|

| IMPACT STREAM SHOWS WEAKNESS THIS AM |

Positve energy may have been spent by now, or there could be just little more to go before

a serious correction begins- its hard to pin point exactly when the energy shift effects traders thought

processes and gears them toward selling.

Fed days next week, Jan 25-26, energy doesnt appear positive at that time, and next week seems to be deeper into the energy change/shift.

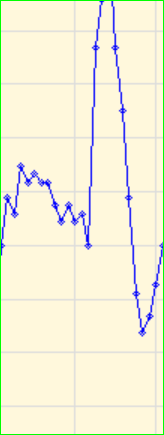

228bars on Thsday last week pivoted the mkt higher on Friday, and 258bars at 12:30 was only a very moderate blip.

Tuesday pivots

90 bars at 1:30pm

120bars at 4pm which could spill over to Wed Am, but afterward the way appears to have positive energy

ENERGY EFFECTS for the week

Tuesday = negative

Wed = Postive

Thsday = positive afternoon

Friday = negative

I had previously discussed and projected an important turn on or about Jan 20th, and we are ALMOST there, but dont expect the mkt to fall out of bed just yet; The most negative energy is set up for mid to late March, but Feb may give us some indication that a correction has really begun.

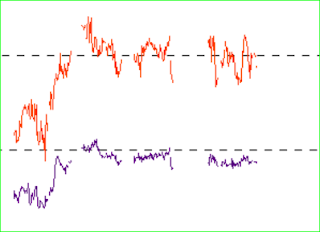

Power data graph for This week shows little or no change, and the EKG might change for the OPEN

once the 8:30am to 9am reports are published

Impact stream right now at 7pm Monday appears much weaker than it has been for a few weeks past.

ALL in ALL, the mkt appears to be losing strength form my perspective above, and I havent even looked at volume or Adv/Decl tech data

On Dec 13th, the INTERNAL tech data reported its LOWEST numbers in years indicating

a GROSSLY overbot market, and yet the bunny kept on rolling higher. so we will have to be from Missouri, and see it in price erosion to confirm the data.

BEARS have been getting BULLED OVER, and just when they thought it would never happen, we might just get that over due correction- and note the strong mkt IMO, is not due to Fed pomo, Bonds, gold or anything else fundamentally similar.

more later

Jay

WE really have to make mental adjustments for the implied volatility that the EKG seems to SHOW.

Since it comes to me that way, I have little or no way to adjust the graph before publishing it, and it would be untrue to change it in any way whatsoever.