I realize you think I'm repeating myself and it sounds like the

little boy who cried wolf once to often

The PREVIOUS Energy discussion explained the similarities we are now experiencing to Aug, 2008 and the 34 trade days that followed dropping 3200 Dow pts

The Current configuration has been compared and found matching in many ways to Spt 6th, 1929

And others have a configuration similar to the 1930-1931 time period

there is also a configuration this month on the 21st that compares with the DUBAI effect

The JULY 30th & 31st configs can act as a trigger to demanding energy about to descend on

our economic structures

This weeks daily effects

Aug 2nd

expect distractions early

Take cover even if the day goes smoothly

Aug3rd

Difficult money matters

Aug4th

Conflicts

Aug 5th

Harsh start, but better after

Aug 6th

Happy, hopeful start

changes later and the caution flags are out

more later

Jay

THE NEW JAYWIZ 2023

THE NEW JAYWIZ 2023

Saturday, July 31, 2010

weekend comments

they've got EVERYONE bullshit'd, which means BULLISH

PC ratios closed at 100% bearish

Jup 90 Pluto @ 4am on the 3rd has NO interference from mars 0 saturn - and we are well into the Lbra transit.

the NEG is enhanced by Mars 180 Jupiter and Mars 90 Pluto

Expect also a SMASH down OPEN or possible flash crash like open on the 4th

WHICH SHOULD RECOVER after the open

_____________

Bradley date is 11th which opens with 39 hrs at 10am

right On the 360 day cycle hit from March 9th & 275 tr days from July9th

______________

It looks like we should expect some very dramatic drops between now and the 11th

_____________

I have NO idea how to label Elliott waves to this point or to

the 10th and Oct4th/7th for that matter, but I really think it will end up counting as a LARGE ABC or 4th wave retreat within P2, OR

possibly will count as wave 1 in P3.

in either case we might expect a 38% to 50% retrace

of the gains since March 9 lows

666-1220= 555 pts

555 X 38%= 212 - 1220 =1008 , been there done that

which might have been the A wave of the above mentioned wave

or more likely

555 x 50% = 278 pts

1220 -278 = 942 which has been mentioned by others

more later

Jay

PC ratios closed at 100% bearish

Jup 90 Pluto @ 4am on the 3rd has NO interference from mars 0 saturn - and we are well into the Lbra transit.

the NEG is enhanced by Mars 180 Jupiter and Mars 90 Pluto

Expect also a SMASH down OPEN or possible flash crash like open on the 4th

WHICH SHOULD RECOVER after the open

_____________

Bradley date is 11th which opens with 39 hrs at 10am

right On the 360 day cycle hit from March 9th & 275 tr days from July9th

______________

It looks like we should expect some very dramatic drops between now and the 11th

_____________

I have NO idea how to label Elliott waves to this point or to

the 10th and Oct4th/7th for that matter, but I really think it will end up counting as a LARGE ABC or 4th wave retreat within P2, OR

possibly will count as wave 1 in P3.

in either case we might expect a 38% to 50% retrace

of the gains since March 9 lows

666-1220= 555 pts

555 X 38%= 212 - 1220 =1008 , been there done that

which might have been the A wave of the above mentioned wave

or more likely

555 x 50% = 278 pts

1220 -278 = 942 which has been mentioned by others

more later

Jay

Friday, July 30, 2010

JULY 30th

Today

180bars hit at OPEN - MKT down 120 dow

26Hrs REBOUND High at 10am- dow off 23

now we see very clearly that the 39 hr cycle series can be rebound highs as well as HOD, or LOD

62%/13 day cycle is @ 11:13am

258bars @ 4pm plus negative energy influence after close

Jay

JUST a NOTE of WARNING since i wont be publishing the August graph till Sunday

MONDAY, Aug 2nd appears QUITE POSITIVE, but dont let it fool you,

as Aug3rd seems to be the EXACT opposite

180bars hit at OPEN - MKT down 120 dow

26Hrs REBOUND High at 10am- dow off 23

now we see very clearly that the 39 hr cycle series can be rebound highs as well as HOD, or LOD

62%/13 day cycle is @ 11:13am

258bars @ 4pm plus negative energy influence after close

Jay

JUST a NOTE of WARNING since i wont be publishing the August graph till Sunday

MONDAY, Aug 2nd appears QUITE POSITIVE, but dont let it fool you,

as Aug3rd seems to be the EXACT opposite

Thursday, July 29, 2010

FOR THOSE who want to KNOW

ALL others for religious or other reasons can ignore, but LETS come back to this publication on

August 24th and Oct 4th to see just how well or not we did with this projection

In addition to Mars entering Libra, +Mars@ 180 Uranus, Today & tomrrow,

we also get Mars 0 Saturn offering STRESS & obstacles

______________

each planet and its placement has much to do with its NATURE & effect on HUMANS

at the time of such placement - where were the planets, sun, moon, stars, etc.?

how do they ineract with each other?

_______________

Heres an example of what I mean

During the SUMMER of 2008 the mkt was in a declining phase,

but when Mars entered Libra on Aug 20 it began to really pick up LEAD FEET.

15tr days later, the Dow had lost 800 pts on Spt 15 on a FULL MOON

34 tr days later the down hit its lows at 8450 on OCTOBER 10 @ a FULL MOON

This SEEMS TO BE the EXCEPTION as most FULL MOON's are like the

ENERGIZER BUNNY for the bulls - as we see the mkt runs higher into MOST FULL MOONS

____________________________

Also note that MANY- MANY Market LOWS occur in OCTOBER-

ITS A WELL KNOWN historic mkt event.

Oct 2002, 2007 - 2008, just to cite a few

____________________________

NOw back to present

Full moon on the Jly 25th found the mkt making highs

July 30th, tomrrow, Mars enters 0 degrees Libra,- mkt struggling to hold highs

---------

NEXT FULL MOON

is on Aug 24th accompanied by Saturn 90 Pluto on the 21st

now thats a SERIOUS combo representing Conflicts & Death-- ouch

__________

NEXT we END the series on OCT 4th - with the FullMoon on the 7th

with Mars in Scorpio / Libra sun & the accompaniment of multiple squares

It also marks STAn Harley's 377 tr day cycle low to low

More shortly

Jay

August 24th and Oct 4th to see just how well or not we did with this projection

In addition to Mars entering Libra, +Mars@ 180 Uranus, Today & tomrrow,

we also get Mars 0 Saturn offering STRESS & obstacles

______________

each planet and its placement has much to do with its NATURE & effect on HUMANS

at the time of such placement - where were the planets, sun, moon, stars, etc.?

how do they ineract with each other?

_______________

Heres an example of what I mean

During the SUMMER of 2008 the mkt was in a declining phase,

but when Mars entered Libra on Aug 20 it began to really pick up LEAD FEET.

15tr days later, the Dow had lost 800 pts on Spt 15 on a FULL MOON

34 tr days later the down hit its lows at 8450 on OCTOBER 10 @ a FULL MOON

This SEEMS TO BE the EXCEPTION as most FULL MOON's are like the

ENERGIZER BUNNY for the bulls - as we see the mkt runs higher into MOST FULL MOONS

____________________________

Also note that MANY- MANY Market LOWS occur in OCTOBER-

ITS A WELL KNOWN historic mkt event.

Oct 2002, 2007 - 2008, just to cite a few

____________________________

NOw back to present

Full moon on the Jly 25th found the mkt making highs

July 30th, tomrrow, Mars enters 0 degrees Libra,- mkt struggling to hold highs

---------

NEXT FULL MOON

is on Aug 24th accompanied by Saturn 90 Pluto on the 21st

now thats a SERIOUS combo representing Conflicts & Death-- ouch

__________

NEXT we END the series on OCT 4th - with the FullMoon on the 7th

with Mars in Scorpio / Libra sun & the accompaniment of multiple squares

It also marks STAn Harley's 377 tr day cycle low to low

More shortly

Jay

July 29th update

this chart for most of August has meaning for me also as you will see when i publish the August energy graph

Helge's chart shows a sell off today & tomrrow which was also shown on the JULY energy

Graph, altho we all know it did not start until the28th. There is some confusion as to NEXT weeks

LOW point as Helge seems to indicate the 9th, BUT energy points to the 10th, and CYCLES are

targeting the 11th.

I will be publishing the AUGUST energy graph this wkend

NOTE that IF we Do see a severe sell off tomrrow, JULY30th, then as Helge shows, Monday could offer a brief reprieve for the day as I will also picture it.

Jay

Its NOT a matter of IF, but simply WHEN

and that WHEN is very close by

Jay

I'm away and only have limited access, so there have been no updates

258 bars hit on Tues @ 2pm

90 b Hit @ 3pm Wed

126b is due at about 11am today and the mkt is still falling afterward

55%/13 day @ 11;59

180bars TODAY is due at 4pm along with some neg energy at 3:45pm

__________________

Tomrrow - friday

Neg energy at 7am & 9:31

26 hrs at 10am

62%/13 day at 11;13

258 bars at 4pm

Neg energy should overshadow the mkt allday.

more later

Jay

Helge's chart shows a sell off today & tomrrow which was also shown on the JULY energy

Graph, altho we all know it did not start until the28th. There is some confusion as to NEXT weeks

LOW point as Helge seems to indicate the 9th, BUT energy points to the 10th, and CYCLES are

targeting the 11th.

I will be publishing the AUGUST energy graph this wkend

NOTE that IF we Do see a severe sell off tomrrow, JULY30th, then as Helge shows, Monday could offer a brief reprieve for the day as I will also picture it.

Jay

Its NOT a matter of IF, but simply WHEN

and that WHEN is very close by

Jay

I'm away and only have limited access, so there have been no updates

258 bars hit on Tues @ 2pm

90 b Hit @ 3pm Wed

126b is due at about 11am today and the mkt is still falling afterward

55%/13 day @ 11;59

180bars TODAY is due at 4pm along with some neg energy at 3:45pm

__________________

Tomrrow - friday

Neg energy at 7am & 9:31

26 hrs at 10am

62%/13 day at 11;13

258 bars at 4pm

Neg energy should overshadow the mkt allday.

more later

Jay

Wednesday, July 28, 2010

July 28th

Expect another 10am high today & it might even stretch to 11am

but the atmosphere should change later today,

as it is possible the highs of the latest ABC rebound OFF the July 2nd LOW at 1010 may have finished

Tuesday at 10am at spx 1121

Jay

but the atmosphere should change later today,

as it is possible the highs of the latest ABC rebound OFF the July 2nd LOW at 1010 may have finished

Tuesday at 10am at spx 1121

Jay

Tuesday, July 27, 2010

Start new thread July 27th

Watch 10 am for a high today

Wed is 55 tr days May6th and could offer an important turn

Jay

Wed is 55 tr days May6th and could offer an important turn

Jay

Sunday, July 25, 2010

POWER Graph week of JULY 30th

more later

Jay

Jay

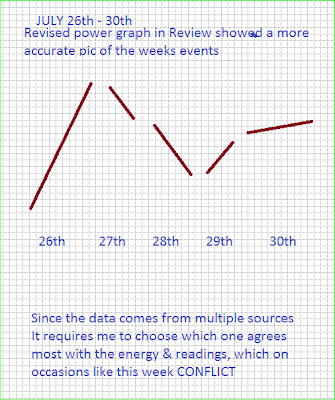

The second graph was published on August 1st to rectify my errors from publishing the original

the original was published a week in advance and was skewed based on other factors

I will try NOT to let those other factors influence my judgment in the future

Jay

Friday, July 23, 2010

JULY 23rd EKG

Thursday, July 22, 2010

JULY 22nd EKG

As promised the 26 hour cycle appears @ 10am and should be the HOD

Jay

NOT exactly what WE were expecting FOR THE Whole DAY but we were warned about a STRONG GAP OPEN.

Note the OBV is showing LESS strength near the end of the day as the dow made slightly higher highs at 3;30pm, but on increasingly WEAKER internal strength

Also note the PC ratios which were 66% bullish on WED close are now 80% bearish tonight

Jay

Jay

NOT exactly what WE were expecting FOR THE Whole DAY but we were warned about a STRONG GAP OPEN.

Note the OBV is showing LESS strength near the end of the day as the dow made slightly higher highs at 3;30pm, but on increasingly WEAKER internal strength

Also note the PC ratios which were 66% bullish on WED close are now 80% bearish tonight

Jay

Wednesday, July 21, 2010

JULY 21st EKG

|

| AND SO we HAVE another PERFECT HIt which CONURED with the POWER data graph |

Today's EKG does seem to CONCUR with the updated POWER GRAPH

156bars today at 10am low seems to be heading there after a higher open

Monday JULY 26th is 275 tr days ( 55 weeks) from a previous

low on JUNE 22nd, 2009

PLUS ~ there is a HEAVY negative energy effect on the 26th @ 1pm

BUT even MORE important is August 10th which is ALSO a 55 week cycle/ 275 tr days

from JULY8th, 2009

JULY 21st UPDATED POWER GRAPH

Sorry about the cut off- chart didnt fit SNIP tool

Sorry about the cut off- chart didnt fit SNIP toolYesterdays LOWER open FIT in QUITE WELL with DATA &

PROJECTIONS PRESENTED In advance on SUNDAY JULY 18th.

RALLY TODAY SHOULD RUN OUT OF GAS about mid day or sooner

Tomrrow's 26 HR cycle at 10am should offer another HOD

& trade in reverse of Tuesday

more later

SCROLL down to previous main page from SUNDAY to get DAILY cycles & readings

Jay

Tuesday, July 20, 2010

CYCLE update

important cycle lows appear as follows.

LOW DUE on July 20 = 260 tr days, or 377 cd from July8, 2009

EXPECT rebound on 21st & 22nd till about 2;30

LOW due on JULY26th = 275 tr days from JUNE 22, 2009 ,

a cycle low

EXPECT HUGe rebound on 27 & 28 till about 11am

Selling picks up again LATE on July 28th and ends on 30th at or near close

First week of August looks MIXED

Up on 2nd

down on3rd

Up till Midday on 6th

then low as CYCLE pivot low ends on Aug10th @ 360 tr days from March 6th

LOW DUE on July 20 = 260 tr days, or 377 cd from July8, 2009

EXPECT rebound on 21st & 22nd till about 2;30

LOW due on JULY26th = 275 tr days from JUNE 22, 2009 ,

a cycle low

EXPECT HUGe rebound on 27 & 28 till about 11am

Selling picks up again LATE on July 28th and ends on 30th at or near close

First week of August looks MIXED

Up on 2nd

down on3rd

Up till Midday on 6th

then low as CYCLE pivot low ends on Aug10th @ 360 tr days from March 6th

JULY 20th EKG

Mark

Markto answer your question & observation YES

but this NEW graph above is from another source which also shows

an ALMOST near duplicate of yesterday's EKG

EXPECT today to END at or near 4pm at LOWS

Some one suggested spx 1030 to 1045, and It would seem right given a rebound due the next day which also concurs with the reading that calls for a marked improvment over night TONIGHT

Jay

IT would APPEAR that Monday & Tuesday FLIPPED places on the power graph

IT would APPEAR that Monday & Tuesday FLIPPED places on the power graphFriday's PC ratios were 80% bullish

Monday's PC ratios were 90% BEARISH

Power data comes from multiple sources and It requires some additional structuring

on my part, which I skew based on energy, cycles etc, so occasionally,

I WILL get such a mix up

Whats that mean for today?

Good question since we DID get an extension of the LATE selling from Monday

then we need to ask, was the low at 9:45 to be considered the LOD?

OR does the 39 HOUR cycle offer a REBOUND HIGH off the open low

at 10:30 to 11am.

Enter other cycles

13 day at 11am can be extended

same goes for 90bars @ 11am

we'll see in about 10 minutes

bars today

90b @ 11am

120b @ 1:30pm

150b@ 4pm

IF 4pm DOES PROVIDE the LOD today, then EXPECT the MKT to EXPLODE higher

tomrrow and higher still on OPEN on Thsday = 26 hrs cycle at 10am

One thing the POWER graph does seem to confirm, but not published yet, is a 55 week

275 tr days LOW on the 26th as well as a 4 tr day cycle all at 4pm

NOTE: Charts Edge this week agrees with my outlook, especially if we flip Mon & Tues

more later

Jay

Monday, July 19, 2010

JULY 19th EKG

Sunday, July 18, 2010

Week of JULY 23rd

____________________________________________

____________________________________________This weeks readings

Monday

Anxiety with $$

Unsocial

Be strategic & Practical

~~~~~~~

Tuesday

Deception

time to remove those ROSE COLORED GLASSES

~~~~~~~~

Wednesday

Tend to $$ matters

Low Energy day

limitations & problems

~~~~~~~~~~

Thsday

Outlook brightens in the AM

But

progress is impeded

expect costly changes

~~~~~~~~~~~~

Friday

Stressful & Unpredictable

emotional conflicts

serious $$ issues

______________________________________________

Bar cycles

Monday

2258b@ 10am

30b@ 12:30

60b@ 3pm

possible 329b@ 3:30- could be the lod ??

~~~~~~~~

Tuesday

13hrs @ 10am - a HIGH would be expected

13 day cycle at 11am combined with 90bars@ 11am

COULD MAKE FOR A VERY WILD morning-

even the power graph seems to concur,

Consider that the data ALL comes from different sources

120b@ 1:30 pm

150B @ 4pm OR open next day

~~~~~~~~~~~~~~

Wed

150bars possible at open OR 156 bars at 10am

180b@ noon

204b@ 2pm

228b@ 4pm, and or open next day - should duplicate previous 4pm/open pivot

~~~~~~~~

Thsday

26HRS at 10am- SHOULD be a high

14.6% /13 day at 10:20am

could make for a CHOPPY morning, also indicated by the power graph

258B @ noon

30b @ 2;30

~~~~~~~~~~~~~

Friday

60Bars @ 10:30

23.6%/13 day at 11:26

90b @ 1pm

120b@ 3:30pm

OR

126bars @ 4pm = COULD Be the LOW OF THE WEEK

MORE LATER

Jay

Saturday, July 17, 2010

Weekend Commentary

Friday was a 96% DOWN VOL DAY

& ARMS ratio a WHOPPING 5.77

PC ratios 80%BULLISH, {{but we had the last 5 of 6 days at 80% Bearish & thsday @ 90%}}

BUT THAT WONT STOP a LAND SLIDE MONDAY

The day calls for ANXIETY with $$

I only USE "TIME ", so if

ANYONE has the next important price level

we would love to know it.

WE all KNOW that 1010 is MONSTER SUPPORT

which will get broken this month, but NOT NEXT WEEK - { imo }

I dont think we will get there on Monday, but there is a pretty good

chance we just might get within 10 pts of it.

2 x 40 = 80 pts from 1096 = 1016

OR

3x 40 = 120 from 1131 = 1011

more later

Jay

& ARMS ratio a WHOPPING 5.77

PC ratios 80%BULLISH, {{but we had the last 5 of 6 days at 80% Bearish & thsday @ 90%}}

BUT THAT WONT STOP a LAND SLIDE MONDAY

The day calls for ANXIETY with $$

I only USE "TIME ", so if

ANYONE has the next important price level

we would love to know it.

WE all KNOW that 1010 is MONSTER SUPPORT

which will get broken this month, but NOT NEXT WEEK - { imo }

I dont think we will get there on Monday, but there is a pretty good

chance we just might get within 10 pts of it.

2 x 40 = 80 pts from 1096 = 1016

OR

3x 40 = 120 from 1131 = 1011

more later

Jay

Friday, July 16, 2010

JULY 16th EKG

NOTE JULY 17th at 10am

NOTE JULY 17th at 10amINCREDIBLE

NOW at 51/75 for 68% ACCCURACY

Power graph now 4 for 7 @ 57% after 7 published weeks

Jay

CYCLES

CYCLES39 hour @ 9:45 to 10am

180bars at 10am

204bars @ noon

228Bars @ 2pm

258Bars @ 10am/ Monday

ENERGY

Pos @ 9:46

Neg @ 11:19

Neg @ 3:59

Neg @ 4:24

Neg @ 5;51

Neg wkend

readings today

Avoid Risk & caution with $

Indecision & challenges

Jay

Thursday, July 15, 2010

REVIEW JUNE & JULY

JULY 15th EKG

OUTSTANDING performance today-- EKG

OUTSTANDING performance today-- EKGENERGY

READINGS

CYCLES

ALL CONGEALED today

GET READY FOR

GAPS in the DATA do NOT mean GAPS in the MKt

GAPS in the DATA do NOT mean GAPS in the MKtCYCLES today

78.6% /13 day @ 12:25pm

120bars @ 11:30 OR 126Bars @ noon

150bars at 2pm OR 156Bars @ 2:30

Neg Energy @ 11;55am

pos energy @ 3:28pm

Neg energy @ 4:01pm

Convergence of NEG energy from 11:30 to Noon:30

Jay

Wednesday, July 14, 2010

Wave & Fibo from Columbia 1

Note a couple things

Note a couple things1099.01 hit at 11;45, same as morning high yesterday

10,400 ditto

Each was just a tad under the 3:45 High of yesterday

JULY13th = 144 & 233 tr days from previous highs on 12/14/09 & 8/7/2009

Genre for the day was GROUP POWER

The above shows price levels at 1085 & 1071 as fibo supports

which would take the dow back to 10,180 @ 1071 spx

July 15th has a Combo of cycles at 11:30 to 12:30

which IF they do get to 1071, would coincide with

the daily read for jarring news & unsteady influences, but OK for later

that would also fit in with power graph for High on 15th at close

AND

39 HOUR top off at 10am on FRIDAY

Jay

JULY 14th EKG

COUNT IT good

COUNT IT goodJay

TIMES for today

TIMES for today26hours at 10 to 10:30am- should be a low

60bars @ 1pm

90bars @ 3;30

From what I'm looking at, it would appear we are going to get that

4th & 5th wave in the UP trend that began from the JULY 2nd low at 1016

And it SHOULD ALL OCCUR between NOW and the CLOSE of BIZ on the 15th

This ONCE again fulfills the monthly scenario of lows at first of month and highs MID month

going back to March 9th, 2009 LOWS

Yesterday's EKG showed a sell off late day which DID start at 3:45pm, and looks like it has spilled over to today

which I had mentioned COULD BE WHAT we will get, and as the CPTN said - MAKE IT SO

ENERGY hits

Neg @ 10:10am

Neg at 2:34 pm

POS @ 3:08pm

Pos close considering also that 90bars occurs at 3:30pm

More Later

Jay

More Later

Jay

Tuesday, July 13, 2010

UPDATE JULY 13th CLOSE

New readings have come to light

TOmrrows read

ADAPT to CHANGES

UNSURE MORNING

Projects fizzle

Thsday

EARLY problems

Jarring news

UNSTEADY influences

***EXPECT LATE RECOVERY

Fri

HEAD FOR COVER

Expect challenges

Avoid risk

caution with $

ITS VERY POSSIBLE we NOW have the HIGh this month,

unless the 15th late afternoon tries to recover,

as the readings calls for such, but it might just FAIL to get anywhere close

depending on how serious it gets next day & 1/2.

Jay

TOmrrows read

ADAPT to CHANGES

UNSURE MORNING

Projects fizzle

Thsday

EARLY problems

Jarring news

UNSTEADY influences

***EXPECT LATE RECOVERY

Fri

HEAD FOR COVER

Expect challenges

Avoid risk

caution with $

ITS VERY POSSIBLE we NOW have the HIGh this month,

unless the 15th late afternoon tries to recover,

as the readings calls for such, but it might just FAIL to get anywhere close

depending on how serious it gets next day & 1/2.

Jay

UPDATED POWER GRAPH & Original JULY Energy

AS I PREVIOUSLY NOTED several TIMES

AS I PREVIOUSLY NOTED several TIMESthe MIDDLE OF NEARLY EVERY MONTH SINCE the Mar 9th, 2009 LOW

We have seen a MID MONTH HIGH from the 16th to 20th

AND a LOW in the FIRST week of the month from the 1st to 8th

I mentioned this b4, and again now

THE ENERGY & daily readings for this week are mostly benign to positive

Thus the ORIGINAL energy graph for JULY has been quite accurate

with only minor variations

math model for recent decline and rebound

spx 1131-1010 =121

121x 78.6% = 94 pts

1010 + 94 = 1104

Might be Wednesday & Thursday target high

Jay

JULY 13th EKG

TODAY did NOT score well unless you consider that last 15 minute slip important

TODAY did NOT score well unless you consider that last 15 minute slip importantTHAT MIGHT JUST HAVE BEEN THE HIGH this month

I'll copy & paste from comment page

I know I mentioned WILD RIDE a few days ago

I know I mentioned WILD RIDE a few days agoThe reading for today indicated GROUP POWER

MY published JULY graph so far is MORE RIGHT than any other graph ive posted this month

Today's HIGH energy is scheduled for 1:52Pm

Cycles for today

A HYPED UP OPEN HIGH could be followed with lows at

204bars at 10am

OR

62%/13day at 11;13

The power data graph also sows a high mid day TODAY and retreat late day

WED tomrrow's 26hr cycle at 10am is also shown

on the power data before running back UP again

to a HIGH on the 15th.

16th power data STILL shows a sharp retreat as does the read for the day -RUN FOR COVER

39hrs at 10am on the 16th still begs for one more HIGh probably @ 9:45am

before giving out to STRONG SELLING

ARMS 5 and TRIN 5 have both issued SELL SIGNALS on yesterday's close

but there can be delays b4 its effects are realized

more later

Jay

Sunday, July 11, 2010

PRELIMINARY EKG

I had thought we would see a lot more today, but they are holding

I had thought we would see a lot more today, but they are holdingneed bad news anyone? -I guess the mkt does

UPDATE AT 8:30am - Monday JULY 12th above

UPDATE AT 8:30am - Monday JULY 12th above This is really prelim as you can see the END OF DAY is NOT finished

This is really prelim as you can see the END OF DAY is NOT finishedANd as we have seen OFTEN, that MID DAY RALLY does NOT have to respond

to the PICTURED AMPLITUDE

SO< Reminder== DIRECTION is MUST more important than Amplitude

in other words

it looks like it could be SOLID DOWN day thus confirming the power data graph

THE DOW made it back exactly 60% of the 980 pts loss from JUNE 21st to JULY 2nd

Anyone looking at the TRANSPORTS might consider IT'S

recent high a NON CONFIRMATION,

assuming we start DOWN STRONGLY in ALL indexes Monday

More later

Jay

PRELIMINARY POWER DATA

There's no way we can precisely determine the price level for a low

BUT using TIME Cycles, we can with some degree of accuracy determine WHEN

the mkt will make a PIVOT LOW.

As it turns out the POWER DATA seems to agree with the 39 hour cycle/ 3 = 13 & 26hrs

REMEMBER - I DONT MAKE THIS STUFF UP ON MY OWN-

POWER DATA is part of the SCIENTIFIC RESOURCES that are noted at the top of the blog page

At times its EASIER to DECIPHER what that scientific data offers, and other times its NOT,

OR maybe its just a matter of experience working with it that will make it easier for Me

to analyze it.

39 hours can be a high or a low, and it breaks down into 13 & 26 hours ,

EACH segment hitting at 10am to 11am,

and can occur anywhere from 9:45 to 11am,

as we have experienced it since discovering its periodicity a few months ago.

Recent history

JUNE 21st at 10am SPX hit 1131 HIGh

June June 29th @ 10am = a low at 1035

July 8th at 9:45 at high at 1071

whats next

JULY 12th at 10am = 13 hrs - possible rebound off opening low ??

JULY 14th at 10am = 26 hr Suspected low

July 16th at 10am = 39 hours = suspected high

EARLY indications of the EKG show a LOWER OPEN- Monday

Friday was the 3rd day in a row with 80% BEARISH PC ratios

more later

Jay

Friday, July 09, 2010

JULY 9th EKG & more

this is ONE of HELGE'S CLEAREST charts above and it shows a LOW

this is ONE of HELGE'S CLEAREST charts above and it shows a LOWon either the 9th and or 12th

MY POWER DATA seems to ALSO show a LOW on the 12th, at the 300 level which is quite low,

THEN takes a big JUMP up on the 13th tot he 600 level.

ENERGY FOR THE DAY [12th] seems benign BUT cycles could trump energy

just as it did all this week

39 hrs at 10am on the 12th -COULD be the hod

THE JULY monthly GRAPH is STILL offering the best view of this month so far

AND IT SHOWS THE 15th as the HIGH OF THE MONTH

that has not changed

JULY 12th is

108 tr days from the FEb 8th low

54 tr days from Apr 26 HIGh

34 days May 20 low

8day June29 low

THE DAY AFTER the 12th has HIGH POSITIVE ENERGY on JULY13th

calling for powerful group activities

more later

Jay

80% Bearish PC ratios are indicating an OFF day today

Red Tide shows a DOWN day with a LOW at 3;30

Thursday, July 08, 2010

JULY 8th EKG

This is WHAT the EKG would have showed IF I had published it with what I thought

This is WHAT the EKG would have showed IF I had published it with what I thoughtwas AFTER hours activity

Keep in MIND there is NO such thing as INVERSIONS,

ONLY mis interpretation by the analyst-

NONE of us can ever be right EVERY SINGLE DAY

but the EKG still has a great track record of 66.7% since march 9th, 2010

IM not making excuses, and Im not going to count this as a positive for the EKG

& Ive mentioned MANY times, that IT IS VERY difficult to PIN POINT the CLOSING

as the data stream IS CONTINUOUS

NOW, we have the PC ratios data and AGAIN it is NOW 80% BEARISH

Helge did have a high close today, and I will be paying greater attention to

his charts which MIGHT help me determine the CLOSE with great accuracy, maybe

Jay

It looks like 1070 attempt at 10-am on the 13 hr cycle high

It looks like 1070 attempt at 10-am on the 13 hr cycle highI mentioned this on Sunday, so dont say you weren't informed

today has been characterized as a Gemini type day

And the other data seems to concur

Up to high at 10am, and the rest of the day heads lower

other cycles today

38.2%/13 day at 10:42

258bars at 12:30

30bars at 3pm

Door # 1= set back to 1030 area on 9th

Door # 2 set back to 1010 or lower on the 9th

OPTIONS Expiration next week is setup with positive energy, but it wont get there

in a straight line

Oversold became overbot in a hurry with a .29 ARMS index yesterday

MY AD & Vol proprietary indeces jumped OFF a BUY level under 300 for each

to 900 & 2300 respectively

PC ratios on close yesterday are 80% bearish, but were 80% bullish on Tues

more later

Jay

CNBC is NOW reporting NO DOUBLE DIP,

last week they were all SCREAMING- DD

hmmm

sentiment has flipped just because we had a little rally

Amazing how it all fits together

Wednesday, July 07, 2010

OVERSOLD TO OVERBOT in 2 days

ARMS Data today was a LOW .29

ARMS Data today was a LOW .29A/D was 6/1

Vol was 21/1

the last 2 days, MY PROPRIETARY AD & Vol data indeces were both UNDER 300

indicating an OVERSOLD condition- but with TODAY'S data applied to the SPREAD sheet

that is NOT the case anymore, at least for the very short term.

ALSO, they FILLED the GAP from 1058 to 1072 AT SPX 1060.27

Power data GRAPH did SHOW either 6th or 7th with POTENTIAL for big UP day

with MIXED trends tomrrow ending lower, and more selling on Friday

SPX at 1060, we could EASILY see a retest of 1010 before

RUNNING IT BACK UP NEXT WEEK to 1100

Friday has converging CYCLE pivot lows including

a Bradley date & an Eclipse on Sunday = ENERGY change next week

Friday' read = controversy & antagonism

Saturday read = erratic

Helge shows a LOW on 12th, but thats because he dates his charts by Mondays

so his low could easily be Friday

Jay

JULY 7th EKG

That did NOT go well for the EKG today now set back for 2 days in a row.

That did NOT go well for the EKG today now set back for 2 days in a row.that hasnt happened since March, when I first started publishing it.

NOTE

we just went from OVERSOLD on Friday to NOW overbot

yesterday's PC ratios were 80% Bullish

Today's PC ratios are 80% BEARISH

Reading for tonight calls for $$ Crisis- no idea what that means,

but we'll see if Europe is effected tonight

10am = 13 hr cycle HIGH, but it could be only a rebound high off an early retreat

IF the EKG rolls over into a lower open tomrrow, rather than a lower close today

Just as I mentioned yesterday, the EKG reflects 156bars on open today

Just as I mentioned yesterday, the EKG reflects 156bars on open todaybut a mid day rebound should then give way to more selling in the last 1 or 2 hours

Wed should open higher in reverse of today, and even it it opens low, then 10am should offer

a great TURN lower from that short term high

Review

July9th LOW

JULY15th High with 16th TURNING LOWER

July 30th LOW

August 10th as published = 360 day LOW from March 6th = 1/2 of 144wks= 72 wks exactly

Jay

Tuesday, July 06, 2010

EKG for JULY6th & updated POWER data graph

Today only counts as a partial so it does not go in as a positive for the day

Today only counts as a partial so it does not go in as a positive for the day46/67= 68.6%

and the power data graph from last week was only a partial also,

now its record stands at 50%. after 4weeks

Power data comes from multiple sources and It forces me to interpret

Power data comes from multiple sources and It forces me to interpretMaybe I should wait before publishing a preliminary picture just as I do for the EKG

and that will make it more reliable as I have more updated & concrete data to work with

13hr high at 10am

13hr high at 10am13day/ 23.6% pivot low at 11:26am

High from 3:30 to 4pm

156bars at 4pm appear will hit at open tomrrow

according to PRELIM data from the EKG

THUS the CHANGE in the POWER DATA showing MOST OF THE GAINS TODAY

and NOT tomrrow, with a final high on the 8th at the 13hr high at 10am

more later

Jay

Addendum

this may be premature, BUT its important to have an IDEA

as to WHERE this mkt is currently heading

from my daily spread sheet data log

August 10th = 360 trade days from March 6th

360/8 = 45 repetitions- 8 cycle convergence

360 / 5 days per week = 72 weeks= exactly half of 144 weeks

August 10th appears to be a very important date

Monday, July 05, 2010

Saturday, July 03, 2010

H&S for 2010 & 50day/200day CROSSOVER

This CHART from HELGE ALSO shows potential for JULY 9th and or 12th LOW

This CHART from HELGE ALSO shows potential for JULY 9th and or 12th LOWHe dates his graphs by Monday dates so don't be MISLED by that demarcation

Since the ENERGY for JULY 9th seems to indicate an intraday CHANGE/TURN,

then we MUST be VIGILANT

for what might be a 2:30 pm low right on the 50%/13 day cycle pivot.

Chart from BINVE at Market Thoughts blog

July 9th = 192 tr days from Oct 2nd, 2009 = 192 tr dys/ 8 = 24 repetitions

July6th = 333 tr days March 9th or 3 times 110 day cycle

July 6th is also 424 tr days Oct 27,2008 or 53 repetitions of 8 day cycles

July6th

13 hrs at 10am, might be a high pivot, but could be just a rebound off a lower open

23.6% /13 day at 11:26

8day cycle low

90bars at 10;30

156bars at 4pm

Reading for the day

Shake up

changes

Snags

WEd has a much improved READING

REWARDING

BOOST income

high confidence

$$ benefits

Thsday

Upbeat in AM

MIXED trend day=Gemini type day

Afternoon = $$ problems

Friday

Antagonism

controversy in the AM

Disputes

----------

gains & romance later

more later

Jay

Subscribe to:

Comments (Atom)