|

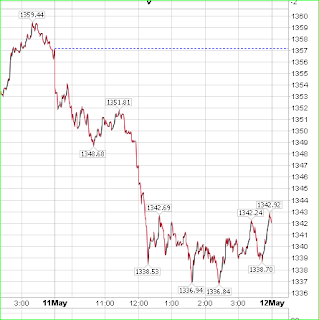

| Tomrrows EKG matches the OUTLOOK and Daneric below |

Danerics graph shows today as possibly marking the top of a 5th wave ENDING Diagonal triangle

If the mkt makes or attempts a new closing high for this year.-TODAY

What comes right after on the 12th & 13th could set the stage for whatever correction

has been illusive.

spx 1380 should be there by 11am

Mid day does get soft, but the end of the day makes a comeback

_____________________

6am update

Impact stream at 6am showing strength to match everything else

Jay

TOP OF THE PAGE IS THE IMPACT STREAM AT 11:30am

IMO, A FAILURE TO MAKE ANY NEW HIGHS today is a death knell

AND

Any new highs also ends the END DIAG Triangle if thats what forming other than the

Irregular or expanding triangle previously discussed

Either way, It looks to me like the next move is a large drop on the 12th& 13th

Jay

1370-1329=41 pts

1359 = a 73 % retrace

A full 78% retrace is at 1361

8 comments:

one day they might come looking at your 401K's since there are a few trillion dollars sitting there, and Uncle Sam sure would like to have them. Now we see that in Ireland they are indeed beginning to raid personal retirement accounts to try and rescue their economy. Are we immune from such things? Probably for a while, since it's an election year coming and no politician has a shot if they start talking about raiding retirements. But you can bet there's several plans to do just that.

So watch your 401K's

When it comes to our fine institutions (cough) dont' ever forget they get:

1) free money from the FED and

2) investor money from their clients.

If they stuff it in the market day after day after day, pushing the market up.. is it their concern if it all goes sour and they lose 50% of their money like they did in 2008? Nope. Not a concern in the world. It's not their money they're losing it's "OPM" other people's money. And.. the grand part is that if they lose so much there's a chance of another Lehmans.. We'll bail them out again.

so yes corruption at the highest level.

"Rajaratnam Guilty of Insider Trading." Sure, the guy is only a small fish compared to the bankester gangester ... please!

The SEC shows as though they are doing their job. Hey SEC how about GS, JPM, C, etc....???

we're at the top of the new up channel on /dx so should reverse and be down all night to the bottom around 74.70 /6e new down channel on /6e

I've been watching the 10 day moving average on the DOW fairly closely because if you do a chart of the DOW, you'll see that it doesn't spend much time under the 10 day unless there's a hefty pull back in the cards. Usually it dips under for a couple days then rockets higher. We had one stretch where it couldn't cross it for like 6 sessions, then finally punched through. But go back a bit and the big plunge in Late Fed/early March was a 6 day struggle with the 10 day too. Now that we're below it.. I'd watch the 18 day closely. If the market closes under that at 12 597..that's a huge danger signal.

Right now we're above 12600 but only by 30 points. There was a couple days a while back where 12580 was the low of the day, and it's my guess that if we fail that.. we're heading lower, possibly much lower for a while. What we'd need is a couple closes under that level to really scare the recent market participants out. That could snowball. So our game is to watch the 18 day at 12597, and if we fail that.. watch those low closes at 12580. A fall under that could be ugly.

My guess is that because CSCO beat the estimates after hours, we'll see a jump in the am in technology. Whether it can hold or not is something else, but my guess is that for the day, it should. After that however, the novelty of it will be gone, so by Friday we could be weak again.

From today to June 10th they plan on giving wall street banks 93 BILLION dollars to purchase Treasuries. That's a lot of money for the cowboys to play with, so it's really hard to think we'll fall in the face of all that free money. But then again, stranger things have happened.

Jaywiz index Monday = .17 very bearish, but did the mkt pay attention- NO

Jaywiz index Tues= .52

Wed = .29

OEX PC ratio = 1.06 finally the bears have become bulls

Jay

Post a Comment