WAVES 1 AND 2

WAVES 1 AND 2If wave 2 is completed, then there is NO TURNING BACK TOMRROW

Jay

What level would it take for the month of SPT to hold its TITLE

What level would it take for the month of SPT to hold its TITLE ITS NOW 4pm, and FINALLY, they gave some back- the graph indicates more, but we will take it for now.

ITS NOW 4pm, and FINALLY, they gave some back- the graph indicates more, but we will take it for now. 1942 to 2012 and we are fast approaching

1942 to 2012 and we are fast approaching  An attempt to match up these 2 charts or overlay might or might not indicate a brief sell off

An attempt to match up these 2 charts or overlay might or might not indicate a brief sell off Heres a chart of the dow from 1936 to 1942

Heres a chart of the dow from 1936 to 1942 This came to my attention

This came to my attention

FRED

FRED COMPARE to EKG below

COMPARE to EKG below graph from Columbia's public charts

graph from Columbia's public charts

FYI- I thought this might be important to see NOW

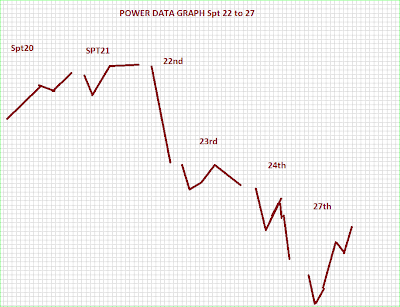

FYI- I thought this might be important to see NOW yesterday was an 8 day high, but one day late for the averages,

yesterday was an 8 day high, but one day late for the averages,  NOTE on 23rd- LOOKS LIKE 22nd & 23rd maybe reversed

NOTE on 23rd- LOOKS LIKE 22nd & 23rd maybe reversed NEARLY PERFECT - STILL at 70%, and I dont really expect it to get any better than that

NEARLY PERFECT - STILL at 70%, and I dont really expect it to get any better than that Looks about the same as yesterday

Looks about the same as yesterday MY proprietary ADV decl & volume indicators are screaming SELL

MY proprietary ADV decl & volume indicators are screaming SELL As previously indicated

As previously indicated No one can really know when this wave will end but the evidence suggests there could be a break this week.

No one can really know when this wave will end but the evidence suggests there could be a break this week. NOT great, but not too bad either- could count it either way

NOT great, but not too bad either- could count it either way Heres a MORE complete view of today's EKG

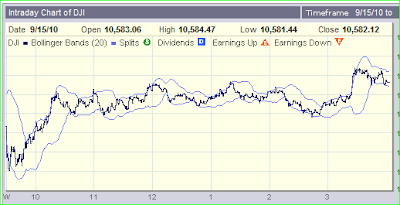

Heres a MORE complete view of today's EKG JUSt as projected by the POWER index, we see the DAILY EKG confirming TOMRROW

JUSt as projected by the POWER index, we see the DAILY EKG confirming TOMRROW For comparison, we can see the OBV not keeping pace with the rise in stock prices at he end of the day. And so far the AM futures indicate an open at 1130 prior to 8:30.

For comparison, we can see the OBV not keeping pace with the rise in stock prices at he end of the day. And so far the AM futures indicate an open at 1130 prior to 8:30. Once again we see the PROBLEM associated with the CLOSE of the day verses the data STREAM which is continuous- WHERE to cut if off ??

Once again we see the PROBLEM associated with the CLOSE of the day verses the data STREAM which is continuous- WHERE to cut if off ?? As we can see, the end of day today "" SHOULD"" sell off into tomorrow at 10am as the SNEAK PREVIEW indicates - Jay

As we can see, the end of day today "" SHOULD"" sell off into tomorrow at 10am as the SNEAK PREVIEW indicates - Jay Late sell off is indicated leading to a LOWER OPEN on Friday

Late sell off is indicated leading to a LOWER OPEN on Friday OK AGAIN

OK AGAIN Let me KNOW if you want me to continue with the DAILY EKG

Let me KNOW if you want me to continue with the DAILY EKG Couldnt ask for anything better

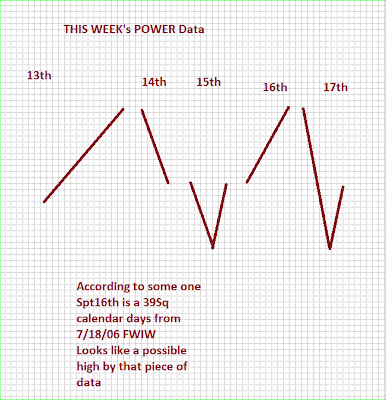

Couldnt ask for anything better Today's cycles

Today's cycles NOT EXACT, but how could anyone expect 100%

NOT EXACT, but how could anyone expect 100% Some one suggested that BECAUSE we have not seen a 20% sell off as of Spt 13th,

Some one suggested that BECAUSE we have not seen a 20% sell off as of Spt 13th, Ive seen a similar chart at another site which also shows what some are labeling as wave 2

Ive seen a similar chart at another site which also shows what some are labeling as wave 2 Is there REALLY going to be any set back, ??

Is there REALLY going to be any set back, ?? Didnt finish as low as pictured, but I really didnt expect it to, unless Monday

Didnt finish as low as pictured, but I really didnt expect it to, unless Monday Much to do about nothing

Much to do about nothing Couldn't ask for a better depiction of today's action

Couldn't ask for a better depiction of today's action Looks like today is day ON HOLD

Looks like today is day ON HOLD