A low on August 8th should lead to a high on Spt4th

From there a deeper low could be possible for the end of Spt which could possibly set the stage & start a mild rising trend thru March or April of 2009

Jay

THE NEW JAYWIZ 2023

THE NEW JAYWIZ 2023

Sunday, August 24, 2008

Monday Aug 25th

Cycle are pointing down for the day and could start with a slump at the open.

Still got Tuesday for big Up

Wed peaking

Thursday much lower

friday starts lower , and should recover some

Jay

Still got Tuesday for big Up

Wed peaking

Thursday much lower

friday starts lower , and should recover some

Jay

Friday, August 22, 2008

Friday Aug 22

looks like a big open

may not last all day, but could drop and recover by days end

Opposite of Yesterday

Monday offers a sloppy day, and one where you should be cautious and little will go right.

Tuesday promises a day of extravagance including stock prices

Wed - more of the same but could turn mid day and head lower

Thurs & friday head for the new moon and a low tide, so do look out for a possible new low for the month.

Jay

may not last all day, but could drop and recover by days end

Opposite of Yesterday

Monday offers a sloppy day, and one where you should be cautious and little will go right.

Tuesday promises a day of extravagance including stock prices

Wed - more of the same but could turn mid day and head lower

Thurs & friday head for the new moon and a low tide, so do look out for a possible new low for the month.

Jay

Thursday, August 21, 2008

stealth rally

the 130 pt rally came off a 100 pt down open.

My cycle work was mixed today and the result is what you saw happen.

Jaywiz index is now somewhat bearish @ 26

PC ratios are neutral to bearish

heres a few things to take not of.

Oct 9 to Aug 15 = 216 tr days = 27 segments of 8

May 19 to july 15 = 39 tr days

July 15 to Spt 9 = 40 tr days = A bradley date

Spt 9 to Nov 4th = 40 tr days

Aug 22nd has a high tide

But the cycle has turned DOWN

Jay

My cycle work was mixed today and the result is what you saw happen.

Jaywiz index is now somewhat bearish @ 26

PC ratios are neutral to bearish

heres a few things to take not of.

Oct 9 to Aug 15 = 216 tr days = 27 segments of 8

May 19 to july 15 = 39 tr days

July 15 to Spt 9 = 40 tr days = A bradley date

Spt 9 to Nov 4th = 40 tr days

Aug 22nd has a high tide

But the cycle has turned DOWN

Jay

Wednesday, August 20, 2008

Wheres that rally ?

Its 2:45 pm on WEd Aug 20

Got a false start today high @ 11am

150 bars @ 10am

204 bars @ 2:30- I would like to see that low HOLD at the close

Tomorrow has the astro look of a potential big Up day till 1pm

Jay

Got a false start today high @ 11am

150 bars @ 10am

204 bars @ 2:30- I would like to see that low HOLD at the close

Tomorrow has the astro look of a potential big Up day till 1pm

Jay

Wed Aug 20

Its now 8:30 AM on WEd Aug 20

Most of my research indicates a solid Upday today

Jaywiz index Mon = .56

Tues = .47

OEX , PC & SPDR ratios also bullish readings

84.5 hr cycle HIGH @ 11am TOmorrow

yesterday's 126 bar cycle low was due at 2:45 and looks like it hit @ 3:15- within the margin of allowed cycle time stretch.

Jay

Most of my research indicates a solid Upday today

Jaywiz index Mon = .56

Tues = .47

OEX , PC & SPDR ratios also bullish readings

84.5 hr cycle HIGH @ 11am TOmorrow

yesterday's 126 bar cycle low was due at 2:45 and looks like it hit @ 3:15- within the margin of allowed cycle time stretch.

Jay

Tuesday, August 19, 2008

update

Its now 2pm on Tuesday Aug 19th;

Lows hit at 10:23 at the Lunar mars 180

Also hit a low @ 12:30 on the 102 bar cycle

Now expecting 126bars cycle @ 2:45 and that might be the LOD

A rebound from there should carry them up till mid day on Wed, and from there its pretty much biased lower till 11:15am on Friday

best wishes

Jay

Lows hit at 10:23 at the Lunar mars 180

Also hit a low @ 12:30 on the 102 bar cycle

Now expecting 126bars cycle @ 2:45 and that might be the LOD

A rebound from there should carry them up till mid day on Wed, and from there its pretty much biased lower till 11:15am on Friday

best wishes

Jay

Monday, August 18, 2008

Has there been a trend change?

friday was an 8 day HIGH

Today is a 9 day TURN

next 8-9 day grouping is the 28/29th

HIGH energy levels are upon us today and it looks like they abate tomorrow

just what that means for stock prices remains to be seen.

Today is also 216 tr days from Oct 10th, and should /could offer a CHANGE in trend.

Best for now

Jay

Today is a 9 day TURN

next 8-9 day grouping is the 28/29th

HIGH energy levels are upon us today and it looks like they abate tomorrow

just what that means for stock prices remains to be seen.

Today is also 216 tr days from Oct 10th, and should /could offer a CHANGE in trend.

Best for now

Jay

Sunday, August 17, 2008

Still on the upswing

Preliminary indications for a Monday high are still posible

If we get a spurt at the open, it could offer the best shorting opp in 2 weeks.

Jaywiz index shows .15 and lowest value in 2 wks

Gold dropping, Oil and commodities all making lower numbers, and should continue this week - we need lower gas prices. $3.50 or lower would be ok for now, and lower later.

Friday was an 8 day high, making Monday a 9 day TURN which should make for a WEd low

Still got potential for Aug 22nd TOP which may or may not be higher than spx1312. Several attempts to break out are common when you get intermediate uptrends. Many still expect the july 15th low to be tested, and thats my lead for the next paragraph.

My19th high @ 13,000, and spx 1440

Jly 15th LOW was 40 trade days and Dow 11,000 with spx @ 1200

There was an NYSE record of 1304 new lows that day- so we should be watching NOW for a lower SPX, NYSE low with LESS new lows for the day in order to say we have seen the BOTTOM. IF there is a lower low with MORE new lows, then we havent seen the bottom

Spt9th is the next important Bradley date and is coincidentally 40 trade days from July 15th

Add another 40 trade days from there takes us to Nov 4th, AH yes Election day and Ive mentioned it several times over the past few months as having a grouping of tough aspects occurring on the 3rd and 4th.

At the Spt 9th date, there is a large grouping of MIXED aspects on Sun the 7th , 8th and 9th which dont appear

to be abundantly negative, thus I think it would be prudent to consider that date a high. In between, however, as mentioned above we have a possible high on Aug 22nd, and now we are thinking a low on Spt 3th with potential rebound to the 9th.

All in All the Fall usually is a tough time for stocks, and with an election upon us accompanied by some very difficut aspects, I would venture to say we should not expect anything in the way of a strong rebound until after nov 4th. In other words, another rebound such as July 15 TO Aug 11th is not expected, but a NEITHER is a CRASH

Best for Now

Jay

If we get a spurt at the open, it could offer the best shorting opp in 2 weeks.

Jaywiz index shows .15 and lowest value in 2 wks

Gold dropping, Oil and commodities all making lower numbers, and should continue this week - we need lower gas prices. $3.50 or lower would be ok for now, and lower later.

Friday was an 8 day high, making Monday a 9 day TURN which should make for a WEd low

Still got potential for Aug 22nd TOP which may or may not be higher than spx1312. Several attempts to break out are common when you get intermediate uptrends. Many still expect the july 15th low to be tested, and thats my lead for the next paragraph.

My19th high @ 13,000, and spx 1440

Jly 15th LOW was 40 trade days and Dow 11,000 with spx @ 1200

There was an NYSE record of 1304 new lows that day- so we should be watching NOW for a lower SPX, NYSE low with LESS new lows for the day in order to say we have seen the BOTTOM. IF there is a lower low with MORE new lows, then we havent seen the bottom

Spt9th is the next important Bradley date and is coincidentally 40 trade days from July 15th

Add another 40 trade days from there takes us to Nov 4th, AH yes Election day and Ive mentioned it several times over the past few months as having a grouping of tough aspects occurring on the 3rd and 4th.

At the Spt 9th date, there is a large grouping of MIXED aspects on Sun the 7th , 8th and 9th which dont appear

to be abundantly negative, thus I think it would be prudent to consider that date a high. In between, however, as mentioned above we have a possible high on Aug 22nd, and now we are thinking a low on Spt 3th with potential rebound to the 9th.

All in All the Fall usually is a tough time for stocks, and with an election upon us accompanied by some very difficut aspects, I would venture to say we should not expect anything in the way of a strong rebound until after nov 4th. In other words, another rebound such as July 15 TO Aug 11th is not expected, but a NEITHER is a CRASH

Best for Now

Jay

Tuesday, August 12, 2008

NOW WHAT ?

OK, they got to 1312 on monday at about 2pm

5 days Arms = 87.4 indicating a short term sell

5 day trin = 437 - Ditto

10 day trin = 968 Ditto

P/C ratios neutral

July 15 low to Aug 11 high = 18.5 days

July 15 to Aug 22 = 28 days

28 days less 18.5 days = 8.5 days

1/2 of that = 4.25 days

Aug 11th at 2pm + 4.25 days = friday @ 4pm

It appears we got a rebound from the low which = wave "A"

guessing that we will have a 3 wave structure of A-B -C

Where's "B "going??

240 pt loss X 50% = 120

1200 + 120 = 1320, Ok we got to 1312, close enuf

120 pt gain from July 15 x

38.2% =46 which carries out to 1266

50% = 60 1252

61.8% = 74 1238

So, we have a range of 1238 to 1266 by friday Aug 15th.

where does that make numbers for the week after? good question.

August 22 nd should find the market ending at 1340 area which could offer a 600 to 800 pt dow rally that week. Astro is lite and positive that week.

Best for now

Jay

5 days Arms = 87.4 indicating a short term sell

5 day trin = 437 - Ditto

10 day trin = 968 Ditto

P/C ratios neutral

July 15 low to Aug 11 high = 18.5 days

July 15 to Aug 22 = 28 days

28 days less 18.5 days = 8.5 days

1/2 of that = 4.25 days

Aug 11th at 2pm + 4.25 days = friday @ 4pm

It appears we got a rebound from the low which = wave "A"

guessing that we will have a 3 wave structure of A-B -C

Where's "B "going??

240 pt loss X 50% = 120

1200 + 120 = 1320, Ok we got to 1312, close enuf

120 pt gain from July 15 x

38.2% =46 which carries out to 1266

50% = 60 1252

61.8% = 74 1238

So, we have a range of 1238 to 1266 by friday Aug 15th.

where does that make numbers for the week after? good question.

August 22 nd should find the market ending at 1340 area which could offer a 600 to 800 pt dow rally that week. Astro is lite and positive that week.

Best for now

Jay

Sunday, August 10, 2008

Thanks for the encouragement

Weve mentioned the math b4 and here it is again

SPX 1440 -1200= 240 X 50% = 120

spx 1200 + 120 = 1320

its also 3 divisions of 40 pts

Same with Dow

14000 - 11,000 = 3000

50% retracement = 12,000

Will we get there on Tuesday?

If Monday drops UNDER well under 1280, then any rally on Tuesday might not make it, but the reading I have is quite positive.

1320-40 = 1280, and yes its that simple

Ive added a 5 day ave to the Jaywiz index, and it is at historical highs measured against the past

FEb 26 = 47.5

Apr 1st = 38.9

May19 = 35.6

Now = 48.7

After Feb 26th, the dow fell 1000 pts into May10th. - just 8 days

Eclipse such as this wkend can go either way but usually accentuates the most current trend

and the solar eclipse on the 1st was within a decline trend.

Best for now

Jay

SPX 1440 -1200= 240 X 50% = 120

spx 1200 + 120 = 1320

its also 3 divisions of 40 pts

Same with Dow

14000 - 11,000 = 3000

50% retracement = 12,000

Will we get there on Tuesday?

If Monday drops UNDER well under 1280, then any rally on Tuesday might not make it, but the reading I have is quite positive.

1320-40 = 1280, and yes its that simple

Ive added a 5 day ave to the Jaywiz index, and it is at historical highs measured against the past

FEb 26 = 47.5

Apr 1st = 38.9

May19 = 35.6

Now = 48.7

After Feb 26th, the dow fell 1000 pts into May10th. - just 8 days

Eclipse such as this wkend can go either way but usually accentuates the most current trend

and the solar eclipse on the 1st was within a decline trend.

Best for now

Jay

RE Group

ive taken some time to re analyze why last week was so bad for me, and I think Im back, but we'll see next week

The Jaywiz index of 1.10 on wed should NOT have been pushed aside as it became obvious as the day progressed on Friday

Some of my data was mixed and thus I could not be sure of my projections

NOW here's what we have:

Jaywixz index = .84 and is also indicating another Upday, but not neccesarilly on Monday

Monday opens with a 90 bar cycle, and the futures did close lower friday- we can see what they read tonight at 6pm EST. the 90 bar cycle means a SHARPLY LOWER OPEN, and the readings for the day are quite negative.

SO, any rebound off Monday should occur on tuesday which has a much more positive reading

But from there Im expecting a strong sell off into OE on friday

The absorption level on Friday was a 7

and the reading for today is 17, which indicates selling

Ive still got some conflicting data, but Im still going to project a lower day monday.

Best for Now

Jay

PS, its amazing how your comments are totally lacking during the 2 weeks I nailed the market, but I miss one day and someone is ready to fade my work.

The Jaywiz index of 1.10 on wed should NOT have been pushed aside as it became obvious as the day progressed on Friday

Some of my data was mixed and thus I could not be sure of my projections

NOW here's what we have:

Jaywixz index = .84 and is also indicating another Upday, but not neccesarilly on Monday

Monday opens with a 90 bar cycle, and the futures did close lower friday- we can see what they read tonight at 6pm EST. the 90 bar cycle means a SHARPLY LOWER OPEN, and the readings for the day are quite negative.

SO, any rebound off Monday should occur on tuesday which has a much more positive reading

But from there Im expecting a strong sell off into OE on friday

The absorption level on Friday was a 7

and the reading for today is 17, which indicates selling

Ive still got some conflicting data, but Im still going to project a lower day monday.

Best for Now

Jay

PS, its amazing how your comments are totally lacking during the 2 weeks I nailed the market, but I miss one day and someone is ready to fade my work.

Thursday, August 07, 2008

Friday Lower

most of my data prefers a lower day on friday, and for now Im sticking with that game plan.

90 bars cycle @ 4pm

today hit highs at 1pm, and the rest of the day was lower

3pm @ 258 bars , thus start a new cycle.

Since the market dropped lower AFTER the 258 bar cycle, it means to me LOWER.

8th is the open ceremony of the Olympics on 8-8-2008 : add the digits = 8

8 is Saturnian in nature , but represents good fortune for Chinese people.

Jaywiz index yesterday = a whopping 1.10, and today =.52

The last time we watched a build up we got big days on 29, & 30th

Im going to get into position on Monday for a HUGE one day rally on Tuesday, and again on Thursday, but maybe not as strong.

IF you remeber what I wrote WAY BACK when, I projected a HIGh at the August 16th ECLIPSE and thats just what we will get.

Dow High 14,000 - Low @ 11K = 3000 pts

50% = Dow 12,000

Can it be that simple? yes it can.

spx1200 + 120 = 1320, and ive mentioned that several times last week.

thats also a 50% retracement

But watch out afterward as rumors are spreading around the web for possible terrorist actions in the next few months at malls, airports, sports stadiums, etc. and reaction by the US military. In Israel, a discarded valise is cause for alarm by every citizen but here it might even get stolen by some shmuck thinking its got a $mil in it.

Nov 4th - has Saturn 180 Uranus & Mars square neptune & venus Square uranus & Venus Square saturn

those combinations are very severe, and very unfriendly to human behavior, so theres NO telling what will happen on or near Election day

Best for now

Jay

90 bars cycle @ 4pm

today hit highs at 1pm, and the rest of the day was lower

3pm @ 258 bars , thus start a new cycle.

Since the market dropped lower AFTER the 258 bar cycle, it means to me LOWER.

8th is the open ceremony of the Olympics on 8-8-2008 : add the digits = 8

8 is Saturnian in nature , but represents good fortune for Chinese people.

Jaywiz index yesterday = a whopping 1.10, and today =.52

The last time we watched a build up we got big days on 29, & 30th

Im going to get into position on Monday for a HUGE one day rally on Tuesday, and again on Thursday, but maybe not as strong.

IF you remeber what I wrote WAY BACK when, I projected a HIGh at the August 16th ECLIPSE and thats just what we will get.

Dow High 14,000 - Low @ 11K = 3000 pts

50% = Dow 12,000

Can it be that simple? yes it can.

spx1200 + 120 = 1320, and ive mentioned that several times last week.

thats also a 50% retracement

But watch out afterward as rumors are spreading around the web for possible terrorist actions in the next few months at malls, airports, sports stadiums, etc. and reaction by the US military. In Israel, a discarded valise is cause for alarm by every citizen but here it might even get stolen by some shmuck thinking its got a $mil in it.

Nov 4th - has Saturn 180 Uranus & Mars square neptune & venus Square uranus & Venus Square saturn

those combinations are very severe, and very unfriendly to human behavior, so theres NO telling what will happen on or near Election day

Best for now

Jay

Wednesday, August 06, 2008

Wed game plan

I think Im going to stick with my original assesment of WEd and Thurs

Which means short a higher open (buyputs) and sell at 3pm

Same for Thursday, or maybe hold for friday @ 3pm- I dont like to hold overnight anymore, but this time it might be ok.

Jay

Which means short a higher open (buyputs) and sell at 3pm

Same for Thursday, or maybe hold for friday @ 3pm- I dont like to hold overnight anymore, but this time it might be ok.

Jay

Tuesday, August 05, 2008

Wed Aug 6th

Wed Aug 6th is a midnite HIGH TIDE DAY, which means the day should close on its highs

Its also a MAJOR convergence day with Multpile fibo and other cycle convergences

However, the Afternoon at 2:50pm has some heavy duty astro that can back stab anyone's rally.

Some of the data i have indicates a possible LOWER open, rally till about 1pm, then a sell off into that 2:40-3pm time zone and a huge rebound in the last hour.

We are at spx1284 NOW for the 4th time in a month since the July15th LOWS. 1291.17 was the HOD previously THUS any break above that with volume could get the SPX to 1320; Gee, I did mention that number last week.

SO, If I dont go long, then Ive got to hold out and buy puts on the close or wait for the open on Thursday.

Today i sold out early, but Im satisfied with the results.

I might have to sit this one out. Now, you know that wont be easy. (G)

Jay

Its also a MAJOR convergence day with Multpile fibo and other cycle convergences

However, the Afternoon at 2:50pm has some heavy duty astro that can back stab anyone's rally.

Some of the data i have indicates a possible LOWER open, rally till about 1pm, then a sell off into that 2:40-3pm time zone and a huge rebound in the last hour.

We are at spx1284 NOW for the 4th time in a month since the July15th LOWS. 1291.17 was the HOD previously THUS any break above that with volume could get the SPX to 1320; Gee, I did mention that number last week.

SO, If I dont go long, then Ive got to hold out and buy puts on the close or wait for the open on Thursday.

Today i sold out early, but Im satisfied with the results.

I might have to sit this one out. Now, you know that wont be easy. (G)

Jay

Game Plan

Bot calls at 1pm on Monday and sold them at 10am on Tuesday and got 30 pts

Sure its higher at 2pm, but I dont care. ive got other things to do with my time.

As for Wednesday,Aug 6th, Im planning to Sell the open at about 10am.(buyputs)

I am expecting to sell those puts at 3pm

Repeat the same process for the 7th.

You could hold them till 2pm on the 8th

Hope this clarifies how to trade this week

Jay

Sure its higher at 2pm, but I dont care. ive got other things to do with my time.

As for Wednesday,Aug 6th, Im planning to Sell the open at about 10am.(buyputs)

I am expecting to sell those puts at 3pm

Repeat the same process for the 7th.

You could hold them till 2pm on the 8th

Hope this clarifies how to trade this week

Jay

Monday, August 04, 2008

monday 11am update

Still flat line so no advances as of yet.

Could take till the 258 bar cycle @ 1pm

Or just the last 30 minutes from 30bars @ 3:30

The calls prices on qqqhr are really hanging tough @ $1.25 area ,but did hit a low of $1.15

Ndx did NOT quite challenge 1800 as yet but did hit 1805

Looks like Today will require an all day vigil

so what else is new? (G)

Jay

Could take till the 258 bar cycle @ 1pm

Or just the last 30 minutes from 30bars @ 3:30

The calls prices on qqqhr are really hanging tough @ $1.25 area ,but did hit a low of $1.15

Ndx did NOT quite challenge 1800 as yet but did hit 1805

Looks like Today will require an all day vigil

so what else is new? (G)

Jay

Monday Aug4th

Today looks like a lower open following on the last 30 minute downtrend on friday

However,

from the data I collect

It looks like BUY calls on the lows at probably 10;15 to 10:30, and sell the OPEN on Tuesday at 10am OR if you want, just hold till about 2pm where a secondary high should set the stage for a lower close.

Jaywiz index = .28, not bullish , but NOT overly bearish unless it counts for today's open.

A run to spx 1290 by tomorrow afternoon would not be out of the question

Jay

However,

from the data I collect

It looks like BUY calls on the lows at probably 10;15 to 10:30, and sell the OPEN on Tuesday at 10am OR if you want, just hold till about 2pm where a secondary high should set the stage for a lower close.

Jaywiz index = .28, not bullish , but NOT overly bearish unless it counts for today's open.

A run to spx 1290 by tomorrow afternoon would not be out of the question

Jay

Thursday, July 31, 2008

LOWER away

WE got to SPX1290 on the 23rd with a close of 1282

then 1234 on the 28th and 1284 on the 30th

It looks like an ABC rebound off the 15th low of spx 1200 intrady.

SO now we have the potential to take out 1200 in the next few days

Today closed as expected

tomorrow indicates lower all day with a last hour potential rally

180 bars @ 1:30

204 bars @ 3:30

Fascinating time coordination this week

Monday LOD @ 3:50pm

Tuesday HOD @ 3;50pm

Wed HOD @ 10:30am

Thurs HOD @ 10:30am

Huge multiple time convergence on the 6th

Best for now

Jay

then 1234 on the 28th and 1284 on the 30th

It looks like an ABC rebound off the 15th low of spx 1200 intrady.

SO now we have the potential to take out 1200 in the next few days

Today closed as expected

tomorrow indicates lower all day with a last hour potential rally

180 bars @ 1:30

204 bars @ 3:30

Fascinating time coordination this week

Monday LOD @ 3:50pm

Tuesday HOD @ 3;50pm

Wed HOD @ 10:30am

Thurs HOD @ 10:30am

Huge multiple time convergence on the 6th

Best for now

Jay

Wednesday, July 30, 2008

july 15 low

What we have is WILD swings in a series of A-B-C's

What we have is WILD swings in a series of A-B-C's You can clearly see 3 wave structures in both directions, or at least I can.

the july 15 low and subsequent rebound is still in effect and hasn't finished its trip to the top of the mountain.

But As for tomorrow, I have preliminary indications of a low @ 3:30pm at 126 bars, and You can see the potential for a DOWN leg to complete another 3 wave structure.

spx lost 240 pts may 19 to july15

240 x 38.2 =92 + 1200 = 1292, and we almost got that today.

A 50% rebound = 120 + 1200 = 1320, and that could be the final goal, BUT NOT tomorrow

New moon solar eclipse should set the stage for tomorrow's, among other data that I have accumulated.

Jay

Aug 6th time conversion

34 tr days from Jne19

55 from May19, a high

81 from Apr10, a high

110 from Feb 27, a high

117 from Nov 26, a low

122 from Feb13, a high

Eclipse date is Aug 1st @ 6am

Aug 6th = Mars 180 Uranus @2:38 pm

Merc 180 Nptune @ 2:42 pm

readings that week are wild;

Monday, Aug4th calls for a roller coaster type day, which, imo, hold onto your _____

Tuesday Aug 6th reads Improvement over yesterday

Wed Aug 6th calls for Accidents, tempers & highly volitile

Thurs & fri are rebounds.

As for today, we got exactly what was expected. a 10:30 HOD failed to hold and they are selling off dramatically and will continue into the 31st;

Bar cycle for 31st = 126 b @ 3:30 which should provide a low .

best for now

Jay

55 from May19, a high

81 from Apr10, a high

110 from Feb 27, a high

117 from Nov 26, a low

122 from Feb13, a high

Eclipse date is Aug 1st @ 6am

Aug 6th = Mars 180 Uranus @2:38 pm

Merc 180 Nptune @ 2:42 pm

readings that week are wild;

Monday, Aug4th calls for a roller coaster type day, which, imo, hold onto your _____

Tuesday Aug 6th reads Improvement over yesterday

Wed Aug 6th calls for Accidents, tempers & highly volitile

Thurs & fri are rebounds.

As for today, we got exactly what was expected. a 10:30 HOD failed to hold and they are selling off dramatically and will continue into the 31st;

Bar cycle for 31st = 126 b @ 3:30 which should provide a low .

best for now

Jay

Tuesday, July 29, 2008

Eclipses

August 1st and Aug 16th

August 30th a second new moon in one month. very rare occasion

As projected , the market had a good day today

the HIGH jaywiz index readings did show its stuff today- delayed reaction

Many major declines or so called crashes have occurred during eclipse months, usually b4 or after.

Jan 22nd was a full moon, but the eclipse was on FEb 6th, 15 days later.

This time, however, we have a Mars 180 Uranus in between on Aug 6th, and that could tip the scales in favor of a large decline starting on the 4th.

I can't stress this time period more. as it might be one of the most important market events this year.

Today's rally into the CLOSE was helped along by a Sun 0 Merc @ 4:05pm, just for those of you who still dont understand the relationships of our planet to the cosmos.

Science has many studies linking solar and cosmic forces effecting our planet, especially people and behavior.

heres a bit of news - LA quake 5.8 talk about cosmic forces-- whew

Jaywiz index today = .26

CBOE pc ratio = .84

OEX pc ratio = 1.00

but more important SPDR ratio = .80, a drop from 3.27 yesterday

Oil down to 122, looks ready to give a $5.00 pop

Gold down $60 in so many days also might pop

best for now

Jay

August 30th a second new moon in one month. very rare occasion

As projected , the market had a good day today

the HIGH jaywiz index readings did show its stuff today- delayed reaction

Many major declines or so called crashes have occurred during eclipse months, usually b4 or after.

Jan 22nd was a full moon, but the eclipse was on FEb 6th, 15 days later.

This time, however, we have a Mars 180 Uranus in between on Aug 6th, and that could tip the scales in favor of a large decline starting on the 4th.

I can't stress this time period more. as it might be one of the most important market events this year.

Today's rally into the CLOSE was helped along by a Sun 0 Merc @ 4:05pm, just for those of you who still dont understand the relationships of our planet to the cosmos.

Science has many studies linking solar and cosmic forces effecting our planet, especially people and behavior.

heres a bit of news - LA quake 5.8 talk about cosmic forces-- whew

Jaywiz index today = .26

CBOE pc ratio = .84

OEX pc ratio = 1.00

but more important SPDR ratio = .80, a drop from 3.27 yesterday

Oil down to 122, looks ready to give a $5.00 pop

Gold down $60 in so many days also might pop

best for now

Jay

Monday, July 28, 2008

power is upside

the 29th has potential to rebound all day.

I will buy on a lower open and most likely sell the close

One day rebound is overdue

the Jaywiz index = .29, not strong by any means, but dont forget we had 3 high readings last week, and in my experience, there is sometimes a delayed reaction

Spdr pc ratio which was 1.00 on Friday is now a whopping 3.27= a buy

Arms index = 1.65 and that indicates a lot more selling to follow, but not tmorrow.

Thursday's arms index was also only 1.57

Note : In order to get a strong bottom we need to see the one day ARMS index

of at least 3.00 or higher and would be even better back to back.

Thats called a CLIMACTIC ending when yuo get 3 days back to back with high Arms ratios

We could get that on the Aug 4th to 6th action

best for now

Jay

I will buy on a lower open and most likely sell the close

One day rebound is overdue

the Jaywiz index = .29, not strong by any means, but dont forget we had 3 high readings last week, and in my experience, there is sometimes a delayed reaction

Spdr pc ratio which was 1.00 on Friday is now a whopping 3.27= a buy

Arms index = 1.65 and that indicates a lot more selling to follow, but not tmorrow.

Thursday's arms index was also only 1.57

Note : In order to get a strong bottom we need to see the one day ARMS index

of at least 3.00 or higher and would be even better back to back.

Thats called a CLIMACTIC ending when yuo get 3 days back to back with high Arms ratios

We could get that on the Aug 4th to 6th action

best for now

Jay

Sunday, July 27, 2008

down monday indicated

Preliminary indications are for a down Monday

Jaywiz index = .34 mildly negative

It looks like the Jaywiz Index high numbers earlier this week had little effect as the SPX 1290 threashold resistence level might have been the top of a 90 point rebound

PC ratio = .83 and is negative

Vix = 22.91

Spdr ratio = 1.00

SPX 500 ratio = 1.25

OEX ratio = .35 and is extremely bearish, if I got the right data.

Consider the LOD was at 3:30 and the 30 b low cycle @ 2pm, then in my experience, the trend is still DOWN

The 60 b cycle is @ 10am and indicates a sharply lower open as we also watched that occur recently as i mentioned last week.

The Eclipse on 8/1 at 6am seems to be a natural magnet for a low as most new moons seem to be, but this one is enhanced by the solar eclipse.

Aug 4th to 6th has some heavy dute astro events which could settle the dispute over the bottoming process

best for now

Jay

Jaywiz index = .34 mildly negative

It looks like the Jaywiz Index high numbers earlier this week had little effect as the SPX 1290 threashold resistence level might have been the top of a 90 point rebound

PC ratio = .83 and is negative

Vix = 22.91

Spdr ratio = 1.00

SPX 500 ratio = 1.25

OEX ratio = .35 and is extremely bearish, if I got the right data.

Consider the LOD was at 3:30 and the 30 b low cycle @ 2pm, then in my experience, the trend is still DOWN

The 60 b cycle is @ 10am and indicates a sharply lower open as we also watched that occur recently as i mentioned last week.

The Eclipse on 8/1 at 6am seems to be a natural magnet for a low as most new moons seem to be, but this one is enhanced by the solar eclipse.

Aug 4th to 6th has some heavy dute astro events which could settle the dispute over the bottoming process

best for now

Jay

Friday, July 25, 2008

Noon on July25th

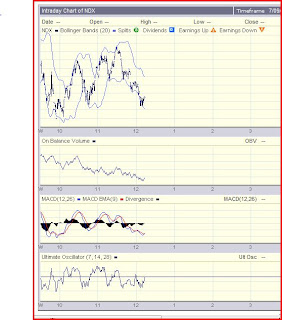

YO can see a number of thisngs from this chart

1. the OBV is DROPPING

2. the Ult oscilator is declining

3. the dow made a second attemtpt to move higher but stopped at the 85 level, and the balance of the day should attemtpt to stay afloat

The 258 bar count cycle was @ 11:30. and there was a low at that time point, but he dow is dropping lower AFTER the completed 258 bar cycle, and is starting a new one & going lower.

A LOWER close today spells a very serious day for Monday.

best for now

Jay

Another view

You can also view this week's drop off as an ABC

today would be looked as an X wave

that leaves another potential ABC for next week

which means at least another 350 dow points or more

best for now

Jay

today would be looked as an X wave

that leaves another potential ABC for next week

which means at least another 350 dow points or more

best for now

Jay

today's potential

This week off the intraday highs on Wed.

Dow High = 11,697

Dow Low yesterday = 11,348

Difference = 350 pts

From high to low looks like 3 waves

that means to day is wave 4

wave 4 can reach 38.2% of the loss

350 x 38.2% = 134 pts + 13348= 11482 is the highest potential

the first rally got to 11,443 which = 103pts = 29%

is that enuf? -- maybe

Once wave 4 is complete, they give it up to wave 5 which usually = wave 1 but could also be mcu worse.

We have some indications that show the market dropping all next week, with of course soem intraday lifts, but nothing that sticks until Aug1st.

Jay

Thursday, July 24, 2008

BITE ME !!

Down from the start & NON stop tot he close, But you already knew that

and of course you also know that's exact opposite to what my work told me for today

I wouldn't rule out a rebound open, but If that happens, I will be shorting it as I had expect to go short at todays , chhmmm highs

Time& cycles had posted a high for the 25th, and I had the 24th, - both of us appear wrong.

No I dont expect a big rebound tomorrow, on Friday.

More later

Jay

and of course you also know that's exact opposite to what my work told me for today

I wouldn't rule out a rebound open, but If that happens, I will be shorting it as I had expect to go short at todays , chhmmm highs

Time& cycles had posted a high for the 25th, and I had the 24th, - both of us appear wrong.

No I dont expect a big rebound tomorrow, on Friday.

More later

Jay

Wednesday, July 23, 2008

Jaywiz Index

Jaywiz Index = WOW WOW a whopping .88

Except for the open , most of tomorrow should be a screamer.

using Murrey math levels, the spx closed above 1281, and the next level is ( 1312 ) they might get to 1320 b4 giving up at least 1/2 of the day's gains

Spooz close virtually flat, but ndx is up 850

Ndx which was suffering on Tuesday, but came alive today

july24 is 8 day high

july25 is 9 day turn

Update in the AM if anything changes about the open.

best for now

Jay

Except for the open , most of tomorrow should be a screamer.

using Murrey math levels, the spx closed above 1281, and the next level is ( 1312 ) they might get to 1320 b4 giving up at least 1/2 of the day's gains

Spooz close virtually flat, but ndx is up 850

Ndx which was suffering on Tuesday, but came alive today

july24 is 8 day high

july25 is 9 day turn

Update in the AM if anything changes about the open.

best for now

Jay

Tuesday, July 22, 2008

Just as described

Nice volatility today as mentioned yesterday

Got in early and out late;

Tomorrow opens with a 90 bar cycle @ 10am and should slip into that low, but maybe not as severe as today.

but once again the day should recover and move higher.

today's Jaywiz Index is , Yup a wildly bullish @ 68, so whatever we got today is going to be superceded shortly;

remember that the 24th is an 8day high and the 9th is an 9 day turn, which could be higher intraday, or not.

Time and cycles has the 25th for a high and 8/1 as a low which is a solar eclipse day.

best for now

Jay

Got in early and out late;

Tomorrow opens with a 90 bar cycle @ 10am and should slip into that low, but maybe not as severe as today.

but once again the day should recover and move higher.

today's Jaywiz Index is , Yup a wildly bullish @ 68, so whatever we got today is going to be superceded shortly;

remember that the 24th is an 8day high and the 9th is an 9 day turn, which could be higher intraday, or not.

Time and cycles has the 25th for a high and 8/1 as a low which is a solar eclipse day.

best for now

Jay

Monday, July 21, 2008

Timing stats

July 22nd = 110 tr days Feb 13

july 22 = 55 tr days May2nd

Wed = 89 tr days / march 17

But more important

24th is 8 day high

25th is 9 day Turn

24th is 90 tr days march 17

&

200 tr days oct10, 2007

24th is Midnite high and moon cycle high

Spx 50% retrace = 1320

Tomorrow could be day traders delight with large moves in both directions.

Jay

july 22 = 55 tr days May2nd

Wed = 89 tr days / march 17

But more important

24th is 8 day high

25th is 9 day Turn

24th is 90 tr days march 17

&

200 tr days oct10, 2007

24th is Midnite high and moon cycle high

Spx 50% retrace = 1320

Tomorrow could be day traders delight with large moves in both directions.

Jay

Slow DRIP

Not the kind of day to make a lot of $$

It would appear the 259 bar cycle truncated at Friday's close @ 252 bars,and according to Stan Harley who discovered this cycle, thats allowed as most cycle do expand and contract frequently.

reminder, in case you forgot~~~ALL BAR CYCLES ARE LOW POINTS

So what happened after? as long term readers know, the cycle starts over once 258 bars have completed.

Today's 30 bar cycle @ noon to 12:15

Today's 60 bar cycle was perfectly timed at 2;30 to 2:45

The closing Spooz are Minus 1250, and that should offer a sharply lower open, and almost vindicate my call for a dow off 200 pts. starting from the open today was 11,505 , we could be off 150 from that level at the start, but that should provide a very good opp to buy calls as the day should improve for a mid day high b4 dropping off.

Jaywiz Index is mildly bullish @ .43

Oex pc ratio = 1.20 ~ ditto

spx 500 pc ratio = 1.96 ~ ditto

Vix still dropping @ 23.05

Today was a 70 year Gann convergence. for whatever that might mean to some one.

Best for now

Jay

It would appear the 259 bar cycle truncated at Friday's close @ 252 bars,and according to Stan Harley who discovered this cycle, thats allowed as most cycle do expand and contract frequently.

reminder, in case you forgot~~~ALL BAR CYCLES ARE LOW POINTS

So what happened after? as long term readers know, the cycle starts over once 258 bars have completed.

Today's 30 bar cycle @ noon to 12:15

Today's 60 bar cycle was perfectly timed at 2;30 to 2:45

The closing Spooz are Minus 1250, and that should offer a sharply lower open, and almost vindicate my call for a dow off 200 pts. starting from the open today was 11,505 , we could be off 150 from that level at the start, but that should provide a very good opp to buy calls as the day should improve for a mid day high b4 dropping off.

Jaywiz Index is mildly bullish @ .43

Oex pc ratio = 1.20 ~ ditto

spx 500 pc ratio = 1.96 ~ ditto

Vix still dropping @ 23.05

Today was a 70 year Gann convergence. for whatever that might mean to some one.

Best for now

Jay

Sunday, July 20, 2008

Bar cycle count

Friday was a difficult day to read the bar ccycles as they were not well defined.

However, as best as i can read, heres the cycles for Monday

258 b cycle @ 10am, AND if they make a deep cycle low at that point, it might be the LOD, but i doubt it as the

Sunday night 7 pm Spooz are virtually flat.

As long term readers know, the cycle starts over After 258Bars.

30bars now cycle @ 12:30

60bars cycle @ 3pm

you will remember the open on the 11th was exact @ 60bars, and can be quite exciting.

Im still expecting a lower day Monday, and a Lower open on Tuesday to buy calls at premium prices.

The week from there looks higher with a more solid runup on the 24th where a couple of geomag cycles converge.

Jay

However, as best as i can read, heres the cycles for Monday

258 b cycle @ 10am, AND if they make a deep cycle low at that point, it might be the LOD, but i doubt it as the

Sunday night 7 pm Spooz are virtually flat.

As long term readers know, the cycle starts over After 258Bars.

30bars now cycle @ 12:30

60bars cycle @ 3pm

you will remember the open on the 11th was exact @ 60bars, and can be quite exciting.

Im still expecting a lower day Monday, and a Lower open on Tuesday to buy calls at premium prices.

The week from there looks higher with a more solid runup on the 24th where a couple of geomag cycles converge.

Jay

Friday, July 18, 2008

rally will continue, but

The rebound will continue, but monday should offer about 200 dow pts OFF

From there, however, the rest of the week should trend higher to an SPX high of 1292 - 1320

Why those #s

240 pts was the loss

240 X 38.2 = 92 which is 1200 + 92

You can do the math for 50% retrace.

I was under the impression the market would drop into the Eclipse on Aug 1st, but that doesnt seem to be what we will witness.

What about oil? After Monday, it should continue to drop down to hopefully the $100 level or less.

Can you imagine were hoping for $100, amazing, last year we were UNhappy with $65 oil,,, Ggeeesh.

Jayiwz index this week;

mon = .23

Tues = .20

Wed = .41 ahah - see the rally firm up

Thurs = .25

Fri = .22

The BEAR pressure is still in effect, but might be weakening

best for now

Jay

From there, however, the rest of the week should trend higher to an SPX high of 1292 - 1320

Why those #s

240 pts was the loss

240 X 38.2 = 92 which is 1200 + 92

You can do the math for 50% retrace.

I was under the impression the market would drop into the Eclipse on Aug 1st, but that doesnt seem to be what we will witness.

What about oil? After Monday, it should continue to drop down to hopefully the $100 level or less.

Can you imagine were hoping for $100, amazing, last year we were UNhappy with $65 oil,,, Ggeeesh.

Jayiwz index this week;

mon = .23

Tues = .20

Wed = .41 ahah - see the rally firm up

Thurs = .25

Fri = .22

The BEAR pressure is still in effect, but might be weakening

best for now

Jay

Thursday, July 17, 2008

Success

How many people in this world can prdict a 500 pt rally 2 days prior ???

Someone tell Donald Trump

No, never mind, I really want to keep this a secret

Now what; You ask

Casey lowers the boom, thats what

I told another member of a web group to expect OIL to drop like a rock the last 2 days , and of course to me that was a no brainer considering i was looking for a run up on the dow.

Today's low of day cycled @ 11:15 at 120 bars

another minor dip @ 160b at 2;45 - was supposed to be @ 1:45

The NEXT 2 days should sell off severely into monday

Best for now

Jay

Someone tell Donald Trump

No, never mind, I really want to keep this a secret

Now what; You ask

Casey lowers the boom, thats what

I told another member of a web group to expect OIL to drop like a rock the last 2 days , and of course to me that was a no brainer considering i was looking for a run up on the dow.

Today's low of day cycled @ 11:15 at 120 bars

another minor dip @ 160b at 2;45 - was supposed to be @ 1:45

The NEXT 2 days should sell off severely into monday

Best for now

Jay

Wednesday, July 16, 2008

good money day

today turned out to be a good trading day $$$$

Tomorrow should duplicate today till 3pm

Today's cycles

30b @ 10:20 today was a buy in , even tho I missed the earlier low

60b cycled @ 12;45, very minor dip

3;15 hit @ 90 b also

Im trying to reconcile another cycle today

11:45 & 2;15 were more prominent lows

spx should make it to 1271-1276 tomorrow at its highs.

Jay

Tomorrow should duplicate today till 3pm

Today's cycles

30b @ 10:20 today was a buy in , even tho I missed the earlier low

60b cycled @ 12;45, very minor dip

3;15 hit @ 90 b also

Im trying to reconcile another cycle today

11:45 & 2;15 were more prominent lows

spx should make it to 1271-1276 tomorrow at its highs.

Jay

rally continues

Even tho Im fighting it in my mind, the data i rely on says we go up thru the 17th.

Full moon on 18th @ 3am influences the 17th as positive

I dont know If I will buy the open lower today or not, but according to my data, I should.

18th calls for BE FLEXIBLE, and to me that means a CHANGE in direction.

Jay

Full moon on 18th @ 3am influences the 17th as positive

I dont know If I will buy the open lower today or not, but according to my data, I should.

18th calls for BE FLEXIBLE, and to me that means a CHANGE in direction.

Jay

Tuesday, July 15, 2008

Downtrend will continue

Sell any morning rallies

the market will stay in a downtrend until at least the Augst 1st Eclipse

Jay

the market will stay in a downtrend until at least the Augst 1st Eclipse

Jay

Rebound still possible

got a 250 pt rally but Haha, it came off a 200 pt decline = 450 pt day;

got in calls this Am and sold them later for a very nice money day.

Took ____ to buy calls this AM , but my scenario was good, and I bot into it.

Tomorrow still looks promising for an UP day; However, Im planning to SHORT it, as Thursday and Friday look LOWER.

Jay

got in calls this Am and sold them later for a very nice money day.

Took ____ to buy calls this AM , but my scenario was good, and I bot into it.

Tomorrow still looks promising for an UP day; However, Im planning to SHORT it, as Thursday and Friday look LOWER.

Jay

Monday, July 14, 2008

Rebound due

Any rebound next 2 days is extremely short lived.

Downtrend is still in effect

Spx held 1225 - under 1219 would have dropped quickly to 1188, but not now

Charts edge has them dropping all week. WCA had today right and rebound tomorrow.

Today's lows

150 bars @ 10:30am

180bars @ 1:15pm

204bars @ 3;20pm

Tomorrow could open a little lower @ 10:45 = 226 bars, but its not a must;

spx futures closed flat

q's show a little lower open.

Jay

Downtrend is still in effect

Spx held 1225 - under 1219 would have dropped quickly to 1188, but not now

Charts edge has them dropping all week. WCA had today right and rebound tomorrow.

Today's lows

150 bars @ 10:30am

180bars @ 1:15pm

204bars @ 3;20pm

Tomorrow could open a little lower @ 10:45 = 226 bars, but its not a must;

spx futures closed flat

q's show a little lower open.

Jay

Sunday, July 13, 2008

Sunday 7pm SPOOZ

SPX futures are UP 12.30 indicating an up open X 8 = 100 dow points

As I wrote the 11AM trine is very powerful

But It doesnt look like it will be very lasting

still expect lower for day

Jay

As I wrote the 11AM trine is very powerful

But It doesnt look like it will be very lasting

still expect lower for day

Jay

Monday LOWS

July 14th should bring in a very short term low

spx 1200 to 1188

the rally on the 15th and 16th will look Spectacular, and most likely be led by financial stocks

ndx should get at least a 100+ bounce

spx + 60 or more

dow + 500 or more

oversold bounce really over due but downward cycles still in charge

8 day low due Monday and turn on Tues.

early scientific readings are confirming lower for Monday

will be able to get better readings later Sunday

Jay

spx 1200 to 1188

the rally on the 15th and 16th will look Spectacular, and most likely be led by financial stocks

ndx should get at least a 100+ bounce

spx + 60 or more

dow + 500 or more

oversold bounce really over due but downward cycles still in charge

8 day low due Monday and turn on Tues.

early scientific readings are confirming lower for Monday

will be able to get better readings later Sunday

Jay

Saturday, July 12, 2008

Whipped

Monday July 14th is the Capitulation LOW, for now short term.

Midnite low tide

Day after bradley on 13th = 14th

8 day LOW

Scientific data indicates a low

Spx should break 1219 and hit the 1200 mark, ---- could go as low as Murrey math 1188

258 bar cycle started new @ 10:30am on Thursday

60 bars hit right at the open

102 bars then cycled @ 1pm low

the close is 6 bars short of the next important mark which will be

144b @ 10am on monday's open should be lower till 10am.

Then there is a sun trine uranus at 11am which should mark a rebound high, but from there its straight down to 3:30 @ 204bars or 3:45 pm

Jay

Midnite low tide

Day after bradley on 13th = 14th

8 day LOW

Scientific data indicates a low

Spx should break 1219 and hit the 1200 mark, ---- could go as low as Murrey math 1188

258 bar cycle started new @ 10:30am on Thursday

60 bars hit right at the open

102 bars then cycled @ 1pm low

the close is 6 bars short of the next important mark which will be

144b @ 10am on monday's open should be lower till 10am.

Then there is a sun trine uranus at 11am which should mark a rebound high, but from there its straight down to 3:30 @ 204bars or 3:45 pm

Jay

Thursday, July 10, 2008

early highs gone

Typical bear market action- love them at the open and hate than at the close.

July9th puts an official bear market stamp on the market

bar cycle today has a potential low @ 1:45 to 2:15

90 Bars cycle at 9:45 on 11th has potential to mark a very short term low.

Would then look for a high on Monday @ 11am; downtrend to continue into the 15th

Jay

July9th puts an official bear market stamp on the market

bar cycle today has a potential low @ 1:45 to 2:15

90 Bars cycle at 9:45 on 11th has potential to mark a very short term low.

Would then look for a high on Monday @ 11am; downtrend to continue into the 15th

Jay

Wednesday, July 09, 2008

Renewed CRASH Alert

Today's action renews the CRASH alert posted last week.

Need I say more ????

I dont think so.

Jaywiz index Monday = .14

Tues = .28

Wed = .26

Merc 180 pluto is like a snowball on a downhill slope which becomes an avalanche

mars 0 Saturn = WAR & a DOSE of Reality

Bradley date looks like a LOW or not even, but just a part of a declining trend into the August 1st eclipse.

Jay

Need I say more ????

I dont think so.

Jaywiz index Monday = .14

Tues = .28

Wed = .26

Merc 180 pluto is like a snowball on a downhill slope which becomes an avalanche

mars 0 Saturn = WAR & a DOSE of Reality

Bradley date looks like a LOW or not even, but just a part of a declining trend into the August 1st eclipse.

Jay

Notice the wave from 10am to 11;30 forms in a 5 wave set with wave 4 overlapping wave 1

Notice the wave from 10am to 11;30 forms in a 5 wave set with wave 4 overlapping wave 1Under Elliott rules, this is considered a failure wave indicating a change of direction as you can see from the folow up decline.

Also note the OBV is in a steady declining phase from the open with only a minor bounce at 10;30.

Macd also topped at 10;30

Ult osc topped at 11am

Jay

Tuesday, July 08, 2008

back to short term

Expected a high tomorrow, but today is just fine;

Gonna get wild and crazy this week and next

heres the outcome

Down into 10th mid day

up thru monday july14th at 11am

down into 15th

up into 17th, down into 22nd

Drive everyone crazy except day traders who can catch the waves.

Jay

Gonna get wild and crazy this week and next

heres the outcome

Down into 10th mid day

up thru monday july14th at 11am

down into 15th

up into 17th, down into 22nd

Drive everyone crazy except day traders who can catch the waves.

Jay

Crash mitigated for now

Even though there has been a lessening of a CRASH potential, we still MUST be vigilant of a declining market from NOW till Nov 4th and maybe into December

I use NOV 4th - NOT due to political reasons but for cycle events

I'm Still focused this week on July10th @ 2;15pm

Interesting the LOD on Monday was @ 2:15pm at 90 bars

Using the progression that I mentioned b4 we might look like this;

spx hit 1440 on May19 & May30

1440 - 40 pt segments to 1260 = 180 pts , and thats 4 X 40 =160 + 20

now that leaves another 20 pts open, but wait , we got that Monday !! SO, is that all there is?

well Maybe---

Using Murrey math; the break under 1250 would infer a test or close of 1219, and yes it would seem we got that, but July10th is still in the way of a rebound, so another test of 1220 must be viewed as quite possible..

Also keep in mind we are in a market that is the antithesis of the rising trend that held the bulls attention for 5 years from 2002 to 2007. SO that means EVERY rally is suspect of being a selling OPP.

The Bradley date of July6th may have brot in a short term low on the new moon of the 3rd, but there does not seem to be ANY support for a sustained rally.

In addition, the next Bradely date is July13, and it might turn in a VERY SHORT TERM high with a rebound late on the 10th ending on the 14th mid morning, and that would encompas the 13th date.

The bradley model has been right on track this year and it now shows a sustained decline from here to Dec15th: - so AGAIN we must be wary of the potential for much further declines this year.

best for now

Jay

I use NOV 4th - NOT due to political reasons but for cycle events

I'm Still focused this week on July10th @ 2;15pm

Interesting the LOD on Monday was @ 2:15pm at 90 bars

Using the progression that I mentioned b4 we might look like this;

spx hit 1440 on May19 & May30

1440 - 40 pt segments to 1260 = 180 pts , and thats 4 X 40 =160 + 20

now that leaves another 20 pts open, but wait , we got that Monday !! SO, is that all there is?

well Maybe---

Using Murrey math; the break under 1250 would infer a test or close of 1219, and yes it would seem we got that, but July10th is still in the way of a rebound, so another test of 1220 must be viewed as quite possible..

Also keep in mind we are in a market that is the antithesis of the rising trend that held the bulls attention for 5 years from 2002 to 2007. SO that means EVERY rally is suspect of being a selling OPP.

The Bradley date of July6th may have brot in a short term low on the new moon of the 3rd, but there does not seem to be ANY support for a sustained rally.

In addition, the next Bradely date is July13, and it might turn in a VERY SHORT TERM high with a rebound late on the 10th ending on the 14th mid morning, and that would encompas the 13th date.

The bradley model has been right on track this year and it now shows a sustained decline from here to Dec15th: - so AGAIN we must be wary of the potential for much further declines this year.

best for now

Jay

Monday, July 07, 2008

STill coming

looks like I got my Monday and Tuesday mixed up.

WCA has the same depiction

Today so far we have the OBLIGATORY dow +100 pts

Erik Hadik says dow 11,437 is the threashold at this juncture.

A Sun 180 jupiter takes over and is related to stress and poor communications along with Merc 180 Pluto on the 10th, but the BIG GUN is Mars 0 Saturn on the 10th. That will call in the chips and bulls will throw in the towel.

Jay

WCA has the same depiction

Today so far we have the OBLIGATORY dow +100 pts

Erik Hadik says dow 11,437 is the threashold at this juncture.

A Sun 180 jupiter takes over and is related to stress and poor communications along with Merc 180 Pluto on the 10th, but the BIG GUN is Mars 0 Saturn on the 10th. That will call in the chips and bulls will throw in the towel.

Jay

Sunday, July 06, 2008

One day at a time

thats the way the market works so why shouldnt WE.

Brokers tell you to look over the valleys and hope for the mountains. You dont NEED the money now, so why worry, be happy- no seriously, the market has spoken and it is in BEAR trend, so IF your long term, I would take steps to protect the value of your portfolio.

Monday is scheduled to open DOWN- how far and how long? that is the question

As for tomorrow, we can envision 2 scenarios

1. the LOD on Thursday, ( seems like ages ago) was at 10:15 @ 259 bars; If we add 70 bars its gets us to 329 and that would hit @ 9:45 am to 10am.

2. If the 259 bars cycle closed out @ 10:15, then the next cycle which became clear at 30bars @ 12:45 low would take us to 11;30am @ 60bars.

There is astro to suppport a 11;30 low as well as 90 bars @ 1:46pm.

Once the low is set we should see a rebound but still lower close.

another interesting point about astro- Venus trine Uranus on the 6th, is often found hovering just b4 a major decline- which was also a bradley date.

Im still gettingThrusday @ 2pm if my bar count is right which matches an important astro event at the time.

best for now

Jay

Brokers tell you to look over the valleys and hope for the mountains. You dont NEED the money now, so why worry, be happy- no seriously, the market has spoken and it is in BEAR trend, so IF your long term, I would take steps to protect the value of your portfolio.

Monday is scheduled to open DOWN- how far and how long? that is the question

As for tomorrow, we can envision 2 scenarios

1. the LOD on Thursday, ( seems like ages ago) was at 10:15 @ 259 bars; If we add 70 bars its gets us to 329 and that would hit @ 9:45 am to 10am.

2. If the 259 bars cycle closed out @ 10:15, then the next cycle which became clear at 30bars @ 12:45 low would take us to 11;30am @ 60bars.

There is astro to suppport a 11;30 low as well as 90 bars @ 1:46pm.

Once the low is set we should see a rebound but still lower close.

another interesting point about astro- Venus trine Uranus on the 6th, is often found hovering just b4 a major decline- which was also a bradley date.

Im still gettingThrusday @ 2pm if my bar count is right which matches an important astro event at the time.

best for now

Jay

Potential crash next week

Yes !! -- this a REPEAT WARNING !!!!

Ive given you the data b4- scroll back

Now we also have a convergence of longer cycles on July22nd

54 tr days goes back to May6th a previous Bradley date

360 trade days goes back to FEb 20th, 2007, just prior to the 415 pt drop on the 27th

500 trade days goes back to July 23, 2006 , the mid year low

110 tr days Feb 13

Best for now

Jay

Ive given you the data b4- scroll back

Now we also have a convergence of longer cycles on July22nd

54 tr days goes back to May6th a previous Bradley date

360 trade days goes back to FEb 20th, 2007, just prior to the 415 pt drop on the 27th

500 trade days goes back to July 23, 2006 , the mid year low

110 tr days Feb 13

Best for now

Jay

Thursday, July 03, 2008

Potential crash next week

Any rally today as the futures are pointing higher is doomed to fail later today.

I've been out of touch the last few days as I was traveling and now entertaining family from out of town all this week.

However, I did post very important information about July10th as a potential short term bottom, and you can scroll back to get all the data.

After a few days of failed rally attempts, the market appears doomed to take a bigger plunge next week with July10th as the focus.

best for now

Jay

I've been out of touch the last few days as I was traveling and now entertaining family from out of town all this week.

However, I did post very important information about July10th as a potential short term bottom, and you can scroll back to get all the data.

After a few days of failed rally attempts, the market appears doomed to take a bigger plunge next week with July10th as the focus.

best for now

Jay

Sunday, June 29, 2008

8pm Update

Just to clarify in case I was incomplete

The market should open higher

lows for the day

30 bars @ 11:30

60bars @ 2pm

That means the end of the day should close on the UP side.

The outlook for the day calls for flexibility as CHANGE is in the air

Jay

The market should open higher

lows for the day

30 bars @ 11:30

60bars @ 2pm

That means the end of the day should close on the UP side.

The outlook for the day calls for flexibility as CHANGE is in the air

Jay

Monday

I will be travelling Monday, and Im becoming reluctant to trade.

The market last week favored 11:30 and 2pm time frames + - 1/2 hr.

Monday has a 30bar low due @ 11:30, but my propietary work indicates an up open which is just the reverse of Friday as it should be coming off the 1:45pm low @ 228 bars, but a little late.

Since 11:30 am is ample time to end an opening rally a respond negatively, I would tend to buy puts by 10 to 10:30, and sell them at the 11:30 time slot;

For me that would give me plenty of time to pack & get ready to leave at 1pm.

As for the rest of the day, I would expect a continuation of chop possibly ending near the lod.

Tuesday might be more of the same, but I dont really have much of a handle on the day, and i will be out of touch.

The best bet for the week will probably come on WEd when I do expect a rally to extend into Monday July7th.

Jay

Jay

The market last week favored 11:30 and 2pm time frames + - 1/2 hr.

Monday has a 30bar low due @ 11:30, but my propietary work indicates an up open which is just the reverse of Friday as it should be coming off the 1:45pm low @ 228 bars, but a little late.

Since 11:30 am is ample time to end an opening rally a respond negatively, I would tend to buy puts by 10 to 10:30, and sell them at the 11:30 time slot;

For me that would give me plenty of time to pack & get ready to leave at 1pm.

As for the rest of the day, I would expect a continuation of chop possibly ending near the lod.

Tuesday might be more of the same, but I dont really have much of a handle on the day, and i will be out of touch.

The best bet for the week will probably come on WEd when I do expect a rally to extend into Monday July7th.

Jay

Jay

Saturday, June 28, 2008

Was that THE bottom ?

The bottom of WHAT- just like stores offer discounts 50%- 50% off of WHAT?

Most bottoms are clinched when ALL the major indeces hit it at one time - AND That is JUST not the case right now. so where are we and what just happened.

So far we got

DOW breaking to new lows.

SPX not breaking under 1260, the March 17th lows

NDX closing the April18th gap

I have posted some of the data that analysts have been looking at

However, we did get a 109, or 110 day low from Jan 22nd and of course that important

717 lunar months ended on June29th

Some have June30th as 42 calendar days from may19th

needless to say, if you read back, you can get a jist of the data available for a low on June30, which may have already occurred on the 27th.

whats that ? you ask- you only want to know what Im thinking. Ok; lets explore.

Jaywiz index = .23 on Thursday, and .22 on Friday- both bearish.

On the 24th, My own propietary adv dcl index = 259, & volume index = 323 Indicating a low was about to occur. as you remember, when these values drop under 400, its an alert to look for a low.

Oil is the word of the day, at least for last week, and should continue to hold our attention until it drops firmly under $100-- haha fat chance. however, whatever is parabolic on the upside, reverses with equal force.

As you have read on my previous posts Im looking at July10th as a more important point of reference for a major low; But before that we are about to get a relief rally next week into a high on july7th.

As for my trading on Friday

I bot puts in the first 5minutes and sold them b4 11am ,little early but still satisfactory

As for Monday, I will report on Sunday

best for now

Jay

Most bottoms are clinched when ALL the major indeces hit it at one time - AND That is JUST not the case right now. so where are we and what just happened.

So far we got

DOW breaking to new lows.

SPX not breaking under 1260, the March 17th lows

NDX closing the April18th gap

I have posted some of the data that analysts have been looking at

However, we did get a 109, or 110 day low from Jan 22nd and of course that important

717 lunar months ended on June29th

Some have June30th as 42 calendar days from may19th

needless to say, if you read back, you can get a jist of the data available for a low on June30, which may have already occurred on the 27th.

whats that ? you ask- you only want to know what Im thinking. Ok; lets explore.

Jaywiz index = .23 on Thursday, and .22 on Friday- both bearish.

On the 24th, My own propietary adv dcl index = 259, & volume index = 323 Indicating a low was about to occur. as you remember, when these values drop under 400, its an alert to look for a low.

Oil is the word of the day, at least for last week, and should continue to hold our attention until it drops firmly under $100-- haha fat chance. however, whatever is parabolic on the upside, reverses with equal force.

As you have read on my previous posts Im looking at July10th as a more important point of reference for a major low; But before that we are about to get a relief rally next week into a high on july7th.

As for my trading on Friday

I bot puts in the first 5minutes and sold them b4 11am ,little early but still satisfactory

As for Monday, I will report on Sunday

best for now

Jay

Friday, June 27, 2008

More to come

read timeand cycles blog spot

Ian insists June30, and major major low, and for now he looks to be right

But as I posted july10 does look MORE important

For now, however, if they do break under spx1262 today and recover then Monday might offer the same action.

the SPX FUtures closed UP 300- called spoos by the pros and that should give the OPEn a big boost of at least 100 dow points, and according to my scientific data feed, theres LOTS more selling coming on the 27th.

Its 110 trade days from jan 22, or 109 from jan 23rd, take your pick.

bar cycles @ 1pm, and 3pm, but yesterdays bar cycles were 1/2 hour late.

jaywix index for today = .23,

Oex PC ratio = .67

both bearish

I told you that OIL would be a catalyst for lower stock prices and there it is________140

It would appear there not done yet

Best for now

Jay

Ian insists June30, and major major low, and for now he looks to be right

But as I posted july10 does look MORE important

For now, however, if they do break under spx1262 today and recover then Monday might offer the same action.

the SPX FUtures closed UP 300- called spoos by the pros and that should give the OPEn a big boost of at least 100 dow points, and according to my scientific data feed, theres LOTS more selling coming on the 27th.

Its 110 trade days from jan 22, or 109 from jan 23rd, take your pick.

bar cycles @ 1pm, and 3pm, but yesterdays bar cycles were 1/2 hour late.

jaywix index for today = .23,

Oex PC ratio = .67

both bearish

I told you that OIL would be a catalyst for lower stock prices and there it is________140

It would appear there not done yet

Best for now

Jay

Wednesday, June 25, 2008

Stealth rebounds continue

markets rally and go nowhere- NO rate cut. DUH what else should we have expected.

CNBC is touting rate hikes- Yikes;

However, this stalemate should = higher Oil and lower gold, and of course higher oil means lower stocks at this juncture in time.

a few things have come to my attention;

the market last few days even though in the 22week cycle has not and will not produce a major selloff

July10th is the NEXT BEST date for a severe selling bout

July13 is a Bradley date

July 10 is 245 days from July19, 2007

Is 80tr days from March 17th= 10 segments of 8

IS a cluster of hard astro aspects

Is 110 days from Feb4th

IS 192 tr days from oct9 = 24 segments of 8

Mars 0 Saturn - it means the party is over & you will get sober

Merc 180 Pluto = liken to a snowball rolling downhill in the snow.

42 Calendar days from May30th high

9 months from October 10, 2007 = 270 calendar days OR 34 segments of 8 = 272 days;

SO, a large number of identifying characteristics fall into one time period and one day= July10th.

Tomorrow has a 126 bar cycle @ 10:30 LOW, and should make a 2pm high on the 13 day low to high rotation from June9th - NDX made an initial low on June9th at 1950 and that was today's high as will be tomorrow.

Contrary to my prior statement, I would NOW expect a sell off on Friday into Monday June30 @ 11:30am

Friday has the potential for a low @ 3pm @ 259 bars.

from there a rebound into july3rd sets up a smash the week after ending on the 10th.

Best for now

Jay

CNBC is touting rate hikes- Yikes;

However, this stalemate should = higher Oil and lower gold, and of course higher oil means lower stocks at this juncture in time.

a few things have come to my attention;

the market last few days even though in the 22week cycle has not and will not produce a major selloff

July10th is the NEXT BEST date for a severe selling bout

July13 is a Bradley date

July 10 is 245 days from July19, 2007

Is 80tr days from March 17th= 10 segments of 8

IS a cluster of hard astro aspects

Is 110 days from Feb4th

IS 192 tr days from oct9 = 24 segments of 8

Mars 0 Saturn - it means the party is over & you will get sober

Merc 180 Pluto = liken to a snowball rolling downhill in the snow.

42 Calendar days from May30th high

9 months from October 10, 2007 = 270 calendar days OR 34 segments of 8 = 272 days;

SO, a large number of identifying characteristics fall into one time period and one day= July10th.

Tomorrow has a 126 bar cycle @ 10:30 LOW, and should make a 2pm high on the 13 day low to high rotation from June9th - NDX made an initial low on June9th at 1950 and that was today's high as will be tomorrow.

Contrary to my prior statement, I would NOW expect a sell off on Friday into Monday June30 @ 11:30am

Friday has the potential for a low @ 3pm @ 259 bars.

from there a rebound into july3rd sets up a smash the week after ending on the 10th.

Best for now

Jay

Monday, June 23, 2008

Stealth rallies ??

Thats a rally that did NOT occur, and once agin it came off an lower start, but thats exactly what I wrote on friday - 11am to 11;30 did offer a 3 hour buy , THEN sell at 2pm, but 4pm was a bust;

Ok, weve got Roy Ashworth offering the Hindenberg Omen

We are at 108 tr days from Jan 22 on Wed

we are 110 tr day from jan 22 on friday

Split the middle and that gives us Thursday WHERE there is also a 13 day(84.5) hour cycle from June9th and thats @ 2pm

WCA and charts edge are both expecting a big down day on FRIDAY, but MY work indicates just the opposite for friday; also note that Saturday has a reading that calls for fun and games and its a keeper type day;

So, given the 22 week cycle culmination this week, i would venture to guess they will move up into July4th week from the lows on June 25/26th

best for now

Jay

Ok, weve got Roy Ashworth offering the Hindenberg Omen

We are at 108 tr days from Jan 22 on Wed

we are 110 tr day from jan 22 on friday

Split the middle and that gives us Thursday WHERE there is also a 13 day(84.5) hour cycle from June9th and thats @ 2pm

WCA and charts edge are both expecting a big down day on FRIDAY, but MY work indicates just the opposite for friday; also note that Saturday has a reading that calls for fun and games and its a keeper type day;

So, given the 22 week cycle culmination this week, i would venture to guess they will move up into July4th week from the lows on June 25/26th

best for now

Jay

Sunday, June 22, 2008

monday June23

fridays close left the door open for a lower open on Monday;

If we get such, then I am buying calls as I closed out my puts on Friday

We got a 3pm low @ 126 bars exactly

156bars cycle doesnt hit till 11 am but that might only be minor setbacks in a rising market

expecting the close to be the peak of a rebound for the day

180 bar cycle @ 1:30 could be the kick off to the higher close;

Jay

If we get such, then I am buying calls as I closed out my puts on Friday

We got a 3pm low @ 126 bars exactly

156bars cycle doesnt hit till 11 am but that might only be minor setbacks in a rising market

expecting the close to be the peak of a rebound for the day

180 bar cycle @ 1:30 could be the kick off to the higher close;

Jay

Saturday, June 21, 2008

Simon Says

many of you will remember a couple weeks past,we had a few large numbers on the jaywiz index but no rally had occured yet, but it was delayed a day;

Thats what we have now.

we've got a 56, 19,73,& 75 on friday

that indicates a rebound in the making

Add to that a potential low on monday at 156 bars @ 11am, and the day could end quite a bit higher

Jay

Thats what we have now.

we've got a 56, 19,73,& 75 on friday

that indicates a rebound in the making

Add to that a potential low on monday at 156 bars @ 11am, and the day could end quite a bit higher

Jay

Wednesday, June 18, 2008

so much for non existing rallies

each of the last 4 days had an 11am high, but today as indicated by 180bars hit a low at 11am, as was forecasted yesterday.

the full moon at 12:32 provided a rebound high from which further declines ensued.

Dow under 12k with volume such as we are getting would indicate further erosion the next 2 days.

I've had june 20th as a potential low point and the projection seems to becoming reality.

spx murrey math levels under 1343, and as i write this at 1pm its @1338, would seek the next 31 pt lower level @ 1312, then 1281 thus equals dow levels of 11,800,then 11,550

Jay

the full moon at 12:32 provided a rebound high from which further declines ensued.

Dow under 12k with volume such as we are getting would indicate further erosion the next 2 days.

I've had june 20th as a potential low point and the projection seems to becoming reality.

spx murrey math levels under 1343, and as i write this at 1pm its @1338, would seek the next 31 pt lower level @ 1312, then 1281 thus equals dow levels of 11,800,then 11,550

Jay

Tuesday, June 17, 2008

june lows

today was exactly as described altho it was a tedious day.

the jaywiz idex which gave a sell on monday@.13

Now gives a BUY today @ .56

the Oex & sp 500PC ratios agree