this was published and sent to my FRIENDLY YAHOO group

and for some reason, it never got to them. - server error??

BUT they can attest to the DATE & TIME stamp

Feb 21st at 7pm

as I resent it from my SENT page on Comcast email logs

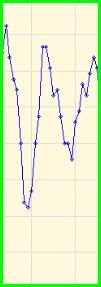

YOU WILL ALL NOW NOTICE the 11;30sh low this morning

the 3pm High and turn lower today

which FITS the Daily guidance quite well

I am transferring the email to the blog at 4pm on Monday

~~~~~~~~~~~

The DAILY guidance that Ive

been posting a DAY Ahead comes

to me in a form that I can only guess at times.

Thats why I publish the bar cycle pivots, 13 day cycle

and any important astro or elliott interpretation -

to get some frame of reference for times

_______________\

PROBLEM

Some of the ANON's at the blog

do not appreciate the value of such a graph

and thus I am NOW reluctant to publish it

___________________

I do NOT make up the daily guidance graph on my own

IT IS NOT ASTRO

IT IS NOT CYCLES

It IS energy similar to what Coy produces from different sources

His graph last week performed better than mine

--------------------

When I posted Coy's graph, the ANON"s took exception

to the diversity since they were not in sync;

between us we have had similar graphs, some times

and opposite sometimes

The week before last was a perfect hit every day

for mine, but this week, the rises were pictured

with equal declines which did not materialize.

_________________

So this week, I will be publishing the graph on the blog

AFTER THE FACT, and Im sure I will get BLASTED

for that claiming I made it up afterwards

------------------------

Oh well -- so be it

Jay

BUT I will offer it here in the PRIVATE GROUP

FYI for information only and as COY's Monday map, I agree

~~~~~

I posted on the blog earlier today

NOT MUCH ADO ABOUT NOTHING

YADA YADA this whole week

________________________

-----------11:30 LOW @ 258bars--------Lower at close leading to 60bTues@10am

Highs could occur between 1pm and 3pm typical daily hourly turns

Pay little attention to the AMPLITUDE

and more attention to DIRECTION

At least If I show it here, and it is successful,

I can say it was published

prior to tomrrow and not be lying about it

-----------------------

It shows a WEAK open, Mid day recovery and

weak close

_____________

258 bars = a low @ 11:30

30 bars = a low at 2pm,

Thus 60 bars does not occur until Tuesday at

10am, and MY published readings for the week

under comments does reflect that projection

J

Market Timing ** Whats NEXT**

@

http://Jaywiz.blogspot.com----- Original Message -----

From:

jerryo1314@aim.comTo:

TimingShortTerm@yahoogroups.comSent: Sunday, February 21, 2010 5:32:24 PM GMT -05:00 US/Canada Eastern

Subject: Re: [TimingShortTerm] week ahead 22-26

Jay ,

On the chart or graph you post is that 1 day or more. Could you put a time like 12noon +/- 1 hr as a reference?

Jerry

-----Original Message-----

From:

jaywiz10534@comcast.netTo:

TimingShortTerm@yahoogroups.comSent: Sun, Feb 21, 2010 2:01 pm

Subject: Re: [TimingShortTerm] week ahead 22-26

Chart from Columbia - thanks Michael

Chart from Columbia - thanks Michael