| |

| March 31st @ 11am |

I have a copy of Charts egde, but can add seem to it here, however, it does ALSO show a SEVERE drop in stock prices next week to Apr 11th.

Theres NO way to tell just how much they can sell off in one week, but it could end anywhere from a level of spx 1250 to as low as 1105.

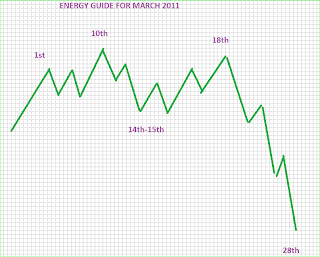

We did NOT get the END of MARCH sell off as previously projected as the FIBO cycle convergences inverted to what looks like highs.

IT looks like we get to flatten out the next 2 days and whatever happens over this highly energetic wkend will surely show its effect on markets on Monday, April 4th

It would appear this NEW moon CYCLE has uplifted Energies thus FALSELY Elevating our expectations including stock prices, and ONCE it has culminated, appears will allow REALITY

to hit us hard in all directions as per my previous publication about negative energies coming at us next week from events about to occur

I went looking for TIME relationships for April11th and found this

NOV 20, 2008 to Apr 11th, 2011 is 600 trade days

Oct 12, 2007 to Apr 11 = 880 tr days

in between there are coincidental highs or lows at SOME 220 day intervals, but not all

there are no fibo times that can be found for this date

Jay