|

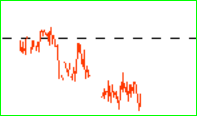

| IMPACT stream SHOWS a HUGE let down AFTER Yesterdays BIG DAY |

|

| 4pm- MAYBE today is UNEVENTFUL, And tomrrow is more UNSTABLE -THe POWER DATA does show tomrrow |

Jay

| |

| Activity index at 8:30am dropped off from earlier highs of 300, but only down to 200 |

FLUX once again has picked up and has been WILD for 5 days now

180Bars @ 2pm might be an lod

New moons tend to be downers tonight

26hrs at 10am tomrrow= employment reports @ 8:30& 10am

Today says ISSUES clouded - Egypt ??

Power data graph shows today a holding pattern and one more go attempt tomorrow

Jay

IMPACT STREAM showing how weak today is or should we say JUST NOT BULLISH

and this emulates the POWER DATA graph published yesterday

Activity index has been FLAT all day at 200, not weak, but not strong either

Tomrrow is ALSO called FOR UNEVENTFUL

Friday 's call is for Frustrated Aggression

Jay

|

| 4pm Impact stream --WHERE'S the BEEF? |

12 comments:

Friday and into next week seems to me to be the most critical time of the last few months. Why? Well, as you know I'm seeing tons of divergences in the market. The transports haven't confirmed this wild run on the DOW And S&P. The Baltic dry index has pretty much CRASHED over the past 9 months, the smaller index's haven't kept pace with the DOW/S&P, we're overbought on virtually every indicator. Yet of course the insane policy of Bernanke has been pushing and pushing the markets higher. My feeling is that not only are we overdue for a good 10% pulldown, I think we're close to getting it.

when we get the jobs report.. if it's really good, I think we roar higher. I mean roar. Maybe two or three days of 150+ points. But if it happens, I also think it will be a "blow off top" and we get our pulldown. If the number stinks, like so many of them do.. I think the FED props us up for a day or two, but then.. we start the fall and correct.

Since Red is illegal in the market now adays, it seems flat is the only pullback you get. We did dip pink for a bit this am, but they quickly decided they didn't like it and we are slightly green on the day. I expect us to stay slightly green today, althoug a close of - 30 wouldn't surprise me either. They're going to hold us up, and try and coast into the jobs report on Friday. I do however think that's going to be the big issue for next week, so we have to stay "wary".

rrman - you think oil topped out and ready for a decline?

ABDULLAH

SORRY , but You will have to WAIT IT OUT

Feb 17th to 25th should be a little sloppy and take some away

BUT

March 10th to 28th is the BIG BEAR PLUNGE

Jay

yeah i think the dollar hit the support trendline this morning and has reversed and will go up all month so oil has topped and Euro has topped and I would say stocks also but Jay's call on stocks is probably right on choppy this month i say slight down he says up biased so probably choppy with nice trading range but euro is done put a stick in it

http://www.cyclelt.com/SEIR.htm

euro has tracked well on helge long term 1st chart is good to see the big picture 3rd chart is my favorite its zoomed in enough to trade by...see the peak that we just made on euro and reverse for /dx? now we're in that quick downmove into friday then a halfway back up next week but big down move into end of month....like I said euro follows pretty well but as you can see the red line is the Dow it tends to be late on the moves historically

ung and dto are going to look really cheap in a few weeks

Nat Gas is more reflective of the economy as it is hard to store and play the contango game like oil...but look at a daily chart of /ng it bottomed in Nov. and we are just making higher highs and higher lows since...

bradley date tomorrow,hourly charts look to me like another high being put in then or friday.maybe some more congestion for next week

FYI - BGZ, FAZ and others are doing a 1 -to- 5 reverse split.

NOT GOOD!!!

Alan Newman, editor of Crosscurrents, spoke of the stockholders within the greatest Nasdaq companies:

“Three months ago the insider chart for the 8 top companies in the QQQ were the very worst we had ever seen. Well, guess what? It’s worse now. . . . . only 3,500 shares were purchased (by insiders) and 87,400,000 were sold. . . . . The companies represent a huge segment of the market, valued at $1.32 trillion. . . . For good measure, for the week ended January 14th, Bloomberg reported absolutely no buyers among insiders of the S&P 500 companies, and total sales of $163 million of their stock.”

Post a Comment