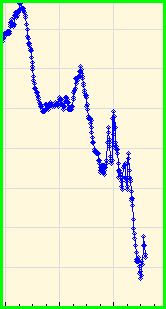

-------------1/20Close----1/21--2:30L-4pmH--1/22H9:45----noonL- so far

-------------1/20Close----1/21--2:30L-4pmH--1/22H9:45----noonL- so far55%/13 day cycle at noon

might hold them for the day

chart not complete for 22nd yet, so we will have to wait for tomorrow am to see the ending

BUT IT still shows potential for minor recovery late today and or tomrrow by 10AM

game plan is to buy some shorts at close on a recovery, and add more on tomrrow's first 30 min open.

Jay

12 comments:

UPDATED Chart NOW shows FURTHER declines after the LAST blip up on the far right edge of the chart

Jay

per my afternoon post about harvesting the crops if the $VIX printed 22.44, the crooks closed it @ 22.27

things are right on schedule

here are numb-ers from today:

$SPX

1138

1144

since the market needs to print 1144, we'll have to go flirt with 1150 again

the dancing in this tight range will end on the first trading day of February

if you want to visualize what the daily chart will look like, look no further than the 3 minute chart today from 10:06-10:30

as everybody saw today, once the rogue bid is gone, the market collapses under it's own weight

the down will end the first trading day of Feb?

Thanks to.

rrman you are right too.

No doubt market in tight lower range for next 5/6 days.

However if you see 60m SPX there is a double bottom with 4th Jan low and also a certain kind of wedge which may take the market up in Fri morning session. I had written 3 days ago on Tuesday to expect very low days but nobody cared what I said probably at the end of a thread in a late evening.

Nontheless things work the way we see.

pk

rrman:

no the dancing between 1100ish to 1150 will end on feb 1st

the ritual ends tomorrow

a ramp job is coming next week, and since i have the 1144 numb-er from today it means were going to go flirt with 1150 again

Here are some macro numb-ers:

$SPX 733.22

this is from the same series that gave me 748.23 from the previous stock market bubble. $SPX 741.02 was the Nov 21 2009.

AAPL: 134.42

GS: 135.23 (buffet already told everybody what the its is worth ($115)).

Norseman on Tickerforum posted this

he is normally bullish kinda interesting

IMVHO if this is comparable to 1938 and we are in the beginnings of a Catastrophic (C). It should act like it. 10% needs to come off this Market by end of next Week. Thats how much came off the top of 1938 top in approx.10 days.

"January barometer"...if we are at 1116.65 or Higher and close January green the chances of Catastrophic (C) are pushed out. Almost just based on that average alone. Many other reasons low odds at this time.

TO

thanks for your updates

however, If I rad yuo right, yuo are telling us to look NOW for another run on 1150

Given what happened Today, and banks in trouble, I sincerely doubt we will see 1144 or 1150 again in Jan.

The reason Today happened AFTER the Jan 18th BRADLEY TOP is NOW due to SATURN 90 PLUTO

Now you may not KNWO what that implies, but Ive posted it several TIMES

Saturn = REstrictions

Pluto = Death transformation

Together they SPELL FORCED CHANGES as we have already seen the white house is ready to do battle with the banking industry

AND to top it all off, the US Supreme court just wiped out a 100 year ban on Corp interference on the Govt.

I REALLY THINK THE HAND WRITING IS ON THE WALL

and of course it also means that my DAILY graphs have NOT been ACCURATE

BUT we really do appreciate EVERYONE"S input

Its very important to have different views and I welcome you and all the others

Jay

wow. Everybody is sure beared up.

nn

rrman

I have that 1938 to 1942 chart and I Agree with it

we got a rally of 55% JUST LIKE their rally of 63%, and within 3 months made a crash dive similar to my yr 2000 graph posted a few days ago

I have projected many times on this blog that April6th will be considerably lower

TO

Your spx 733 level would fit right into the above scenario for April6th.

Most of such a decline in the 2 times mentioned above, occurred mostly within 13 days of the LOW date.

And thus the major thrust DOWN would Occur this year from March 22nd to April6th

Until then there is plenty of volatility to enjoy and capture

going both ways

Thus we can EXPECT Feb 2nd to provide a PIVOT LOW with a recovery lasting till at least

Feb 12th, and maybe a little after

to be discussed at a later time.

Jay

10am was a PERFECT call for a rebound high, but I did not add shorts.

not becuase i didnt want to

I couldnt get my price- greedy

but I have a position from yesterday which is doing well

Jay

Bernanke delayed till next week

Jay

Post a Comment