ANOTHER NEW HIGH IS COMING SHORTLY

FIND OUT WHEN and HOW HIGH

JUST JOIN THE JAYWIZ VPN and BE IN THE KNOW

GET AHEAD OF THE MARKET, and STAY TUNED

Jay

THE NEW JAYWIZ 2023

THE NEW JAYWIZ 2023

Tuesday, January 31, 2012

Market Timing-Whats Next -JANUARY 31st EKG & SWPX comparison

Monday, January 30, 2012

Market Timing-Whats Next -JANUARY 30th today's EKG & AM report

|

|

| Jan 30- FEB 1- trend |

page we are calling " MARKET WEATHER"

IT OUTLINES what is expect THRU FEB 17th for NOW and will be UPDATED to include the rest of the month shortly.

________________________

IN addition, VPN members are accustomed to using various cycle pivots to pinpoint potential

highs and lows during each day thru the 17th.

BAR CYCLES

13 day

ED cycles

membership comes with an explanation

of HOW to USE those cycles as well as the DAILY EKG.

VPN Clients learn about SCIENTIFIC resources APPLIED TO MARKET behavior. THEY can then MERGE this data with their OWN

analysis, or combine with other services they use to make more informed

& better trading trading decisions.

STAY TUNED FOR MORE DETAIL

CRANKS & CYBER BULLIES are NOT WELCOME

Jay

Market Timing-Whats Next -JANUARY 25th - DYNAMIC index shows TOP

this was sent to VPN members on Jan 25th at 9am

NEXT DAY ENERGY IN ADVANCE

Jay

Jay~

Just wanted to take a minute to say thanks for all the the insight you have

provide me thru membership in your VPN. Having traded for many years I

have learned that there is no black box to trading the market. Your site

has helped take the mystery out of trading and provided me with what golfers

refer to as an all in one utility club. Combining your work with market sentiment

and what I have learned thru Elliott Wave has greatly improved my confidence.

Keep up the good work!

Biff McNamara

NEXT DAY ENERGY IN ADVANCE

Jay

Jay~

Just wanted to take a minute to say thanks for all the the insight you have

provide me thru membership in your VPN. Having traded for many years I

have learned that there is no black box to trading the market. Your site

has helped take the mystery out of trading and provided me with what golfers

refer to as an all in one utility club. Combining your work with market sentiment

and what I have learned thru Elliott Wave has greatly improved my confidence.

Keep up the good work!

Biff McNamara

Market Timing-Whats Next -Jan 23 to 27 IN REVIEW-- SPX verses EKG

|

|

| Jan 30 Review |

time periods making it even more difficult to show continuity. BUT the VPN members get the updates daily and the CONTINUITY becomes OBVIOUS to what has now grown to over 200 members with a 70% renewal rate.

STAY TUNED FOR FURTHER UPDATES

Jay

Hi Jay,

Happy to renew up to May 15, just let me know what you need me to do.

EKG is my best clue, but with the new format for market weather I

might be able to see where we start from a bit better.

Is start time a problem with other subscribers? I know you have said it

presents you with confusion sometimes.

Also have some confusion where EKG suggests a big move but nothing happens

in the market.

As I've mentioned before, I think it will probably get easier over time but any

suggestions you have will help.

I day trade rather than swing, but I'd like to develop some swing trades if I felt

more sure of direction for a period of days. At the moment we both think we're

in a wave 4 which is a lousy place to try and get a swing trade on, so maybe it'll

be easier when 4 finishes.

Also, volume is very low currently which can't help with signals.

All in all I enjoy the detective work to find trades although this month your signals

have stopped me taking trades that would have been wrong a lot of the time.

Nothing wrong with that!

Regards,

Ed

Friday, January 27, 2012

Market Timing-Whats Next -JANUARY 27th EKG DOES IT AGAIN - WATCH THIS

HOW CAN A NATURAL occurring PHENOMENA predict market behavior so WELL DAY after DAY

for 3 years in a row now !!??

I DONT QUESTION IT ANY MORE, I just use it to make $

for 3 years in a row now !!??

I DONT QUESTION IT ANY MORE, I just use it to make $

Market Timing-Whats Next -Gold in FEb 2012- WILL IT FOLLOW the SPX lower?

A GOLD PROJECTION for a solid rally this year above the previous high at 1900 on AUG 23rd-2011 is possible, and quite likely once it breaks over 1900.

IF IT DOES THAT by JULY 23rd, 2012 , then that might be the HIGH for the next few years

as ALL markets from Late October could repeat 2008 -09 again in 2013 -14.

COMMENTS to VPN group about the market late today

SPX, GOLD, OIL, EURO, Silver - ALL OVER DUE FOR A CORRECTION.

THIS SUCKER's getting a slow start,

its got till FEb 10th to complete its mission - ala 4th wave,

so its in no rush to get anywhere soon

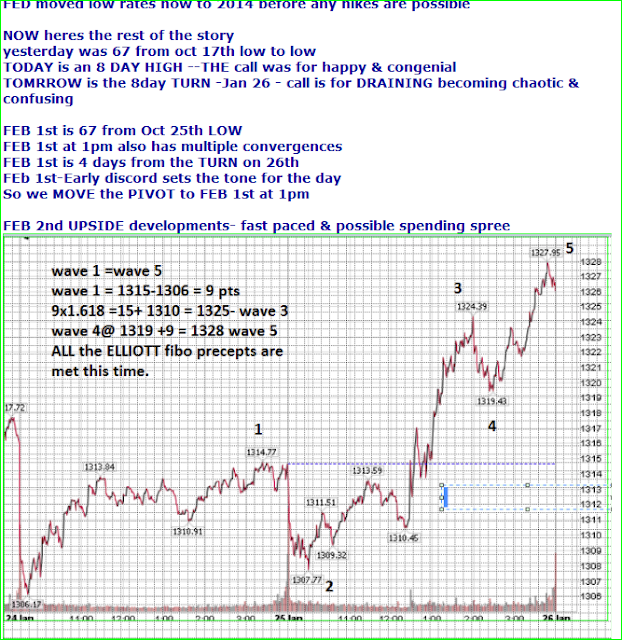

SPX hit an important level as previously noted on the 26th , consider that wave a 3rd wave peak.

NOW we expect a 4thw ave retreat as follows

wave 1 dn to FEB 1st

wave 2 up on Feb 2 , 3rd & part of 6th

wave 3, ah yes feb 6 to 8th

wave 4 on 9th

wave 5 on 10th for A of IV

B if IV up to the 17th- options exp

C- IV Pivot lows on FEB 23/24th

Price levels ,GRAPHS, and explanations are available,

and have been delivered to the VPN group- 1/28/12

STAY IN TOUCH

but

CYBER BULLIES and CRANKS NOT- welcome

constructive additions can be suggested via email

thnx

EKG daily has been performing at the 80% level for many months, and we dont anticipate any changes for that phenomena

A new report format called MARKET WEATHER was just published tot eh VPN group

today covering the projected wave 4 as shown above with daily interaction to allow day traders to use as well as position traders.

In addition, we prepared a graph showing the above wave 4 and how it should make progress between now and FEB 10th. In addition , it also shows potential wave progress thru LATE APRIL 2012.

WEVE ALSO projected the 18 month cycle to find LATE 2013 seriously lower-- NOT PREDICTING ANY CRASHES- just a much more somber market than we are going to get for 2012-- I SUPPOSE you believe all those DOOMSDAYERS predicting 2012 as a nasty stock market

year- GUESS again- it aint gonna be so.

when those same people start writing and claiming its fine to get back in the water, then you can be sure there are dangers lurking out there- DONT FOLLOW the CROWD over the CLIFF. GET IN TOUCH with Jaywiz and stay ahead of the game

best wishes for 2012

Jay

IF IT DOES THAT by JULY 23rd, 2012 , then that might be the HIGH for the next few years

as ALL markets from Late October could repeat 2008 -09 again in 2013 -14.

COMMENTS to VPN group about the market late today

SPX, GOLD, OIL, EURO, Silver - ALL OVER DUE FOR A CORRECTION.

THIS SUCKER's getting a slow start,

its got till FEb 10th to complete its mission - ala 4th wave,

so its in no rush to get anywhere soon

SPX hit an important level as previously noted on the 26th , consider that wave a 3rd wave peak.

NOW we expect a 4thw ave retreat as follows

wave 1 dn to FEB 1st

wave 2 up on Feb 2 , 3rd & part of 6th

wave 3, ah yes feb 6 to 8th

wave 4 on 9th

wave 5 on 10th for A of IV

B if IV up to the 17th- options exp

C- IV Pivot lows on FEB 23/24th

Price levels ,GRAPHS, and explanations are available,

and have been delivered to the VPN group- 1/28/12

STAY IN TOUCH

but

CYBER BULLIES and CRANKS NOT- welcome

constructive additions can be suggested via email

thnx

EKG daily has been performing at the 80% level for many months, and we dont anticipate any changes for that phenomena

A new report format called MARKET WEATHER was just published tot eh VPN group

today covering the projected wave 4 as shown above with daily interaction to allow day traders to use as well as position traders.

In addition, we prepared a graph showing the above wave 4 and how it should make progress between now and FEB 10th. In addition , it also shows potential wave progress thru LATE APRIL 2012.

WEVE ALSO projected the 18 month cycle to find LATE 2013 seriously lower-- NOT PREDICTING ANY CRASHES- just a much more somber market than we are going to get for 2012-- I SUPPOSE you believe all those DOOMSDAYERS predicting 2012 as a nasty stock market

year- GUESS again- it aint gonna be so.

when those same people start writing and claiming its fine to get back in the water, then you can be sure there are dangers lurking out there- DONT FOLLOW the CROWD over the CLIFF. GET IN TOUCH with Jaywiz and stay ahead of the game

best wishes for 2012

Jay

Market Timing-Whats Next -Jan 27th Morning report & EKG to SPX

an important price level was hit as per yesterdays trading at 10am

and an important tech sell signal was issued at the same time, which was reflected

by the TECHNICAL INTERNALS at the close

IMV, its ONLY a 3rd wave peak,. thus once the 4th wave is completed, a fifth wave to

1340 is very likely in FEBRUARY

STAY IN TOUCH

Jay

Thursday, January 26, 2012

Market Timing-Whats Next -STATS THAT JUMP OFF THE PAGE

Today's high is near exact double the March 9, 09 low at 666.67

666.67 X 2 = 1333.34-- actual high, at least so far = 1333.47

666.67 x 3 = 2000-- hmmm, but when [gg]

666.67 X 2.5 = 1666-- more likely in this decade??

ALSO

There are 260 tr days/ year

260/65-Gann tr days cycles = 4

Actual cycle is 65 to 69 w 67 mean ave

((You'll see how well that cycle works in a few minutes))

another math fact 666/2 = 333 and we saw that cycle from

May 2nd top to Oct 3rd bottom

March 6th to Jan 26th = 752 tr days

752/ 2 = 376 , DAMN near FIBO 377

((according to Stan Harley, 377 is the MAGIC number for the stock mkt

and the BAR CYCLE that he gave me is based on that number))

THE NEXT 67 tr days cycles are indicated on the GRAPH coming next

but I left out Jan 26th + 67 tr days = April 25-30 could also be a high,

but since we have already indicated March 22 as a potential wave

3 high, then it would only fit in as a rebound high off an APRIL 6th low

as per the ENERGY GRAPH that was delivered earlier this week.

Do some math - when is the NEXT 377 tr day cycle

377 = 18 months

Oct 3rd , 2011 + 18 months = April2013

Jan 26th + 18 months = July 2013

666.67 X 2 = 1333.34-- actual high, at least so far = 1333.47

666.67 x 3 = 2000-- hmmm, but when [gg]

666.67 X 2.5 = 1666-- more likely in this decade??

ALSO

There are 260 tr days/ year

260/65-Gann tr days cycles = 4

Actual cycle is 65 to 69 w 67 mean ave

((You'll see how well that cycle works in a few minutes))

another math fact 666/2 = 333 and we saw that cycle from

May 2nd top to Oct 3rd bottom

March 6th to Jan 26th = 752 tr days

752/ 2 = 376 , DAMN near FIBO 377

((according to Stan Harley, 377 is the MAGIC number for the stock mkt

and the BAR CYCLE that he gave me is based on that number))

THE NEXT 67 tr days cycles are indicated on the GRAPH coming next

but I left out Jan 26th + 67 tr days = April 25-30 could also be a high,

but since we have already indicated March 22 as a potential wave

3 high, then it would only fit in as a rebound high off an APRIL 6th low

as per the ENERGY GRAPH that was delivered earlier this week.

Do some math - when is the NEXT 377 tr day cycle

377 = 18 months

Oct 3rd , 2011 + 18 months = April2013

Jan 26th + 18 months = July 2013

Market Timing-Whats Next -Jan 26th COMPARE -- NEAR EXACT MATCH to SPX, PUBLISHED on the 25th

|

| Original EKG published 1/116@8:45am |

| ||

| EKG #2 also at 8:45am on 1/26 |

yesterday was an 8 day HIGH, making today and 8 day TURN

WHEN is the NEXT BEST PIVOT BUY ?

A high of short term significance may have occurred at 1327.58 yesterday.

an 8 day turn should now work its way to a 4 day LOW w 5 day PIVOT on FEB 1st.

Above, plus other CYCLE data seem to be telling us to look for a pivot low on FEB 1st at 1pm

As previously shown, we could still expect another new high at the 1340 level by Mid FEb

stay in touch

Jay

Wednesday, January 25, 2012

Market Timing-Whats Next -Jan 25th CLOSING Update

|

| FOLLOW THE EKG-- Jan 25th @ 1;40pm |

TOMORROW calls for DAUNTING obstacles in the AM, but better later

THEY PUSHED the wave 3 Peak into today's late mkt

on an 8day day high along with happy& congenial

thus we can now expect a strong downturn to that FEB 1st pivot mentioned above

ITS AMAZING HOW IT ALL FALLS INTO PLACE

FED speak- Happy & Congenial

how do they know that?

STAY IN TOUCH

Jay

Market Timing-Whats Next -January 2012- WHAT ABOUT GOLD- GET THE ANSWERS here

THE GRAPH ABOVE SHOWS GOLD thru Jan 23rd HIGH and potential for a

FEB 10th low at $1600 or under -

WOULD YOU LIKE TO KNOW whats expected thru JULY 2012 ?

VPN members NOW HAVE that graph thru JULY 2012.

JOIN THE JAYWIZ VPN and you will be in the know also.

THE lower graph is what was published to the VPN group right after the Nov 25th lows, and if YOU follow along with the graph on top, YOU"LL see just how accurate it has been.

STAY IN TOUCH

Jay

FEB 10th low at $1600 or under -

WOULD YOU LIKE TO KNOW whats expected thru JULY 2012 ?

VPN members NOW HAVE that graph thru JULY 2012.

JOIN THE JAYWIZ VPN and you will be in the know also.

STAY IN TOUCH

Jay

Tuesday, January 24, 2012

Monday, January 23, 2012

Market Timing-Whats Next -Monday _ Jaywiz OPEN CLINIC_ Closing COMPARISON

Sunday, January 22, 2012

Market Timing-Whats Next -JAN 23rd EKG update - DELAYED REACTION

| |||||

|

IT also will be updated to include March & April in my next report, since the VPN group already has

an ENERGY guideline thru APRIL2012.

JOIN THE JAYWIZ VPN and STAY TUNED ~~ get ahead of the market. Jay

Market Timing-Whats Next - Jaywiz DATA STREAM Jan 17-20

WOULD THIS DATA have been a benefit to YOUR TRADING EFFORTS LAST WEEK.

this is what was sent to the VPN group on Jan16th

this is what was sent to the VPN group on Jan16th

Market Timing-Whats Next -JAYWIZ cycle PIVOTS- MORE DATA = BETTER trades

ENHANCE your TRADING KNOWLEDGE about the WEEK AHEAD and get the updated data

before the week begins about the JAYWIZ cycles

258bars-X on the graph below

13days-X -- ditto

ED CYCLES -X -- ditto

Energy effects- not shown here

Daily Readings for the week ahead- not shown here

before the week begins about the JAYWIZ cycles

258bars-X on the graph below

13days-X -- ditto

ED CYCLES -X -- ditto

Energy effects- not shown here

Daily Readings for the week ahead- not shown here

Market Timing-Whats Next -Member dialogue

I would say that more info is better than less info. Take what works for you and leave the rest behind. You have to combine information from many sources in addition to technical analysis, which is what every trader must learn in order to stay in this business... and it is a business. The market is ever-changing and unpredictable, there is no way to predict 100% what it will do, and I am surprised at the many correct calls this service makes. Trading is not easy, that is why not everyone does it. Many start, but just as many quit as well. I think it's easier to blame someone else for their losses than to take responsibility, but if you do that you will never learn and continue to lose. Start small and then get bigger over time, not every trade will be a winner and if you can't handle losing, get out, it's as easy as that...

above from one VPN member- thank you- very clear.

Jay's COMMENTS

Jay's COMMENTS

REAL BUY & SELL SIGNALS ARE FAR & FEW BETWEEN

Jaywiz VPN has caught MANY of the BIG swings-- AHEAD OF TIME.

in between, we keep you UP TO DATE with CURRENT TRENDS, And SWING TRADES peaks& pivotsJaywiz VPN has caught MANY of the BIG swings-- AHEAD OF TIME.

NOTE that THE MAJORITY of new and renewal subs COME in when the MKT IS IN DECLINE

Late SPT

Oct thru the 10th

Nov thru the 10th

Dec thru the 10th

ALL during declining mkts

OTHER TIMES, its a BIG YAWN, and traders lose interest in new data, because it doesnt

suit their purposes-- BUY a CRASH- every traders dream -- duhh, me too

I warned during JUNE & JULY and we had an AUGUST MELT DOWN

I warned in SPT and we had anther one

the NEXT real SELL signal is not due till later this year-- SORRY- you may lose interest and

get bored with wing trades, but I have to keep current;

OTHERS tell me MORE - MORE, we want more intraday updates

thats fine, but IM ONLY ONE PERSON, and only have just so much time for research & PREPARING reports

STAY TUNED

Jay

Friday, January 20, 2012

Market Timing-Whats Next -January 20th CLOSING WEEKLY - EKG to SPX

| |

| I filled in the SPX price levels AND NITE TIME SESSIONS because its HARD TO REALLY SEE IT without those demarcations |

that should make it crystal clear

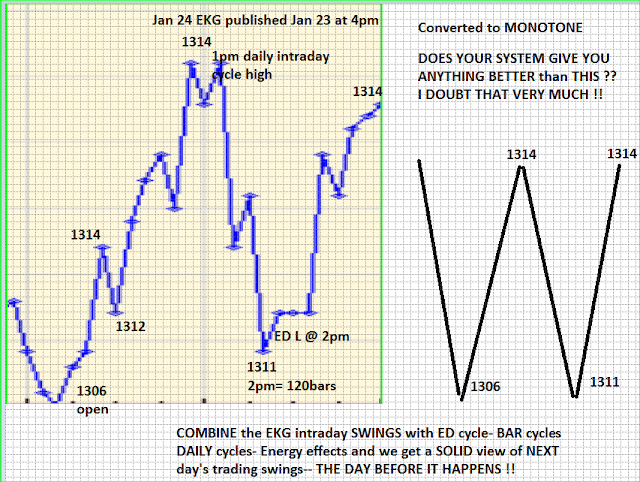

THE EKG IS A NATURALLY occurring phenomena , and as such we have no control over the way

nature decides to present it,

THUS -DEPTH depicted by the EKG is OFTEN over exaggerated , and

THATS WHY WE Instruct VPN members to LOOK only at the evidence it offers for intraday DIRECTIONAL movement, then its nearly 80% correctly depicting those moves, ONE DAY AHEAD

NOW, IF YOU DON'T THINK that's INCREDIBLE, then YOUR NOT breathing

STAY TUNED FOR FURTHER DETAILS

Jay

Market Timing-Whats Next -January 20th CLOSING COMPARISON - EKG to SPX

|

| EKG was PUBLISHED TO THE VPN yesterday at 4pm and again at 7pm |

t t |

| SPX Jan 20, 2012 |

the MARKET WILL BEHAVE - the day before it happens.

I dont know about YOU, but I cant wait for MONDAY

but I guess I have NO CHOICE - [gg]

STAY TUNED FOR FURTHER UPDATES

Jay

THERE IS NOW A MUCH STRONGER CHANCE FOR A SUBSTANTIAL 2 day decline

on Monday & Tuesday next week.

Market Timing-Whats Next -January 20th UPDATE - NO CRASH IN SIGHT!! DOES THAT TURN YOU OFF?

IM SURE YOU ALL REALIZE IM NOT THE ONLY ONE WHO THOUGHT Jan 19th was a day of INFAMY for the stock market- I read it in MANY PLACES- even Daneric.

WHEN WILL WE REALLY have A CRASH ??

is that ALL YOU REALLY WANT TO KNOW??

IT seems like MOST of the TRADERS who LURK on the BLOGS are looking for the MAGIC bullet

WELL GUESS WHAT , PEOPLE, there isnt any such thing.

THE MKT did NOT GET OVERBOT to the point where it would sell off to such a degree as it did on DEC 28th, and Nov 9th. IT IS LOCKED Into a SOLID UPTREND thru at least the

MIDDLE of FEB before any STRONGER selling pressure can develop-- see the graphs below for further details.

WHEN WILL WE REALLY have A CRASH ??

is that ALL YOU REALLY WANT TO KNOW??

IT seems like MOST of the TRADERS who LURK on the BLOGS are looking for the MAGIC bullet

WELL GUESS WHAT , PEOPLE, there isnt any such thing.

THE MKT did NOT GET OVERBOT to the point where it would sell off to such a degree as it did on DEC 28th, and Nov 9th. IT IS LOCKED Into a SOLID UPTREND thru at least the

MIDDLE of FEB before any STRONGER selling pressure can develop-- see the graphs below for further details.

Market Timing-Whats Next -STEADY RISE since DEC 19, CONTINUES

SORRY, BEARS, we are NOT going to see a 50 pt SPX loss in January 2012.

the FIRST REAL suspicious times zone for a strong sell off is still a ways off.

BUT the PD graph & 258bars indicates a pivot low on Monday Jan23rd at 10:30

A higher high is possible in FEB up thru the 16th/17th as IVE mentioned SEVERAL TIMES.

PLEASE excuse my over exuberant bear call for yesterday- after reviewing the graph above and other data, it has become clearer that the RISE from DEC19th will continue to at least FEB 16/17 for starters. Ive shown you an ELLIOTT wave graph also showing the same thing.

STAY TUNED AND GET AHEAD of the mkt

Jay

the FIRST REAL suspicious times zone for a strong sell off is still a ways off.

BUT the PD graph & 258bars indicates a pivot low on Monday Jan23rd at 10:30

A higher high is possible in FEB up thru the 16th/17th as IVE mentioned SEVERAL TIMES.

| |

| ADV/DECL & Volume graph-- INDICATES NO SELL SIGNAL YET. |

PLEASE excuse my over exuberant bear call for yesterday- after reviewing the graph above and other data, it has become clearer that the RISE from DEC19th will continue to at least FEB 16/17 for starters. Ive shown you an ELLIOTT wave graph also showing the same thing.

STAY TUNED AND GET AHEAD of the mkt

Jay

Wednesday, January 18, 2012

Market Timing-Whats Next -IS 400 DOW pts a CRASHETTE ?? NO DEAL TODAY

|

| EKG FOR 1/19 at 7pm on 1/18 |

19th will be PAY THE PIPER day

and a HARD DOSE of REALITY

1280 is an easy target,

and maybe 1258 ,the 62% level may be the real one

1370-1075=295

295X 62% =183 +1075= 1258

78% is at 1307 hit today at close

1307-1258=49 spx pts

EKG shows INTRADAY rebound- WHICH MAY NOT MATERIALIZE

AT ALL, or just VERY LITTLE

considering the SPX is up from DEc 19th at 1205 ALMOST NON STOP to 1308

a DOWN day of 49 pts does NOT seem out of wack given the TYPE OF ENERGY PRESENT

till 4:19pm

WHEN will the NEXT CRASH occur??

JOIN THE JAYWIZ VPN and find out - DONT WAIT TILL THE DAY BEFORE like today

sitting on yuor hands wondering WHEN.

IM SHORT, are you??

STAY TUNED & GET AHEAD of the mkt

Jay

Market Timing-Whats Next -Jan 17th VPN update at 12:49PM

LOOKS LIKE ALL systems AGREE - THIS IS GETTING BETTER

all the time !!

DROP OFF TOMRROW AM probably till 10am on the 39hrs cycle

EKG -Cant tell yet if any recovery will take place but ENERGY seems to say it will

till about 1pm. CANT TELL if it will be higher or not than TODAY"S CLOSE.

BUT1307 is 78% STRONG resistance and of course 1292 is SUPPORT= previous resistance

ONCE tested tomrrow and maybe breached on Thsday, the RALLY SHOULD RESUME according to

ENERGY, but we'll take it day by day for now. Jan E graph shows 23rd as a possible high, before

another MIXED period next week & drop off from mid day high on 26th into 27th-30th pivot low

THIS TIME PERIOD SEEMS TO BE MARKED by STRENGTH, but TENUOUS as we go with brief setbacks

along the way- Refer to my ELLIOTT graph for a PIVOT HIGH on FEB 17th, and stronger sell off after to

the 22-24th

NOTE THE IMPACT SEEMS TO GIVE BACK SOME FOR THE 18th as shown below as squiggles on the 17th

SAME DEAL GOES FOR DYNAMIC

and of course we SEE an OBVIOUS take back at open tomorrow - IGNORE GMT time- just use EST,

unless you live in London which some of you do.

Im long from last week and plan to close out at 4pm or sooner today

NEG E@3;11 & 258bar PIVOT at 3pm should give the close what it needs to make it to resistance @ 1307

AS far as SHORTING, Im think I will wait for the 1pm hour tomrrow, and will plan to close that out on Thsday near 4pm

the next LONG trade might wait for Friday after open, but we'll see how tomrrow & thsday go before deciding

DROP OFF TOMRROW AM probably till 10am on the 39hrs cycle

EKG -Cant tell yet if any recovery will take place but ENERGY seems to say it will

till about 1pm. CANT TELL if it will be higher or not than TODAY"S CLOSE.

BUT1307 is 78% STRONG resistance and of course 1292 is SUPPORT= previous resistance

ONCE tested tomrrow and maybe breached on Thsday, the RALLY SHOULD RESUME according to

ENERGY, but we'll take it day by day for now. Jan E graph shows 23rd as a possible high, before

another MIXED period next week & drop off from mid day high on 26th into 27th-30th pivot low

THIS TIME PERIOD SEEMS TO BE MARKED by STRENGTH, but TENUOUS as we go with brief setbacks

along the way- Refer to my ELLIOTT graph for a PIVOT HIGH on FEB 17th, and stronger sell off after to

the 22-24th

NOTE THE IMPACT SEEMS TO GIVE BACK SOME FOR THE 18th as shown below as squiggles on the 17th

SAME DEAL GOES FOR DYNAMIC

and of course we SEE an OBVIOUS take back at open tomorrow - IGNORE GMT time- just use EST,

unless you live in London which some of you do.

Im long from last week and plan to close out at 4pm or sooner today

NEG E@3;11 & 258bar PIVOT at 3pm should give the close what it needs to make it to resistance @ 1307

AS far as SHORTING, Im think I will wait for the 1pm hour tomrrow, and will plan to close that out on Thsday near 4pm

the next LONG trade might wait for Friday after open, but we'll see how tomrrow & thsday go before deciding

BEST WISHES - Jay

Market Timing ~ Whats Next

http://Jaywiz.blogspot.com

Stay Tuned & get Ahead

This email message & any attachments may contain legally privileged,

confidential, or proprietary information. Whether or not you are the intended

recipient, you are hereby notified that any dissemination, distribution,

or copying of this email message is strictly prohibited. If you have

received this message in error, please notify the sender, and immediately

delete this email message from your computer and or data base.

Market Timing ~ Whats Next

http://Jaywiz.blogspot.com

Stay Tuned & get Ahead

This email message & any attachments may contain legally privileged,

confidential, or proprietary information. Whether or not you are the intended

recipient, you are hereby notified that any dissemination, distribution,

or copying of this email message is strictly prohibited. If you have

received this message in error, please notify the sender, and immediately

delete this email message from your computer and or data base.

Market Timing-Whats Next -January 18th CLOSING COMPARISON

Tuesday, January 17, 2012

Market Timing-Whats Next -Jan 17th Tuesday- CLOSING COMPARISONS

AND AWAY WE GO-!!! - HOW HIGH IS HIGH ? you ask

TODAY'S CLOSE SHOULD HIT INITIAL RESISTANCE.

TOmrrow's EKG shows an early drop off.

ALL THIS IS

EXACTLY AS INDICTED LAST FRIDAY on Jan 11th comments page, AND CONFIRMED BY the SCIENTIFIC RESOURCES published yesterday to the VPN group shown on the previous page- scroll down on main page.

WHAT ARE YOU WAITING FOR? - the next CRASH AIN'T COMIN for a LONG while

2012 will be the PERFECT market for short term to med term position traders, so JOIN the

Jaywiz VPN and stay tuned

TODAY'S CLOSE SHOULD HIT INITIAL RESISTANCE.

TOmrrow's EKG shows an early drop off.

ALL THIS IS

EXACTLY AS INDICTED LAST FRIDAY on Jan 11th comments page, AND CONFIRMED BY the SCIENTIFIC RESOURCES published yesterday to the VPN group shown on the previous page- scroll down on main page.

WHAT ARE YOU WAITING FOR? - the next CRASH AIN'T COMIN for a LONG while

2012 will be the PERFECT market for short term to med term position traders, so JOIN the

Jaywiz VPN and stay tuned

|

| SENT TO THE VPN group on the 16th SEE time & date above |

|

| Jan 17th & 18th OPEN |

|

| Jan 17th @ NOON |

Subscribe to:

Comments (Atom)

YOU DONT HAVE TO BELIEVE what IVE TOLD you about the EKG - JUST HAVE TO BELIEVE YOUR OWN EYES - NO TRICKS-

YOU DONT HAVE TO BELIEVE what IVE TOLD you about the EKG - JUST HAVE TO BELIEVE YOUR OWN EYES - NO TRICKS-

THE Blogger editor wont let me place pics exactly where I want them- but YOU get the IDEA

THE Blogger editor wont let me place pics exactly where I want them- but YOU get the IDEA

THIS COMPONENT of the EKG has been consistently more accurate , but the ORIGINAL showing a late sell off from yesterday OFTEN ROLLS OVER to the NEXT DAY.

THIS COMPONENT of the EKG has been consistently more accurate , but the ORIGINAL showing a late sell off from yesterday OFTEN ROLLS OVER to the NEXT DAY.

any one else see just how well this depicted

any one else see just how well this depicted