TUNED FOR FURTHER UPDATES

Jay

See the graph below-- speaks loudly

NO- We are NOT going to CRASH, but an overdue sell off is upon us.

STAY TUNED FOR FURTHER UPDATES

Jay

Subscribe to:

Comments (Atom)